- South Korea

- /

- Commercial Services

- /

- KOSE:A012750

3 KRX Dividend Stocks To Watch With Up To 5.3% Yield

Reviewed by Simply Wall St

In the last week, the South Korean market has stayed flat, with notable gains of 11% in the Utilities sector. Over the past year, the market's performance has been stable, and earnings are expected to grow by 29% annually over the next few years. Given these conditions, identifying dividend stocks with strong yields can be a prudent strategy for investors seeking steady income amidst a stable market environment.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.51% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 5.79% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.90% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.00% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.03% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.00% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.38% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 6.12% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.54% | ★★★★☆☆ |

| iMarketKorea (KOSE:A122900) | 6.97% | ★★★★☆☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

S-1 (KOSE:A012750)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S-1 Corporation offers safety and security services both in South Korea and internationally, with a market cap of ₩1.99 trillion.

Operations: S-1 Corporation's revenue is primarily derived from its Security Service Sector, generating ₩1.35 trillion, and its Infrastructure Service Sector, contributing ₩1.53 trillion.

Dividend Yield: 4.6%

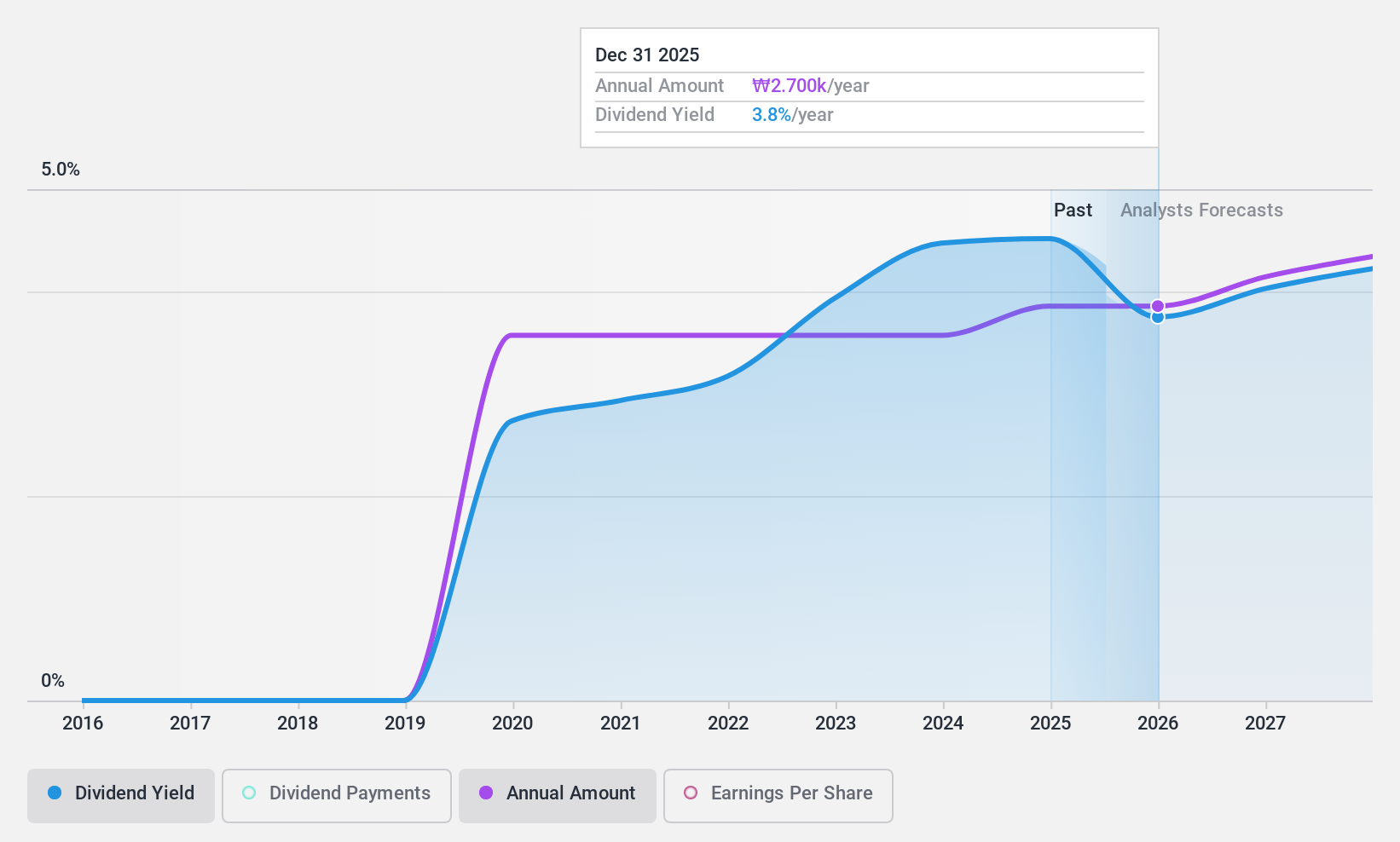

S-1 Corporation's recent earnings report shows solid financial performance, with Q2 sales at ₩695.65 billion and net income at ₩43.34 billion, reflecting year-over-year growth. The company's dividend payments are well-covered by both earnings (payout ratio: 49.5%) and cash flows (cash payout ratio: 38.7%). Although dividends have been stable and growing, S-1 has only a five-year track record of dividend payments, which may concern long-term investors seeking reliability.

- Delve into the full analysis dividend report here for a deeper understanding of S-1.

- According our valuation report, there's an indication that S-1's share price might be on the cheaper side.

NICE Information Service (KOSE:A030190)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NICE Information Service Co., Ltd. operates in South Korea offering credit evaluation, credit inquiries, credit investigations, and debt collection services with a market cap of ₩609.15 billion.

Operations: NICE Information Service Co., Ltd. generates revenue primarily through its services in credit evaluation, credit inquiries, credit investigations, and debt collection in South Korea.

Dividend Yield: 4%

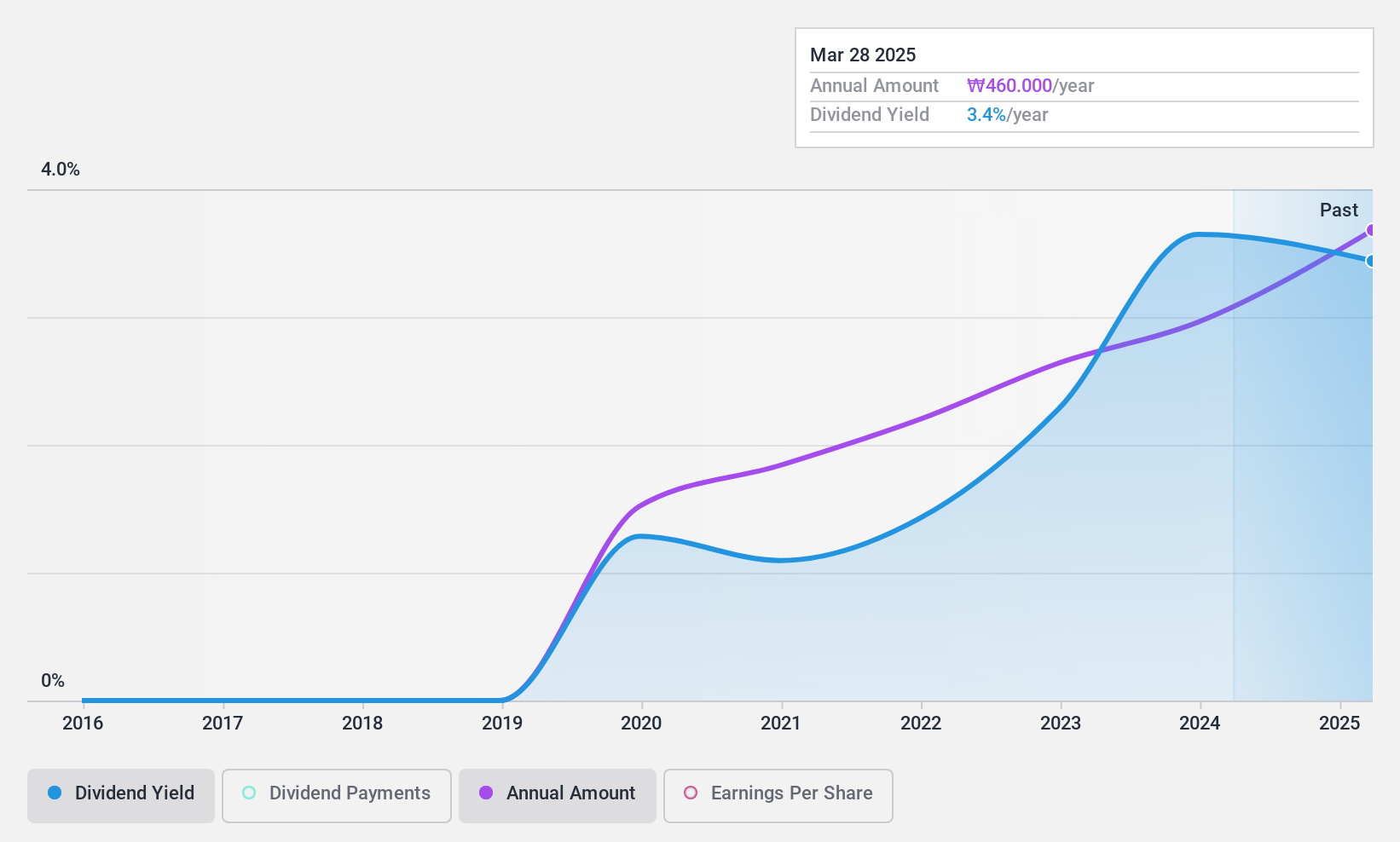

NICE Information Service's dividend payments are well-covered by earnings (payout ratio: 39.2%) and cash flows (cash payout ratio: 32.1%). While the company has only paid dividends for five years, these payments have been stable and increasing. Recent earnings reports show solid growth, with Q2 net income at ₩18.75 billion compared to ₩16.81 billion a year ago, and six-month net income at ₩36.37 billion versus ₩30.64 billion last year.

- Get an in-depth perspective on NICE Information Service's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that NICE Information Service is priced lower than what may be justified by its financials.

GS Holdings (KOSE:A078930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GS Holdings Corp., along with its subsidiaries, operates in the energy, power generation, retail, service, construction, and infrastructure sectors with a market cap of ₩4.36 trillion.

Operations: GS Holdings Corp.'s revenue segments include Trade (₩3.67 billion), Distribution (₩11.08 billion), and Gas and Electric Business (₩7.58 billion).

Dividend Yield: 5.3%

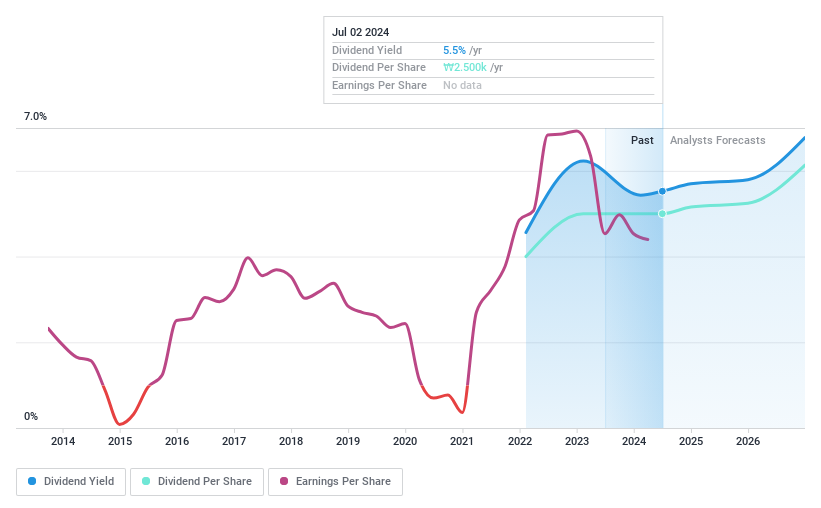

GS Holdings' dividends are well-covered by earnings (payout ratio: 18.2%) and cash flows (cash payout ratio: 14.8%). Although the company has only paid dividends for three years, these payments have been stable and increasing. The stock trades at a low price-to-earnings ratio of 3.4x compared to the KR market average of 11.5x, indicating good value relative to peers and industry standards.

- Click here and access our complete dividend analysis report to understand the dynamics of GS Holdings.

- Insights from our recent valuation report point to the potential undervaluation of GS Holdings shares in the market.

Make It Happen

- Investigate our full lineup of 74 Top KRX Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A012750

S-1

Provides safety and security services in South Korea and internationally.

Very undervalued with flawless balance sheet and pays a dividend.