Stock Analysis

- South Korea

- /

- Machinery

- /

- KOSDAQ:A195990

Strong week for Abpro Bio (KOSDAQ:195990) shareholders doesn't alleviate pain of three-year loss

Abpro Bio Co., Ltd. (KOSDAQ:195990) shareholders should be happy to see the share price up 10% in the last week. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 56% in that period. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

On a more encouraging note the company has added ₩14b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for Abpro Bio

Abpro Bio isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Abpro Bio's revenue dropped 23% per year. That means its revenue trend is very weak compared to other loss making companies. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 16% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

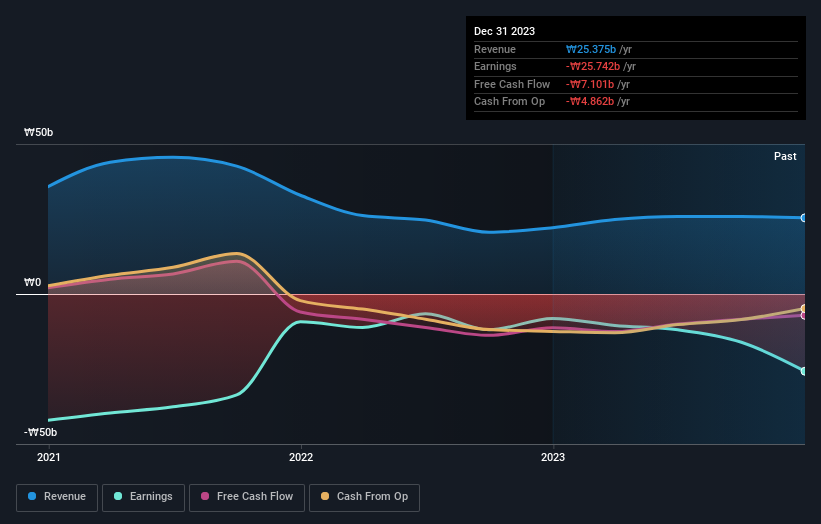

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Abpro Bio's financial health with this free report on its balance sheet.

A Different Perspective

Abpro Bio shareholders are down 1.1% for the year, but the market itself is up 3.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 5% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Abpro Bio better, we need to consider many other factors. For example, we've discovered 1 warning sign for Abpro Bio that you should be aware of before investing here.

But note: Abpro Bio may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Abpro Bio is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A195990

Abpro Bio

Abpro Bio Co., Ltd. engages in the manufacture and sale of various machine tools in South Korea and internationally.

Flawless balance sheet with weak fundamentals.