Stock Analysis

- Hungary

- /

- Real Estate

- /

- BUSE:GOPD

Investors who have held GOPD Nyilvánosan Muködo Részvénytársaság (BUSE:GOPD) over the last year have watched its earnings decline along with their investment

Even the best stock pickers will make plenty of bad investments. Anyone who held GOPD Nyilvánosan Muködo Részvénytársaság (BUSE:GOPD) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 58%. GOPD Nyilvánosan Muködo Részvénytársaság may have better days ahead, of course; we've only looked at a one year period.

While the stock has risen 30% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for GOPD Nyilvánosan Muködo Részvénytársaság

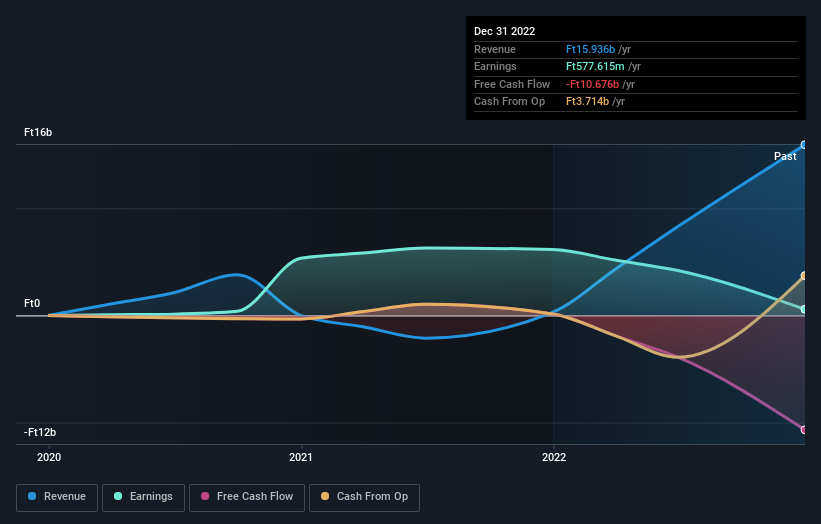

Given that GOPD Nyilvánosan Muködo Részvénytársaság only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

GOPD Nyilvánosan Muködo Részvénytársaság grew its revenue by 5,216% over the last year. That's a strong result which is better than most other loss making companies. Meanwhile, the share price slid 58%. This could mean hype has come out of the stock because the bottom line is concerning investors. Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While GOPD Nyilvánosan Muködo Részvénytársaság shareholders are down 58% for the year, the market itself is up 28%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 30% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand GOPD Nyilvánosan Muködo Részvénytársaság better, we need to consider many other factors. For instance, we've identified 4 warning signs for GOPD Nyilvánosan Muködo Részvénytársaság (3 are concerning) that you should be aware of.

Of course GOPD Nyilvánosan Muködo Részvénytársaság may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hungarian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether GOPD Nyilvánosan Muködo Részvénytársaság is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:GOPD

GOPD Nyilvánosan Muködo Részvénytársaság

GOPD Nyilvánosan Muködo Részvénytársaság engages in the real estate development activities in Hungary.

Imperfect balance sheet with weak fundamentals.