Stock Analysis

- India

- /

- Infrastructure

- /

- NSEI:NAVKARCORP

Investors more bullish on Navkar (NSE:NAVKARCORP) this week as stock jumps 11%, despite earnings trending downwards over past three years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Navkar Corporation Limited (NSE:NAVKARCORP) share price has soared 213% in the last three years. How nice for those who held the stock! In more good news, the share price has risen 11% in thirty days.

Since the stock has added ₹1.6b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Navkar

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, Navkar actually saw its earnings per share (EPS) drop 33% per year. This was, in part, due to extraordinary items impacting earning in the last twelve months.

So we doubt that the market is looking to EPS for its main judge of the company's value. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The revenue drop of 16% is as underwhelming as some politicians. The only thing that's clear is there is low correlation between Navkar's share price and its historic fundamental data. Further research may be required!

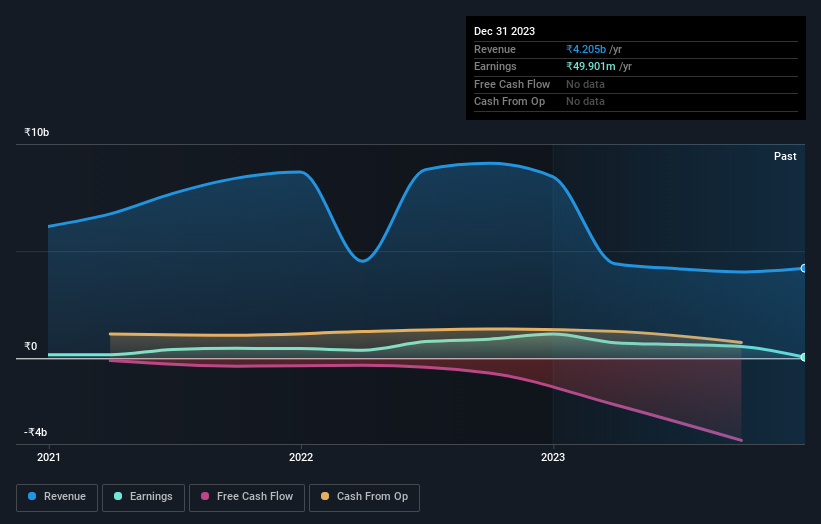

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Navkar has rewarded shareholders with a total shareholder return of 101% in the last twelve months. That gain is better than the annual TSR over five years, which is 24%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Navkar has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course Navkar may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Navkar is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NAVKARCORP

Navkar

Navkar Corporation Limited provides container freight station, inland container depot, rail terminal, container train operator, and warehousing and other logistics solutions in India.

Excellent balance sheet with questionable track record.