Stock Analysis

- Japan

- /

- Interactive Media and Services

- /

- TSE:2371

Exploring Japan's High Growth Tech Stocks September 2024

Reviewed by Simply Wall St

As Japan's stock markets wrap up a volatile month with gains, the Nikkei 225 Index and the broader TOPIX Index have shown resilience despite earlier sell-offs driven by renewed U.S. growth fears and a rapid unwinding of the yen carry trade. In this dynamic environment, identifying high-growth tech stocks requires careful consideration of their innovation potential, market demand, and adaptability to economic shifts.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| SHIFT | 20.25% | 32.08% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc., along with its subsidiaries, offers purchase support and restaurant review services in Japan, with a market cap of ¥494.41 billion.

Operations: Kakaku.com, Inc. generates revenue through its purchase support and restaurant review services in Japan. The company operates within a market cap of ¥494.41 billion, focusing on providing comprehensive consumer information and reviews to aid purchasing decisions.

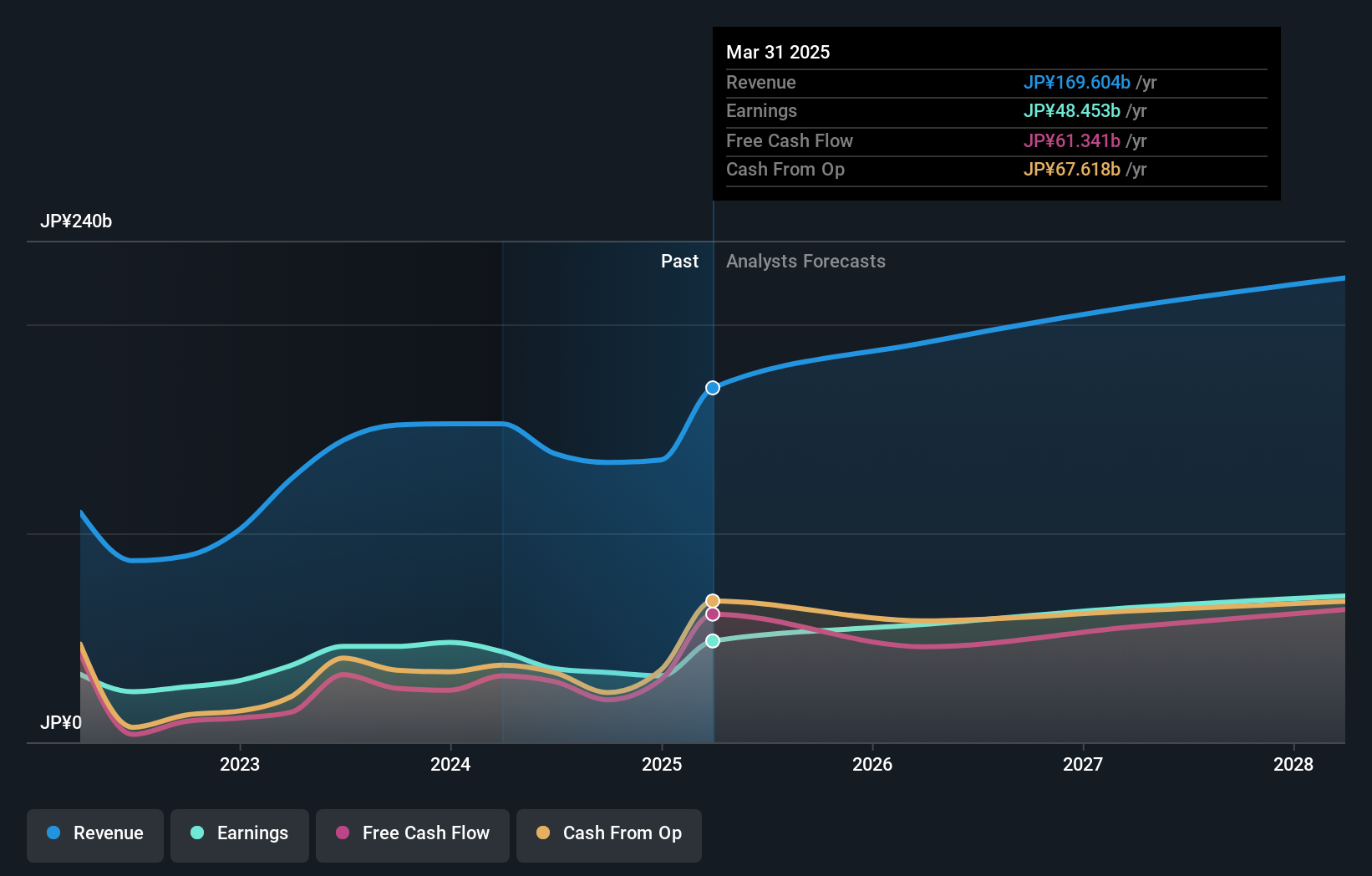

Kakaku.com, a standout in Japan's tech landscape, has shown impressive earnings growth of 23.4% over the past year, outpacing the Interactive Media and Services industry average of 14.5%. Forecasts indicate revenue growth at 8.7% annually, surpassing the JP market's 4.3%, with earnings expected to rise by 8.9% per year. The company's recent board decision on treasury share disposal highlights strategic moves to enhance shareholder value amidst a highly volatile share price environment over the last three months.

- Get an in-depth perspective on Kakaku.com's performance by reading our health report here.

Explore historical data to track Kakaku.com's performance over time in our Past section.

Arent (TSE:5254)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arent Inc. develops SaaS-based solutions for the construction industry in Japan and has a market cap of ¥38.47 billion.

Operations: Arent Inc. generates revenue primarily through its Company Product and Product Co-Development segments, contributing ¥24.30 billion and ¥2.97 billion respectively. The Co-Creation Product Sale segment adds an additional ¥232 million to the revenue stream.

Arent Inc., a notable player in Japan's tech sector, boasts an impressive earnings growth of 107.6% over the past year, significantly outpacing the IT industry's 10.1%. Forecasts suggest annual revenue growth at 18.4%, surpassing the JP market's 4.3%, with earnings expected to rise by 22.8% per year, indicating robust future prospects. The company's focus on R&D is evident from its substantial investment in innovation and development, ensuring it remains competitive and forward-thinking in a rapidly evolving industry landscape.

- Click here to discover the nuances of Arent with our detailed analytical health report.

Understand Arent's track record by examining our Past report.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global company that plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games with a market cap of ¥1.33 trillion.

Operations: Capcom generates revenue primarily from Digital Content (¥103.38 billion), Amusement Facilities (¥20.09 billion), and Amusement Equipment (¥10.34 billion). The company focuses on the development and distribution of various gaming formats both in Japan and internationally.

Capcom's forecasted annual revenue growth of 9.5% and earnings growth of 14.5% per year outpace the Japanese market averages, indicating a solid performance trajectory despite recent negative earnings growth of -23.3%. The company's substantial investment in R&D, reflected by ¥10 billion in expenses last year, underscores its commitment to innovation in the gaming industry. Recent Q1 2025 earnings calls highlighted strong performance driven by popular franchises like Resident Evil and Monster Hunter, contributing significantly to revenue streams.

- Dive into the specifics of Capcom here with our thorough health report.

Gain insights into Capcom's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 129 Japanese High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kakaku.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2371

Kakaku.com

Engages in the provision of purchase support, restaurant review, and other services in Japan.