Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6999

Infocom And 2 Other High Growth Tech Stocks in Japan

Reviewed by Simply Wall St

Japan's stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%, amid speculation about the Bank of Japan's interest rate policies and a strengthening yen. As investors navigate these market conditions, identifying high-growth tech stocks like Infocom can be crucial for capitalizing on emerging opportunities in Japan's dynamic tech sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 20.62% | 32.82% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Infocom (TSE:4348)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infocom Corporation offers IT solutions and services to various sectors including medical institutions, corporations, public agencies, educational institutions, and research facilities in Japan with a market cap of ¥332.05 billion.

Operations: Infocom Corporation generates revenue primarily through its IT Services and Internet Business segments, with the latter contributing ¥58.87 billion. The company serves a diverse clientele across medical institutions, corporations, public agencies, educational institutions, and research facilities in Japan.

Infocom's earnings surged by 66.3% over the past year, significantly outpacing the Interactive Media and Services industry growth of 14.5%. With forecasted annual earnings growth of 27.4%, it is expected to grow faster than the Japanese market's average of 8.6%. Revenue is also projected to increase by 15.3% annually, highlighting strong future prospects despite recent removal from the S&P Global BMI Index on August 3, 2024. The company's R&D expenses emphasize its commitment to innovation and long-term growth strategy. The recent acquisition by Blackstone Inc., which now holds a cumulative stake of approximately ¥250 billion in Infocom, underscores confidence in Infocom’s management team and strategic direction. This transaction involves a substantial cash consideration valued at ¥6060 per share, reflecting Blackstone’s belief in Infocom’s robust potential within Japan's tech sector. The focus on software solutions transitioning to SaaS models ensures recurring revenue streams, positioning Infocom well for sustained growth amid evolving industry dynamics.

- Navigate through the intricacies of Infocom with our comprehensive health report here.

Understand Infocom's track record by examining our Past report.

Yokowo (TSE:6800)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yokowo Co., Ltd. specializes in providing components and advanced devices for wireless communication and information transmission applications, with a market cap of ¥37.58 billion.

Operations: Yokowo Co., Ltd. generates revenue through the sale of components and advanced devices designed for wireless communication and information transmission applications, serving both domestic and international markets. The company operates with a market cap of ¥37.58 billion.

Yokowo's earnings grew by 24% over the past year, significantly outpacing the Electronic industry’s 7.8%. With forecasted annual profit growth of 23.1%, Yokowo is expected to continue outperforming the Japanese market average of 8.6%. The company has been investing heavily in R&D, with expenditures reaching ¥4 billion last fiscal year, emphasizing its commitment to innovation and long-term growth. Recent guidance forecasts net sales of ¥80 billion and operating profit of ¥4.1 billion for FY2025, highlighting strong future prospects in Japan's tech sector.

- Take a closer look at Yokowo's potential here in our health report.

Assess Yokowo's past performance with our detailed historical performance reports.

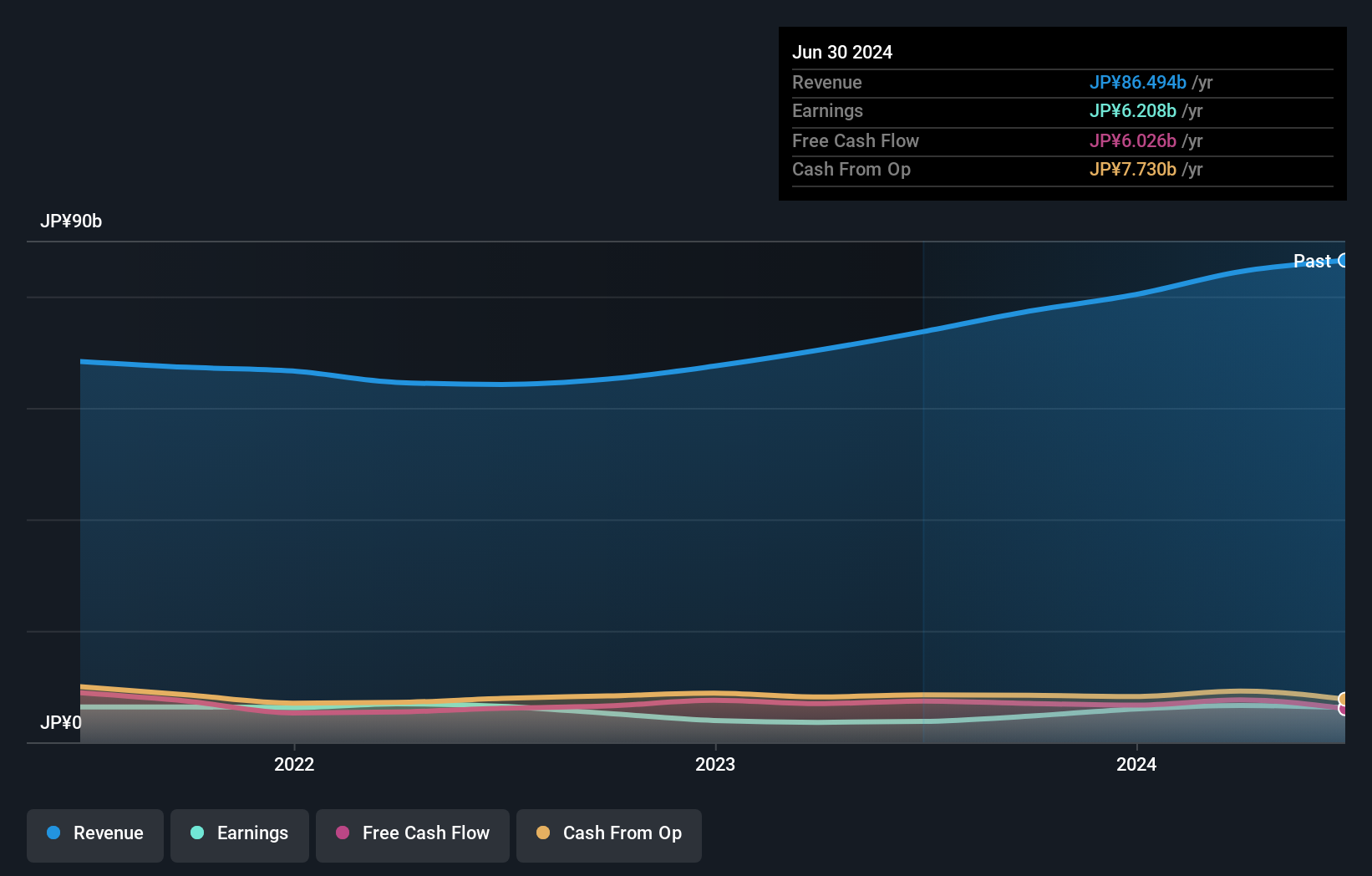

KOA (TSE:6999)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KOA Corporation develops, manufactures, and sells electronic components in Japan and internationally with a market cap of ¥44.77 billion.

Operations: KOA Corporation generates revenue from electronic component sales across various regions, including ¥32.28 billion from Asia, ¥51.10 billion from Japan, ¥12.14 billion from Europe, and ¥11.53 billion from the U.S.A.

KOA Corporation's earnings are projected to grow 30.1% annually, outpacing the Japanese market's 8.6%. Despite a recent dip in profit margins to 3.2%, the company forecasts net sales of ¥71.9 billion and an operating profit of ¥3.9 billion for FY2025, reflecting strong future prospects. With R&D expenses reaching ¥2 billion last year, KOA emphasizes innovation to drive long-term growth in Japan’s tech sector while navigating executive changes and strategic shifts in leadership roles.

- Dive into the specifics of KOA here with our thorough health report.

Review our historical performance report to gain insights into KOA's's past performance.

Where To Now?

- Embark on your investment journey to our 129 Japanese High Growth Tech and AI Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6999

KOA

Develops, manufactures, and sells electronic components in Japan and internationally.