Stock Analysis

- Ireland

- /

- Healthcare Services

- /

- ISE:UPR

Uniphar (ISE:UPR) sheds €67m, company earnings and investor returns have been trending downwards for past year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Investors in Uniphar plc (ISE:UPR) have tasted that bitter downside in the last year, as the share price dropped 27%. That contrasts poorly with the market return of 16%. The silver lining (for longer term investors) is that the stock is still 26% higher than it was three years ago. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days.

After losing 8.5% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Uniphar

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

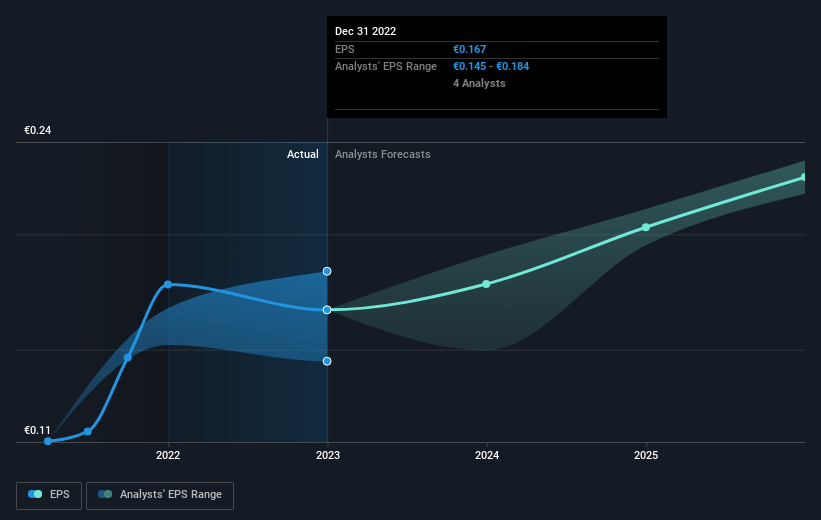

Unfortunately Uniphar reported an EPS drop of 6.2% for the last year. The share price decline of 27% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Uniphar's key metrics by checking this interactive graph of Uniphar's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Uniphar shares, which cost holders 26%, including dividends, while the market was up about 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 8% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Uniphar may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Irish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Uniphar is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:UPR

Uniphar

Operates as a diversified healthcare services company in the Republic of Ireland, the United Kingdom, The Netherlands, and internationally.

Undervalued with adequate balance sheet.