Stock Analysis

- India

- /

- Oil and Gas

- /

- NSEI:PETRONET

3 High-Yield Dividend Stocks In India With Up To 3.5% Yield

Reviewed by Kshitija Bhandaru

The Indian stock market has shown robust performance, with a rise of 1.2% over the last week and an impressive 45% increase over the past year. In this context of strong growth and optimistic earnings forecasts, high-yield dividend stocks can be particularly appealing for investors seeking both stability and income.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Bhansali Engineering Polymers (BSE:500052) | 3.99% | ★★★★★★ |

| Castrol India (BSE:500870) | 3.71% | ★★★★★☆ |

| Balmer Lawrie Investments (BSE:532485) | 4.57% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.81% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.07% | ★★★★★☆ |

| Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.30% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.69% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.38% | ★★★★★☆ |

| Petronet LNG (NSEI:PETRONET) | 3.12% | ★★★★★☆ |

| Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.46% | ★★★★★☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Akzo Nobel India (BSE:500710)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Akzo Nobel India Limited, with a market cap of ₹114.88 billion, engages in the manufacturing, distribution, and sale of paints and coatings both in India and globally.

Operations: Akzo Nobel India Limited generates ₹39.40 billion from its coatings segment.

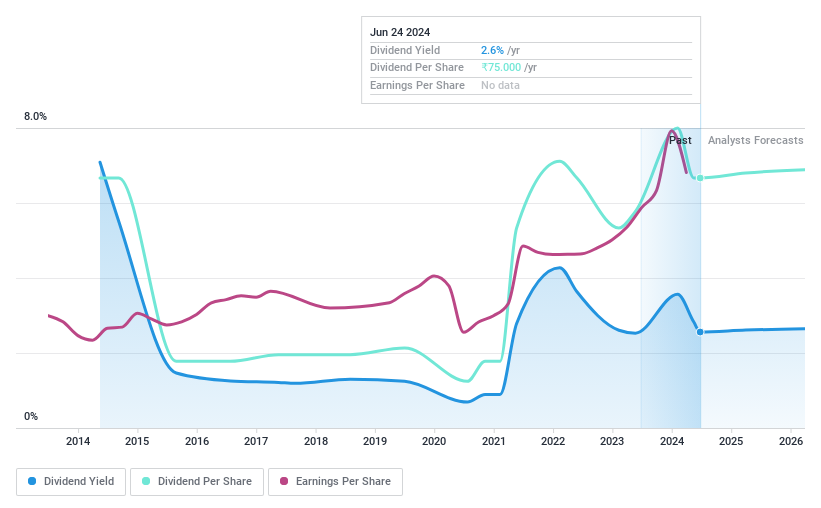

Dividend Yield: 3.6%

Akzo Nobel India's dividend yield stands at 3.57%, ranking in the top quartile of Indian dividend payers, supported by a payout ratio of 82.6% and cash payout ratio of 78.6%. Despite strong recent earnings growth of 31.5% and forecasted revenue growth of 11.44% annually, the company's dividend history over the past decade has been marked by volatility, reflecting an unstable track record in consistent dividend payments. This instability may raise concerns about long-term sustainability despite current coverage ratios being adequate.

- Dive into the specifics of Akzo Nobel India here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Akzo Nobel India is trading beyond its estimated value.

Bharat Petroleum (NSEI:BPCL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited, operating in India, specializes in refining crude oil and marketing petroleum products with a market capitalization of approximately ₹1.38 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue primarily through its downstream petroleum segment, which brought in approximately ₹50.81 billion, and a smaller contribution from exploration and production of hydrocarbons at about ₹1.84 billion.

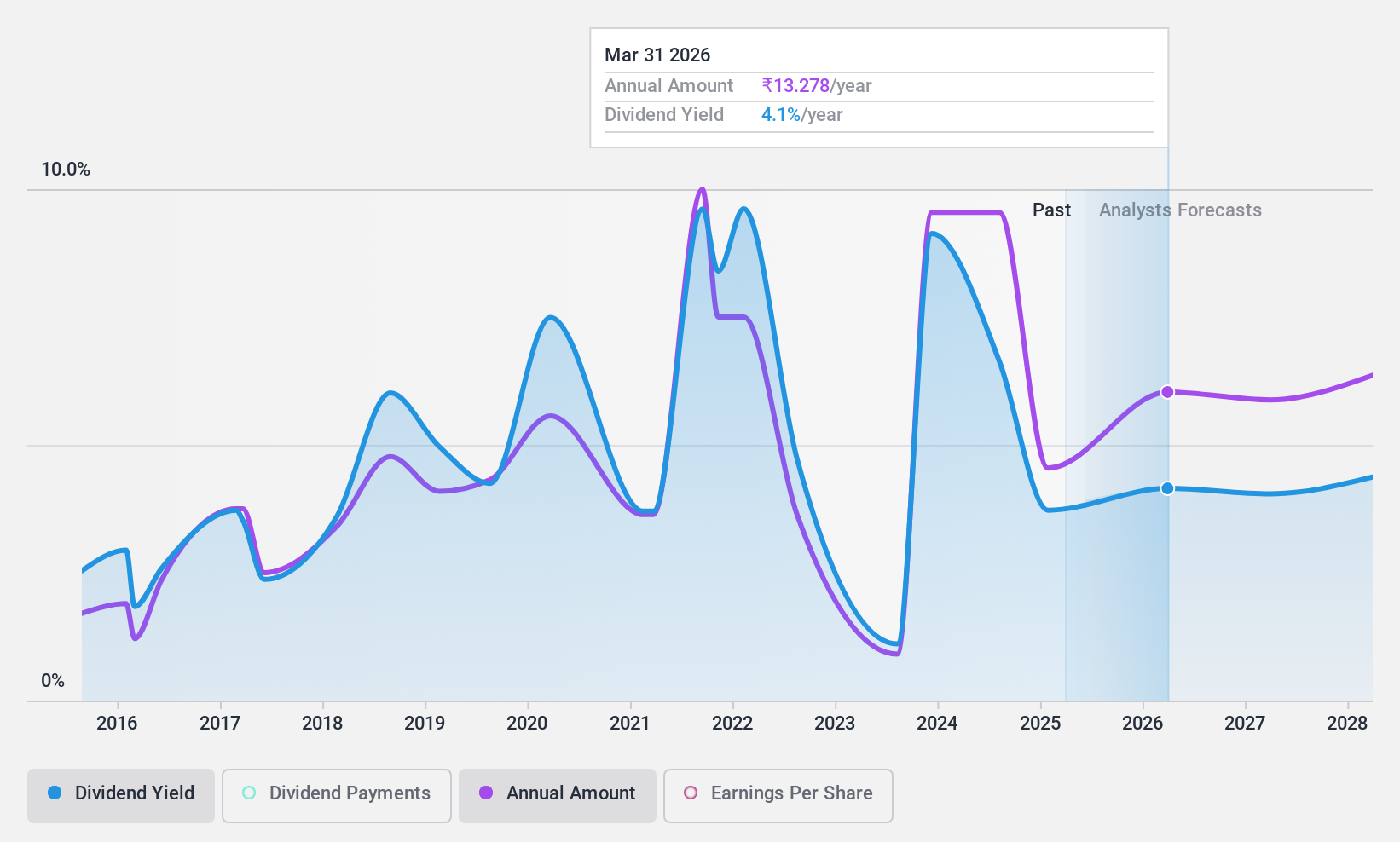

Dividend Yield: 3.3%

Bharat Petroleum's dividend yield is competitive at 3.31%, placing it in the top 25% of Indian dividend payers. Despite a challenging forecast with earnings expected to decline by 40.2% annually over the next three years, its dividends appear sustainable with a modest payout ratio of 40% and a cash payout ratio of 9.3%. However, its dividend history shows volatility and unreliability over the past decade, which might concern investors looking for stable returns. Additionally, recent management changes could influence future strategies and performance.

- Navigate through the intricacies of Bharat Petroleum with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Bharat Petroleum is trading behind its estimated value.

Petronet LNG (NSEI:PETRONET)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Petronet LNG Limited is involved in the import, storage, regasification, and supply of liquefied natural gas (LNG) in India, with a market capitalization of approximately ₹481.13 billion.

Operations: Petronet LNG Limited generates revenue primarily through its natural gas business, which amounted to ₹52.81 billion.

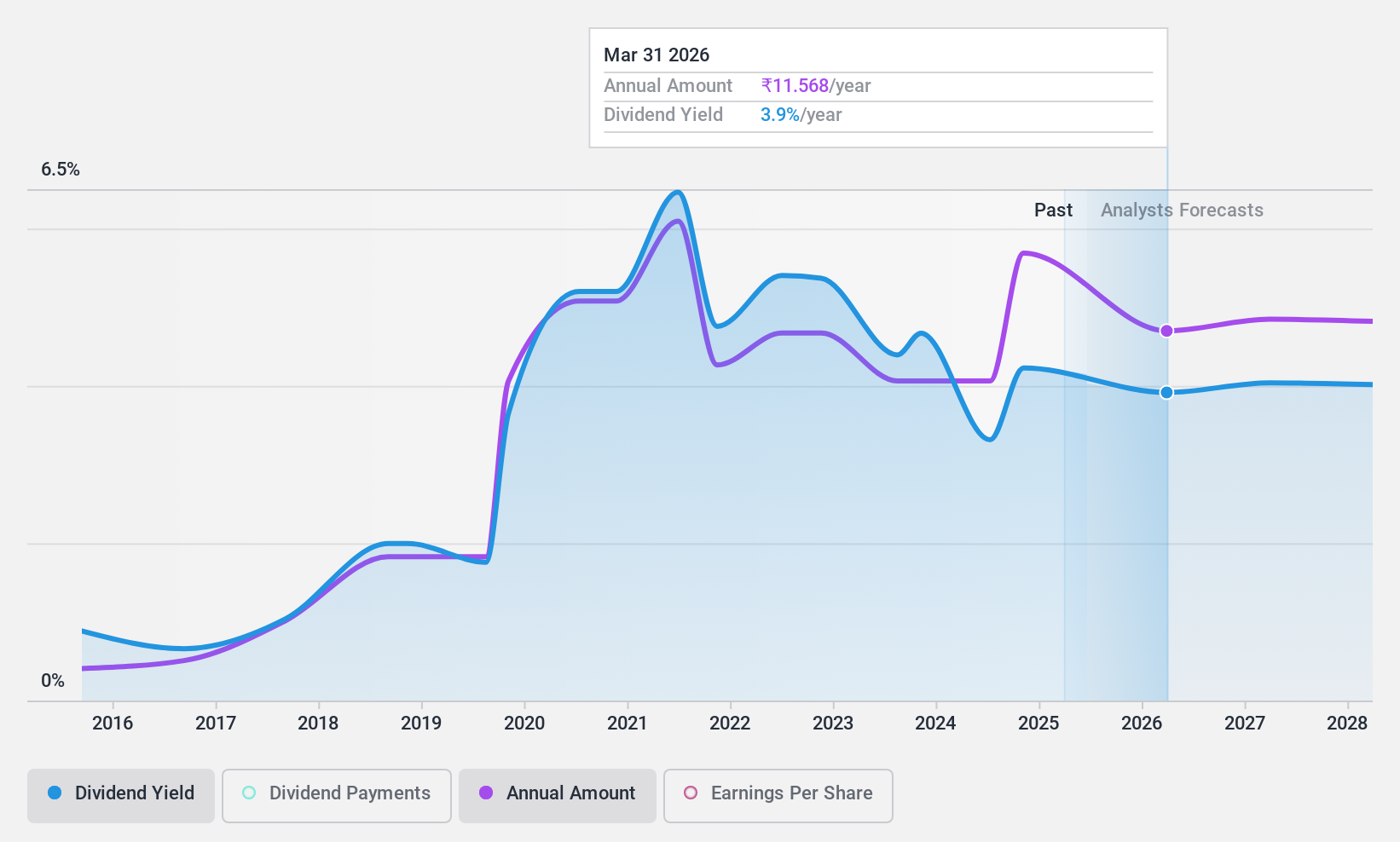

Dividend Yield: 3.1%

Petronet LNG offers a dividend yield of 3.12%, ranking it among the top 25% in India, supported by a low payout ratio of 12.8% and a cash payout ratio of 51.4%, ensuring dividends are well-covered by earnings and cash flows. However, its dividend history shows instability with significant fluctuations over the past decade, posing concerns for those seeking consistent income. Recent strategic moves include a long-term LNG agreement with QatarEnergy, enhancing future stability and supply security in energy sectors critical to India's economy.

- Unlock comprehensive insights into our analysis of Petronet LNG stock in this dividend report.

- Our expertly prepared valuation report Petronet LNG implies its share price may be too high.

Taking Advantage

- Investigate our full lineup of 25 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Petronet LNG is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PETRONET

Petronet LNG

Engages in the import, storage, regasification, and supply of liquefied natural gas (LNG) in India.

Excellent balance sheet established dividend payer.