Stock Analysis

- India

- /

- Marine and Shipping

- /

- NSEI:SCI

Improved Earnings Required Before The Shipping Corporation of India Limited (NSE:SCI) Stock's 26% Jump Looks Justified

The Shipping Corporation of India Limited (NSE:SCI) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

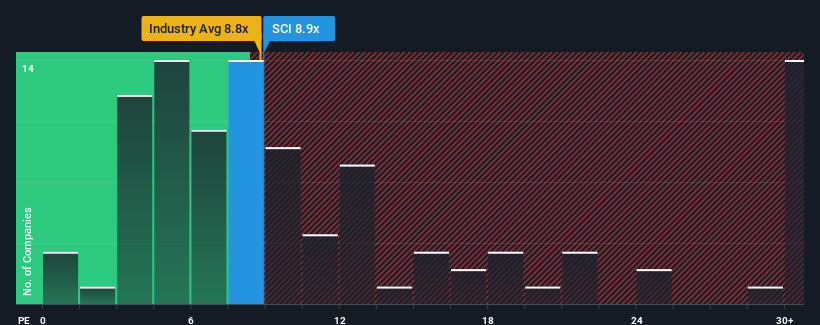

Even after such a large jump in price, Shipping Corporation of India's price-to-earnings (or "P/E") ratio of 8.9x might still make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The earnings growth achieved at Shipping Corporation of India over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Shipping Corporation of India

How Is Shipping Corporation of India's Growth Trending?

Shipping Corporation of India's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 26% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

In contrast to the company, the rest of the market is expected to grow by 26% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Shipping Corporation of India's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Shipping Corporation of India's P/E

Shares in Shipping Corporation of India are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shipping Corporation of India revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Shipping Corporation of India with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Shipping Corporation of India's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Shipping Corporation of India is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SCI

Shipping Corporation of India

The Shipping Corporation of India Limited, a marginal liner shipping company, engages in business of transporting goods in India.

Excellent balance sheet with acceptable track record.