Stock Analysis

- Japan

- /

- Food and Staples Retail

- /

- TSE:3034

Three Prominent Japanese Growth Stocks With Up To 25% Insider Ownership On The Tokyo Stock Exchange

Reviewed by Simply Wall St

Despite a backdrop of economic contraction and modest upward pressure on yields, Japanese equities have shown resilience, with the Nikkei 225 and TOPIX indices posting gains. This environment underscores the importance of focusing on growth companies with substantial insider ownership, which can signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 80.2% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Medley (TSE:4480) | 34% | 24.8% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 82.7% |

Let's review some notable picks from our screened stocks.

Qol Holdings (TSE:3034)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qol Holdings Co., Ltd. operates a network of dispensing pharmacies and provides business process outsourcing services in Japan, with a market capitalization of approximately ¥55.04 billion.

Operations: The company's revenue is primarily derived from its network of dispensing pharmacies and business process outsourcing services.

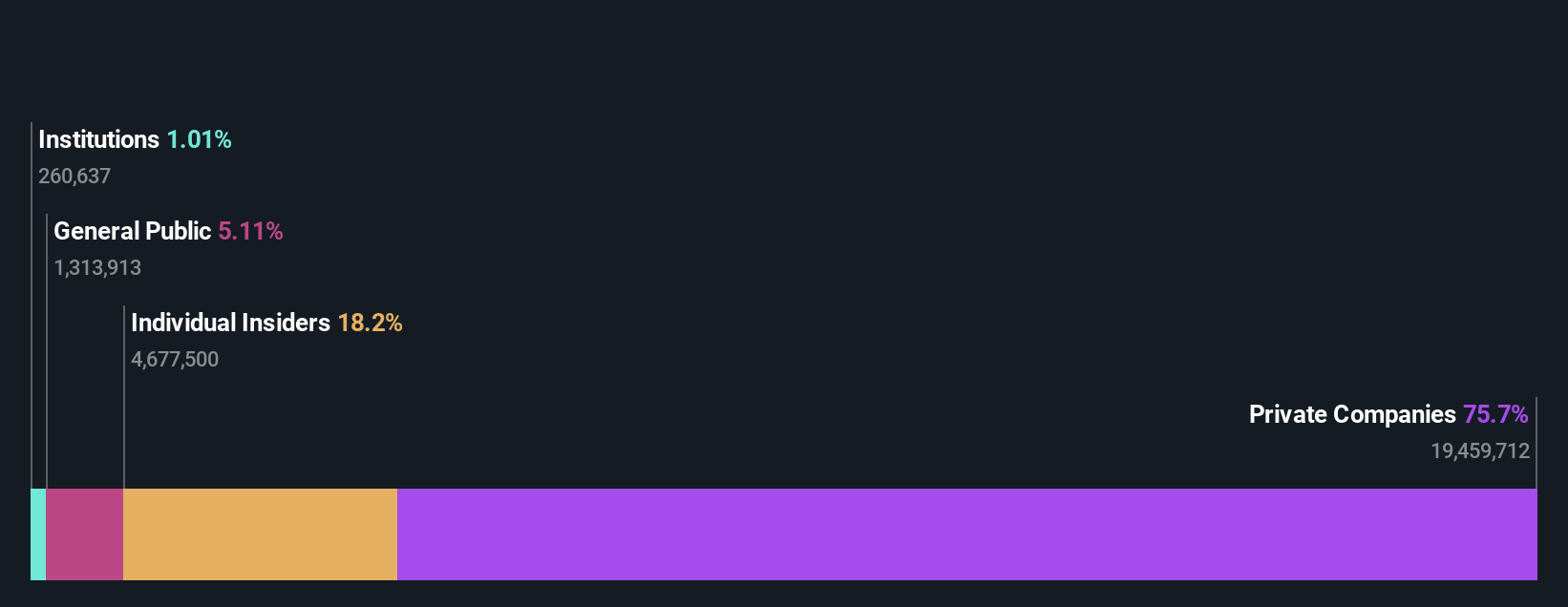

Insider Ownership: 14.5%

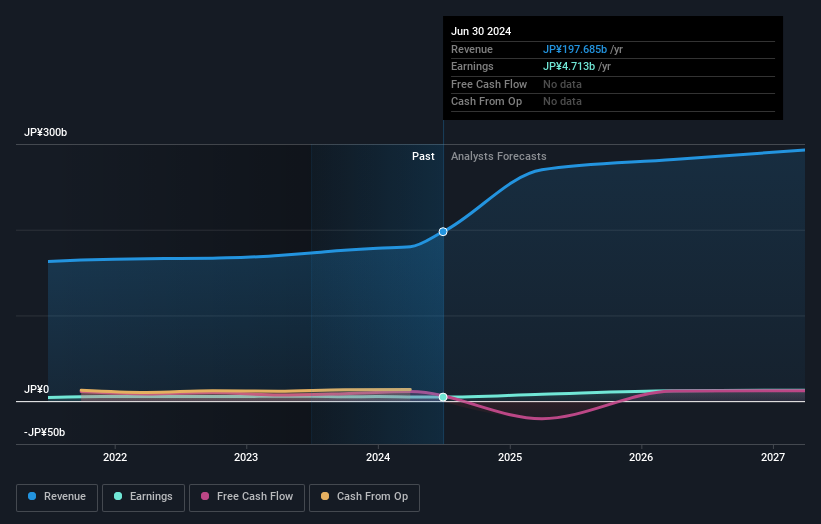

Qol Holdings, a growth company in Japan with high insider ownership, is anticipated to experience robust earnings growth at 29.4% annually, outpacing the Japanese market average of 8.5%. Despite this strong profit outlook, its Return on Equity is expected to remain modest at 17%. The firm's revenue growth forecast at 13.7% yearly also exceeds the market's 3.9%, indicating potential for significant expansion. However, it trades at a substantial discount of 75.9% below estimated fair value and exhibits high share price volatility over recent months. Recent strategic financial maneuvers include a JPY 25 billion debt financing for share acquisitions, underscoring aggressive growth pursuits but adding financial obligations.

- Click to explore a detailed breakdown of our findings in Qol Holdings' earnings growth report.

- The valuation report we've compiled suggests that Qol Holdings' current price could be quite moderate.

World (TSE:3612)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: World Co., Ltd. operates in the apparel and fashion industry, engaging in planning, manufacturing, retailing, selling, and importing/exporting products both domestically and internationally, with a market capitalization of ¥70.72 billion.

Operations: The company generates revenue through the planning, manufacturing, retailing, and international trade of apparel and fashion products.

Insider Ownership: 14.3%

World Co., Ltd., a Japanese growth company with high insider ownership, forecasts robust earnings growth of 22.27% annually, significantly outpacing the broader market's 8.5%. Despite a promising profit trajectory and trading at 77% below estimated fair value, concerns linger due to its high debt levels and unstable dividend record. Recent corporate guidance suggests strong future revenues and profits, yet the fluctuating dividend payouts reflect ongoing financial adjustments.

- Get an in-depth perspective on World's performance by reading our analyst estimates report here.

- The analysis detailed in our World valuation report hints at an deflated share price compared to its estimated value.

JTOWER (TSE:4485)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JTOWER Inc. specializes in infrastructure sharing services across Japan, with a market capitalization of approximately ¥52.14 billion.

Operations: The firm specializes in offering infrastructure sharing services across Japan.

Insider Ownership: 26%

JTOWER Inc., a Japanese growth company with substantial insider ownership, faces challenges despite its potential. The company recently adjusted its management structure to enhance flexibility and accountability, aligning with its strategic shift away from the discontinued 5G mmWave radio unit development due to demand delays. While JTOWER expects significant revenue growth (21.6% annually), it also anticipates a net loss for FY 2025 and has less than one year of cash runway, indicating potential liquidity risks.

- Click here to discover the nuances of JTOWER with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of JTOWER shares in the market.

Taking Advantage

- Reveal the 108 hidden gems among our Fast Growing Japanese Companies With High Insider Ownership screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Qol Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3034

Qol Holdings

Engages in management of dispensing pharmacies and business process outsourcing contracting businesses in Japan.

Flawless balance sheet, undervalued and pays a dividend.