- South Korea

- /

- Personal Products

- /

- KOSE:A278470

3 KRX Growth Companies With High Insider Ownership Expecting Up To 22% Revenue Growth

Reviewed by Simply Wall St

South Korea's economy recently posted a current account surplus of $9.13 billion in July, with exports increasing annually by 16.7 percent, reflecting a robust trade environment despite some deficits in the services account. In this context, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests, making them potential candidates for sustained revenue growth.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 97.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Let's take a closer look at a couple of our picks from the screened companies.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.49 billion.

Operations: The company generates revenue primarily from its Surgical & Medical Equipment segment, amounting to ₩204.37 million.

Insider Ownership: 10.1%

Revenue Growth Forecast: 19.3% p.a.

CLASSYS Inc. showcases strong growth potential with forecasted annual earnings growth of 22.52% and a high return on equity projected at 28.1% over the next three years. The company’s revenue is expected to grow faster than the South Korean market, though slightly below 20% annually. Recently, CLASSYS has been active in presenting at major conferences like Morgan Stanley's Global Healthcare Conference and J.P. Morgan’s Korea Corporate Day, highlighting its commitment to investor engagement and transparency.

- Delve into the full analysis future growth report here for a deeper understanding of CLASSYS.

- Upon reviewing our latest valuation report, CLASSYS' share price might be too optimistic.

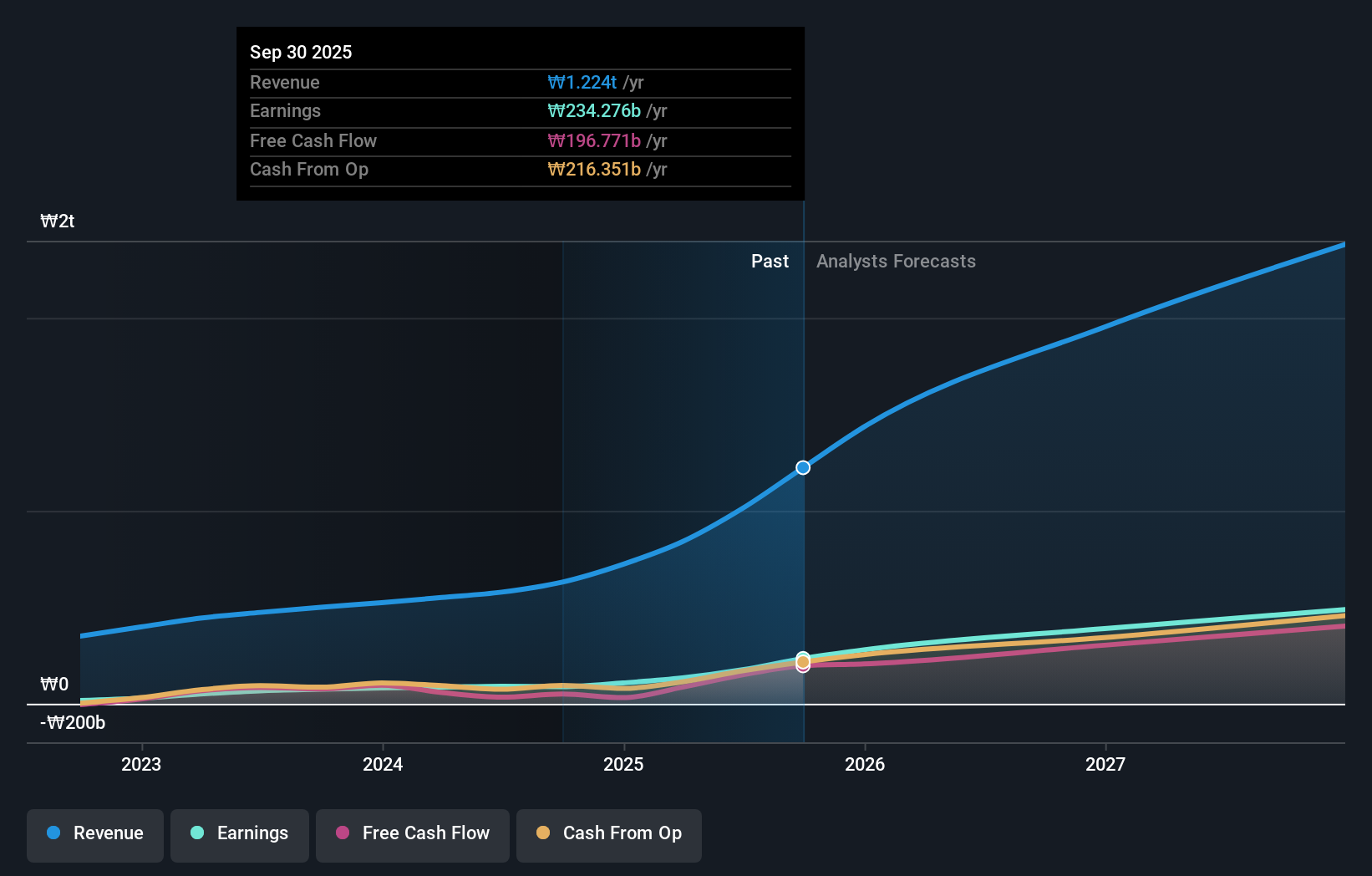

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samyang Foods Co., Ltd., with a market cap of ₩3.51 trillion, operates in the food industry both domestically in South Korea and internationally through its subsidiaries.

Operations: Samyang Foods generates revenue from its food business operations both within South Korea and internationally through its subsidiaries.

Insider Ownership: 11.6%

Revenue Growth Forecast: 17.8% p.a.

Samyang Foods demonstrates strong growth potential with earnings forecasted to grow 21.08% annually and a high return on equity projected at 30.3% over the next three years. Revenue is expected to increase by 17.8% per year, outpacing the South Korean market average of 10.3%. Analysts agree that the stock price could rise by 41.7%, and it currently trades at a significant discount to its estimated fair value, enhancing its attractiveness for growth-focused investors.

- Take a closer look at Samyang Foods' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Samyang Foods is trading behind its estimated value.

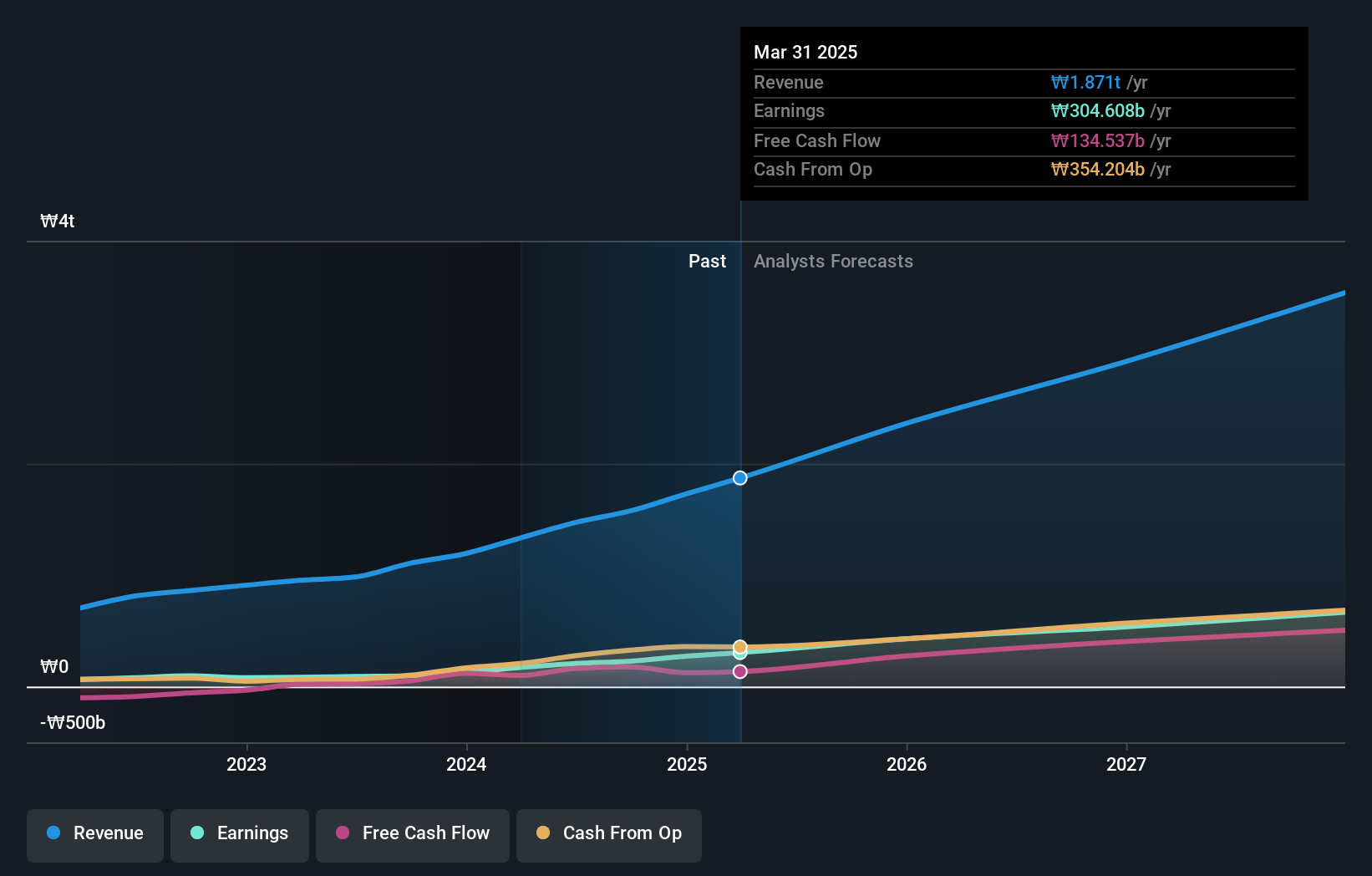

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co.,Ltd manufactures and sells cosmetic products for men and women, with a market cap of ₩2.20 trillion.

Operations: The company generates revenue from cosmetics (₩614.77 billion) and apparel fashion (₩64.46 billion).

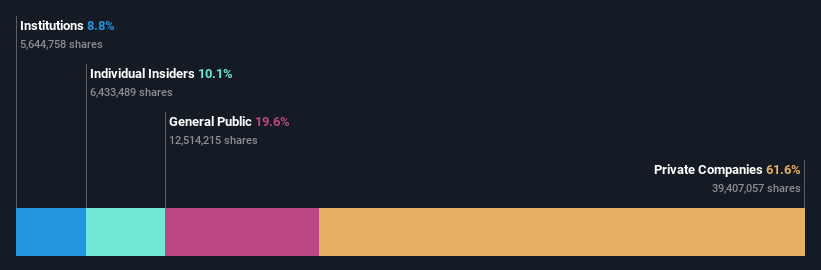

Insider Ownership: 34.4%

Revenue Growth Forecast: 22.2% p.a.

APR Co., Ltd. is poised for significant growth, with earnings expected to increase by 25.6% annually over the next three years and revenue projected to grow at 22.2% per year, outpacing the South Korean market average of 10.3%. The company recently announced a KRW 60 billion share repurchase program aimed at stabilizing its stock price and enhancing shareholder value. Analysts anticipate a 41.4% rise in stock price, while it currently trades at a substantial discount to fair value estimates.

- Click here and access our complete growth analysis report to understand the dynamics of APR.

- Insights from our recent valuation report point to the potential undervaluation of APR shares in the market.

Seize The Opportunity

- Get an in-depth perspective on all 89 Fast Growing KRX Companies With High Insider Ownership by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet with high growth potential.