- India

- /

- Metals and Mining

- /

- NSEI:JINDALSAW

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Jindal Saw Limited's (NSE:JINDALSAW) CEO For Now

Under the guidance of CEO Neeraj Kumar, Jindal Saw Limited (NSE:JINDALSAW) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 27 September 2022. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Jindal Saw

How Does Total Compensation For Neeraj Kumar Compare With Other Companies In The Industry?

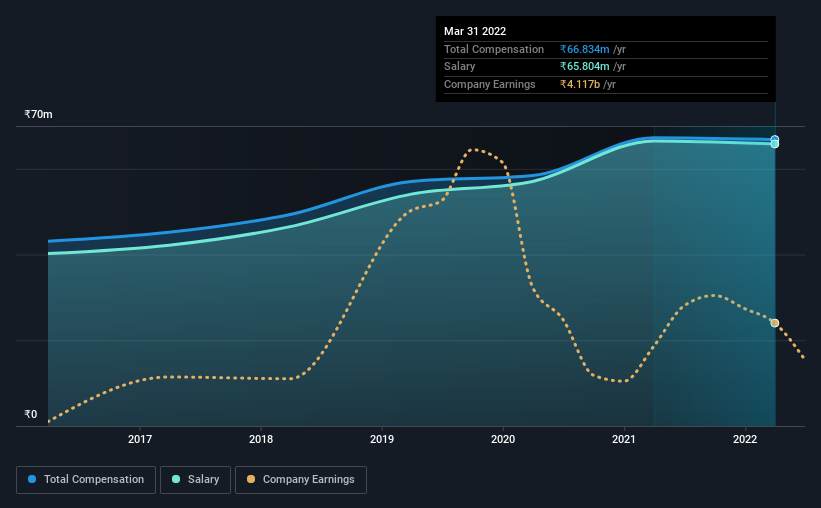

Our data indicates that Jindal Saw Limited has a market capitalization of ₹27b, and total annual CEO compensation was reported as ₹67m for the year to March 2022. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at ₹65.8m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between ₹16b and ₹64b, we discovered that the median CEO total compensation of that group was ₹26m. Accordingly, our analysis reveals that Jindal Saw Limited pays Neeraj Kumar north of the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹66m | ₹67m | 98% |

| Other | ₹1.0m | ₹750k | 2% |

| Total Compensation | ₹67m | ₹67m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. Jindal Saw is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Jindal Saw Limited's Growth

Over the last three years, Jindal Saw Limited has shrunk its earnings per share by 33% per year. It achieved revenue growth of 17% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Jindal Saw Limited Been A Good Investment?

With a total shareholder return of 8.5% over three years, Jindal Saw Limited has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Jindal Saw pays its CEO a majority of compensation through a salary. Some shareholders will be pleased by the relatively good results, however, the results could still be improved. EPS growth is still weak, and until that picks up, shareholders may find it hard to approve a pay rise for the CEO, since they are already paid above the average in their industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 1 which can't be ignored) in Jindal Saw we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JINDALSAW

Jindal Saw

Engages in the manufacture and supply of iron and steel pipes and pellets in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.