Stock Analysis

- South Korea

- /

- Consumer Durables

- /

- KOSE:A079430

Investors in Hyundai Livart Furniture (KRX:079430) from five years ago are still down 54%, even after 11% gain this past week

Hyundai Livart Furniture Company Limited (KRX:079430) shareholders should be happy to see the share price up 14% in the last month. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 56% during that time. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Hyundai Livart Furniture

Because Hyundai Livart Furniture made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Hyundai Livart Furniture saw its revenue increase by 4.3% per year. That's far from impressive given all the money it is losing. This lacklustre growth has no doubt fueled the loss of 9% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

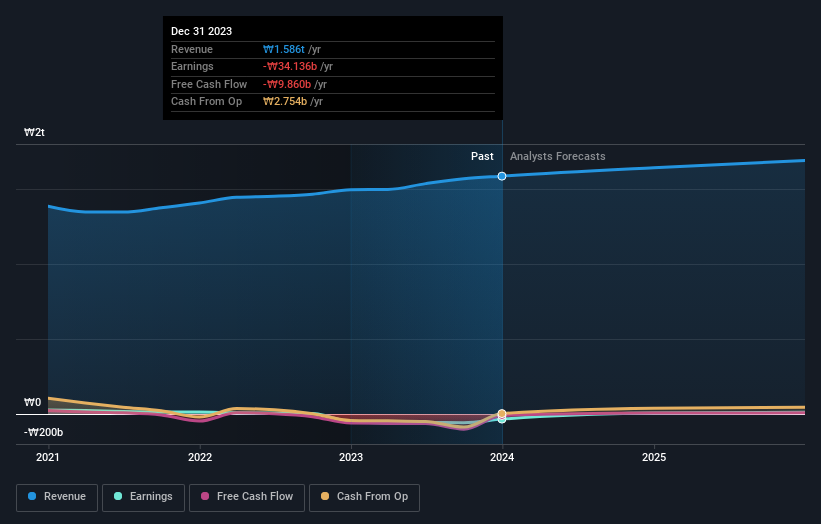

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Hyundai Livart Furniture's financial health with this free report on its balance sheet.

A Different Perspective

Hyundai Livart Furniture provided a TSR of 5.1% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. It could well be that the business is stabilizing. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Hyundai Livart Furniture is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A079430

Hyundai Livart Furniture

Manufactures and sells furniture and wooden products in South Korea and internationally.

Fair value with moderate growth potential.