- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7915

High Growth Tech in Japan 3 Promising Stocks to Watch

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%, amid speculation that market turmoil could influence the Bank of Japan's interest rate decisions. This backdrop creates a fertile environment for high-growth tech stocks, which often thrive in periods of economic adjustment and evolving market conditions. In such a dynamic landscape, identifying promising tech stocks involves looking at companies with strong innovation pipelines, robust financial health, and the ability to capitalize on emerging trends within Japan’s technology sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 21.58% | 32.81% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

MarkLines (TSE:3901)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MarkLines Co., Ltd. operates an automotive industry portal in Japan with a market cap of ¥38.51 billion.

Operations: MarkLines Co., Ltd. generates revenue primarily through its Information Platform Business, which accounts for ¥3.39 billion, and various other segments including Consulting, Recruitment, and Vehicle/Parts Procurement Agency businesses. The company also engages in Promotional Advertising and Teardown Survey Data Sales among other activities.

MarkLines, a standout in Japan's tech sector, is poised for notable growth with earnings expected to surge by 20.9% annually over the next three years. The company's revenue is anticipated to increase at a rate of 19.9% per year, outpacing the broader JP market's 4.3% growth forecast. In the past year alone, MarkLines demonstrated an impressive earnings growth of 18.8%, surpassing the Interactive Media and Services industry's average of 14.5%. With its robust R&D investments driving innovation and high-quality past earnings, MarkLines remains a compelling player in Japan’s tech landscape.

- Click here to discover the nuances of MarkLines with our detailed analytical health report.

Assess MarkLines' past performance with our detailed historical performance reports.

Simplex Holdings (TSE:4373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally with a market cap of ¥138.80 billion.

Operations: Simplex Holdings, Inc. generates revenue primarily from the provision of IT solutions, amounting to ¥42.26 billion. The company serves financial institutions, corporations, and public sectors worldwide.

Simplex Holdings is making significant strides in Japan’s tech sector, with an impressive annual earnings growth forecast of 20.2%, outpacing the broader market's 8.5%. The company projects a revenue increase of 12.8% per year, indicating robust performance compared to the JP market's 4.3%. Notably, their R&D expenses have been substantial, fueling innovation and sustaining competitive advantages; last year alone saw a hefty ¥1.5 billion investment in R&D efforts. With its focus on high-quality earnings and strategic investments in technology, Simplex is well-positioned for continued growth amidst evolving industry dynamics.

- Click to explore a detailed breakdown of our findings in Simplex Holdings' health report.

Understand Simplex Holdings' track record by examining our Past report.

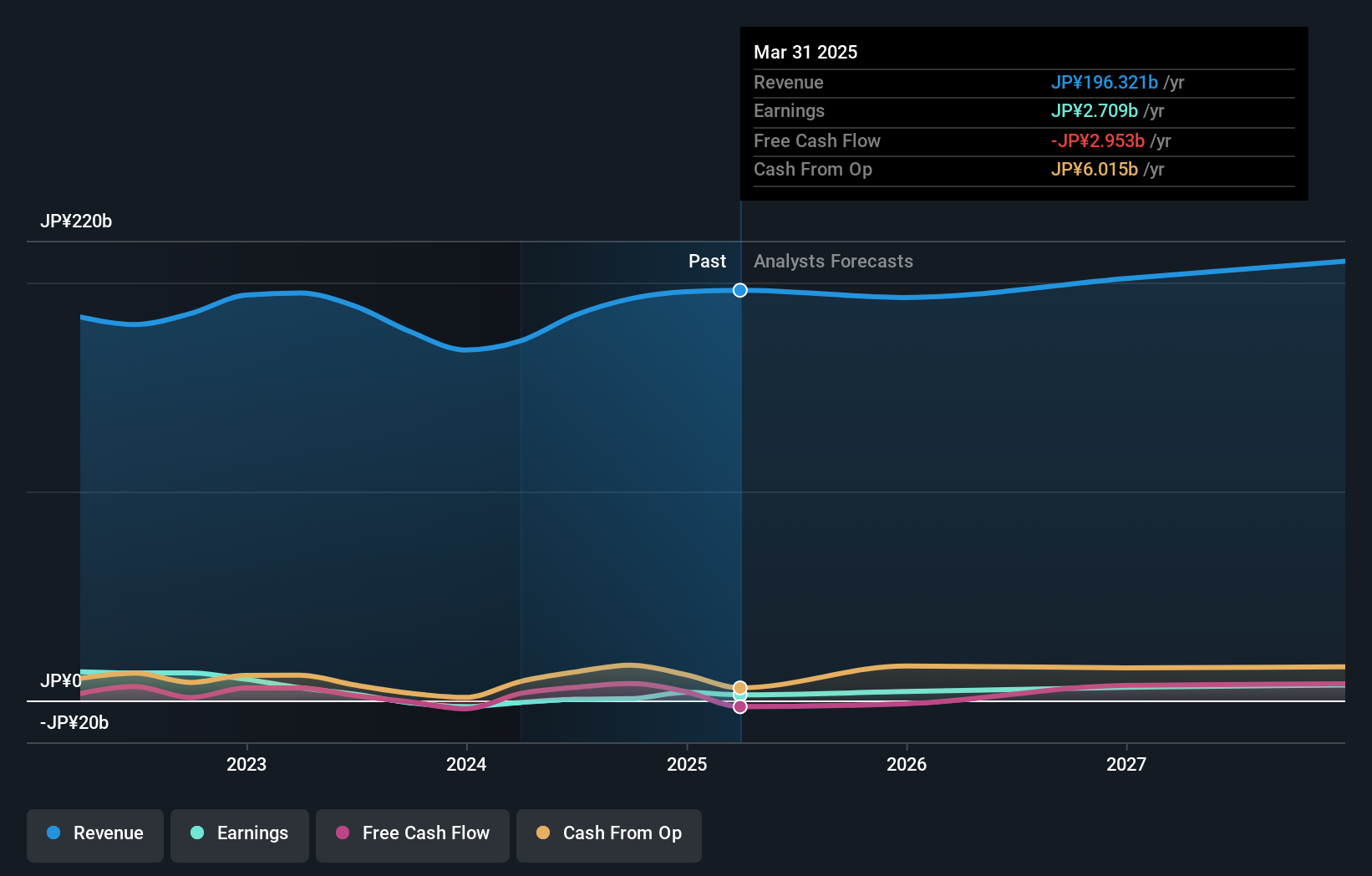

Nissha (TSE:7915)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nissha Co., Ltd. operates in industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics sectors both in Japan and internationally, with a market cap of ¥95.42 billion.

Operations: Nissha Co., Ltd. generates revenue primarily from industrial materials (¥72.03 billion), devices (¥63.30 billion), and medical technology (¥40.72 billion). The company's diverse business segments contribute significantly to its overall financial performance, with industrial materials being the largest revenue stream.

Nissha's earnings are forecast to grow 33.2% annually, significantly outpacing the broader market's 8.5%. Despite a one-off loss of ¥3.1 billion impacting recent results, their R&D expenses remain robust at ¥1.5 billion last year, driving innovation and competitive edge. The company plans to repurchase up to 600,000 shares by November 30, 2024, enhancing shareholder returns and capital efficiency. Revenue is expected to grow at a steady rate of 4.6% per year.

Summing It All Up

- Unlock more gems! Our Japanese High Growth Tech and AI Stocks screener has unearthed 126 more companies for you to explore.Click here to unveil our expertly curated list of 129 Japanese High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7915

Nissha

Engages in industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics businesses in Japan and internationally.

Flawless balance sheet and undervalued.