Stock Analysis

- Japan

- /

- Metals and Mining

- /

- TSE:7305

3 Japanese Dividend Stocks With Yields Up To 3.7%

Reviewed by Kshitija Bhandaru

Amid a backdrop of heightened global uncertainties and market volatility, Japan's stock markets have experienced significant downturns recently, with the Nikkei 225 and TOPIX indices witnessing sharp declines. In such times, investors often look towards dividend stocks as a potentially more stable investment option that can offer regular income. In considering dividend stocks, it is crucial to assess not only the yield but also the sustainability of dividends paid by companies, especially in challenging economic environments. This becomes particularly pertinent given current market dynamics and economic indicators.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| SOLXYZ (TSE:4284) | 3.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.68% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.04% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.30% | ★★★★★★ |

| Innotech (TSE:9880) | 3.91% | ★★★★★★ |

| Toyo Kanetsu K.K (TSE:6369) | 3.53% | ★★★★★★ |

| CMC (TSE:2185) | 3.49% | ★★★★★★ |

| Star Micronics (TSE:7718) | 3.35% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.32% | ★★★★★★ |

| CDSLtd (TSE:2169) | 3.49% | ★★★★★★ |

Click here to see the full list of 417 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

G-Tekt (TSE:5970)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: G-Tekt Corporation, with a market capitalization of ¥91.54 billion, specializes in manufacturing and selling auto body components and transmission parts both in Japan and globally.

Operations: G-Tekt Corporation generates revenue through its operations in North America (¥114.85 billion), China (¥74.88 billion), Japan (¥58.42 billion), Asia excluding Japan and China (¥47.61 billion), Europe (¥34.37 billion), and South America (¥17.20 billion).

Dividend Yield: 3%

G-Tekt offers a stable dividend yield at 3.01%, underpinned by a decade of reliable and growing payments. Its dividends are well-supported, with both earnings and cash flow payout ratios at a low 22%, indicating sustainability. Despite its yield being slightly below the top quartile in Japan's market, its price-to-earnings ratio of 7.9x suggests it is trading at good value relative to peers, with earnings expected to grow by 6.91% annually.

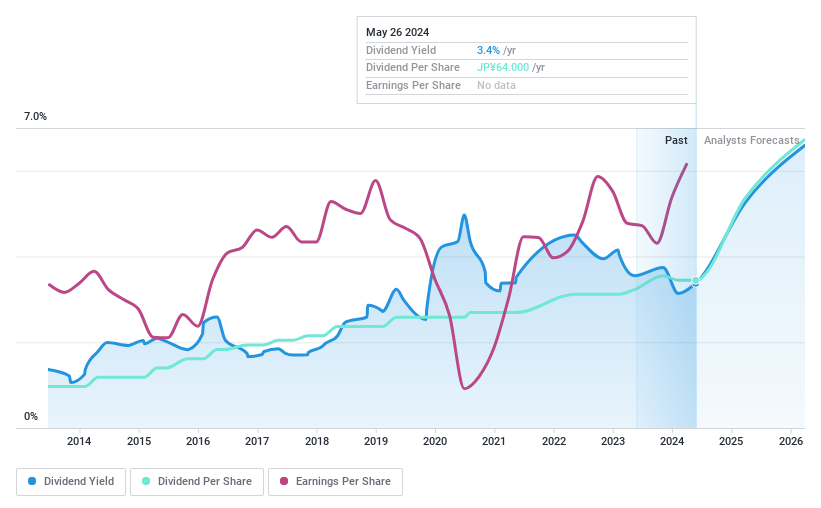

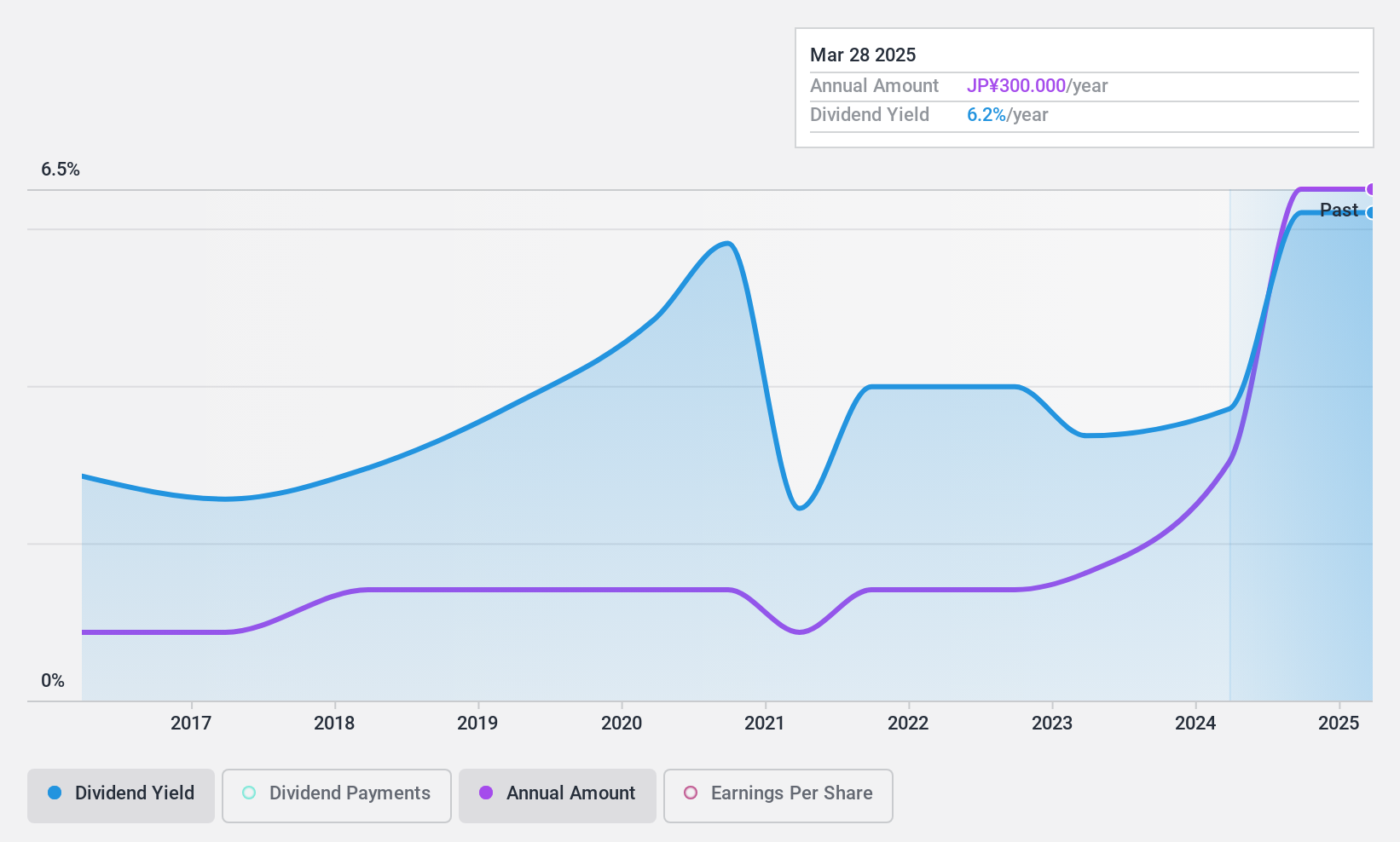

Araya Industrial (TSE:7305)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Araya Industrial Co., Ltd. is a company that manufactures and sells steel products both in Japan and internationally, with a market cap of approximately ¥20.70 billion.

Operations: Araya Industrial Co., Ltd. generates its revenue from the manufacture and sale of steel products across both domestic and international markets.

Dividend Yield: 3.8%

Araya Industrial offers a dividend yield of 3.76%, ranking in the top 25% of Japanese dividend payers. Despite historical volatility in its dividend payments, current dividends are well-supported by both earnings and cash flows, with payout ratios at 12% and 35.1%, respectively. Trading at a 14.4% discount to estimated fair value, the stock presents potential value despite a less stable past and recent declines in profit margins to 4.6%.

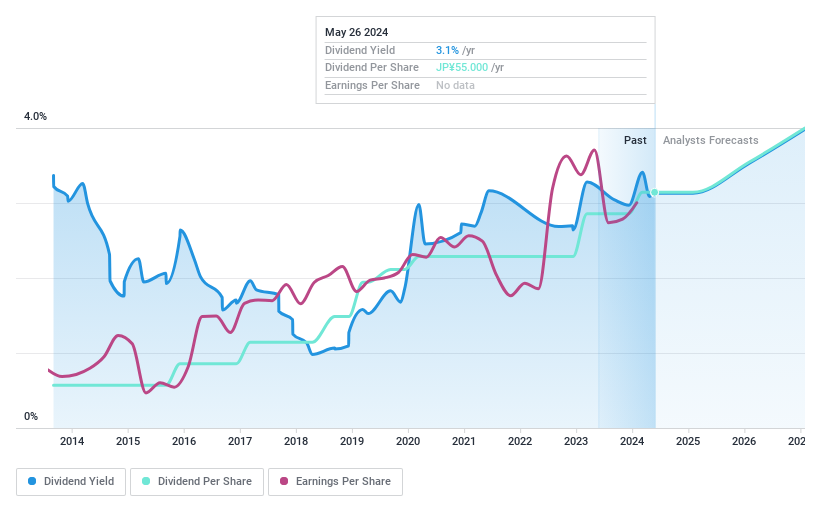

Computer Engineering & Consulting (TSE:9692)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computer Engineering & Consulting Ltd. operates in digital industry and system integration sectors in Japan, with a market capitalization of ¥59.33 billion.

Operations: Computer Engineering & Consulting Ltd. specializes in digital industry and system integration, generating its revenue primarily from these sectors in Japan.

Dividend Yield: 3.1%

Computer Engineering & Consulting maintains a stable dividend, with a 10-year history of consistent payments, underscored by a dividend yield of 3.12%. The dividends are well-supported by earnings and cash flows, with payout ratios of 40.7% and 35.2% respectively. Despite trading at a significant discount to its fair value (35.6% below), the stock experiences high price volatility, which may concern some investors. Additionally, its dividend yield is slightly below the top quartile in its market.

Turning Ideas Into Actions

- Discover the full array of 417 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Araya Industrial is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7305

Araya Industrial

Araya Industrial Co., Ltd. manufactures and sells steel products in Japan and internationally.

Flawless balance sheet established dividend payer.