Stock Analysis

- South Korea

- /

- Oil and Gas

- /

- KOSE:A096770

SK Innovation (KRX:096770) shareholders are up 5.0% this past week, but still in the red over the last three years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term SK Innovation Co., Ltd. (KRX:096770) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 58% decline in the share price in that time. The more recent news is of little comfort, with the share price down 38% in a year. On the other hand the share price has bounced 5.0% over the last week.

While the last three years has been tough for SK Innovation shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for SK Innovation

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, SK Innovation moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 31% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating SK Innovation further; while we may be missing something on this analysis, there might also be an opportunity.

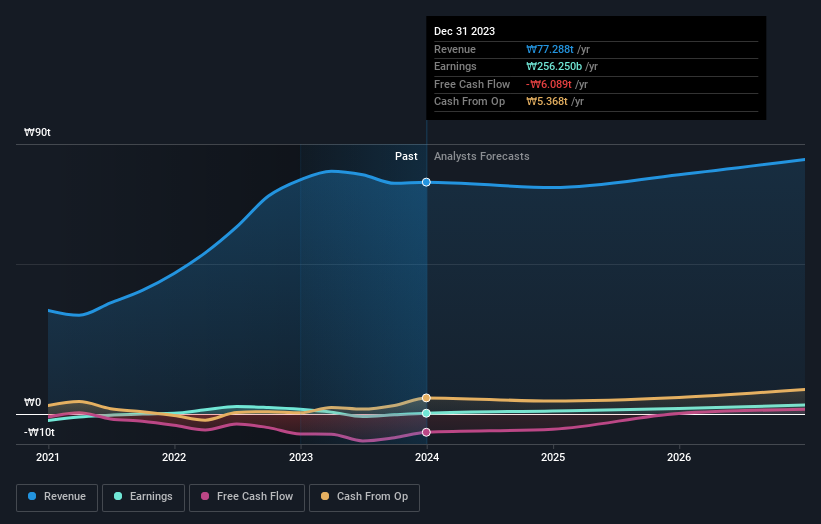

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SK Innovation is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for SK Innovation in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 3.3% in the last year, SK Innovation shareholders lost 37%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with SK Innovation (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

But note: SK Innovation may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether SK Innovation is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A096770

SK Innovation

SK Innovation Co., Ltd., together with its subsidiaries, engages in the production and sale of petroleum products, lubricants, and base oil in South Korea and internationally.

Moderate growth potential with questionable track record.