Stock Analysis

- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

High Growth Tech Stocks To Watch In Hong Kong August 2024

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts and small-cap stocks outperform their larger counterparts, the Hong Kong market has shown resilience with significant investor interest in high-growth tech sectors. In this dynamic environment, identifying strong tech stocks involves looking for companies with robust innovation pipelines and the ability to adapt swiftly to changing economic conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 23.91% | 27.42% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Joy Spreader Group | 35.36% | 107.63% | ★★★★★☆ |

| Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.22% | 50.81% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 9.08% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.24% | 100.10% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our SEHK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe with a market cap of HK$39.55 billion.

Operations: The company generates revenue primarily from acoustics products (CN¥7.64 billion) and electromagnetic drives and precision mechanics (CN¥8.28 billion). Additional revenue streams include optics products (CN¥4.07 billion) and sensor and semiconductor products (CN¥0.92 billion).

AAC Technologies Holdings demonstrated robust performance with a 22% increase in sales to ¥11.25 billion for H1 2024, compared to ¥9.22 billion last year. Net income surged by 257%, reaching ¥537 million from ¥150 million previously, showcasing significant profitability improvements. The company’s R&D expenses are notable, with an investment of approximately 12% of revenue, underscoring its commitment to innovation in acoustic and optical solutions. With earnings forecasted to grow at an annual rate of 20.8%, AAC is poised for continued expansion within the tech sector.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, provides value-added services, online advertising, fintech, and business services in China and internationally with a market cap of HK$3.46 trillion.

Operations: Tencent Holdings Limited generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company operates in China and internationally, leveraging its diversified portfolio to drive growth across multiple sectors.

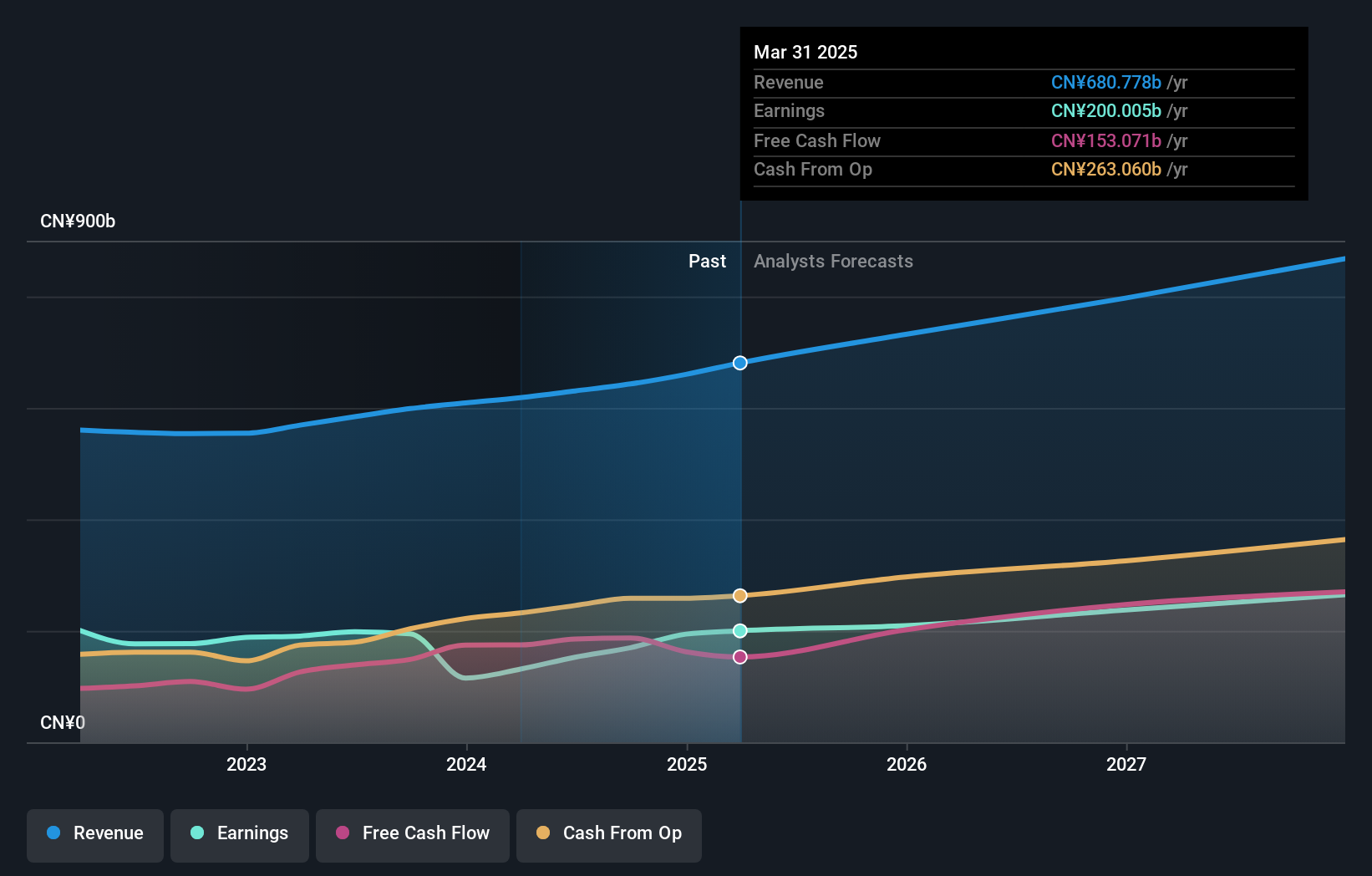

Tencent Holdings reported significant revenue growth, with Q2 2024 revenue reaching ¥161.12 billion, up from ¥149.21 billion a year earlier. Net income surged to ¥47.63 billion compared to ¥26.17 billion previously, highlighting robust profitability improvements. The company's R&D expenses are substantial, constituting around 8% of its revenue, underscoring its commitment to innovation in AI and software development sectors. Tencent's earnings are forecasted to grow at an annual rate of 12.8%, outpacing the broader Hong Kong market's expected growth rate of 10.8%.

- Unlock comprehensive insights into our analysis of Tencent Holdings stock in this health report.

Assess Tencent Holdings' past performance with our detailed historical performance reports.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited, an investment holding company with a market cap of HK$117.22 billion, develops, manufactures, and markets technology products and services.

Operations: Lenovo generates revenue primarily through its Intelligent Devices Group (IDG) at $45.76 billion, followed by the Infrastructure Solutions Group (ISG) at $10.17 billion and the Solutions and Services Group (SSG) at $7.64 billion. The company focuses on developing, manufacturing, and marketing technology products and services across these segments.

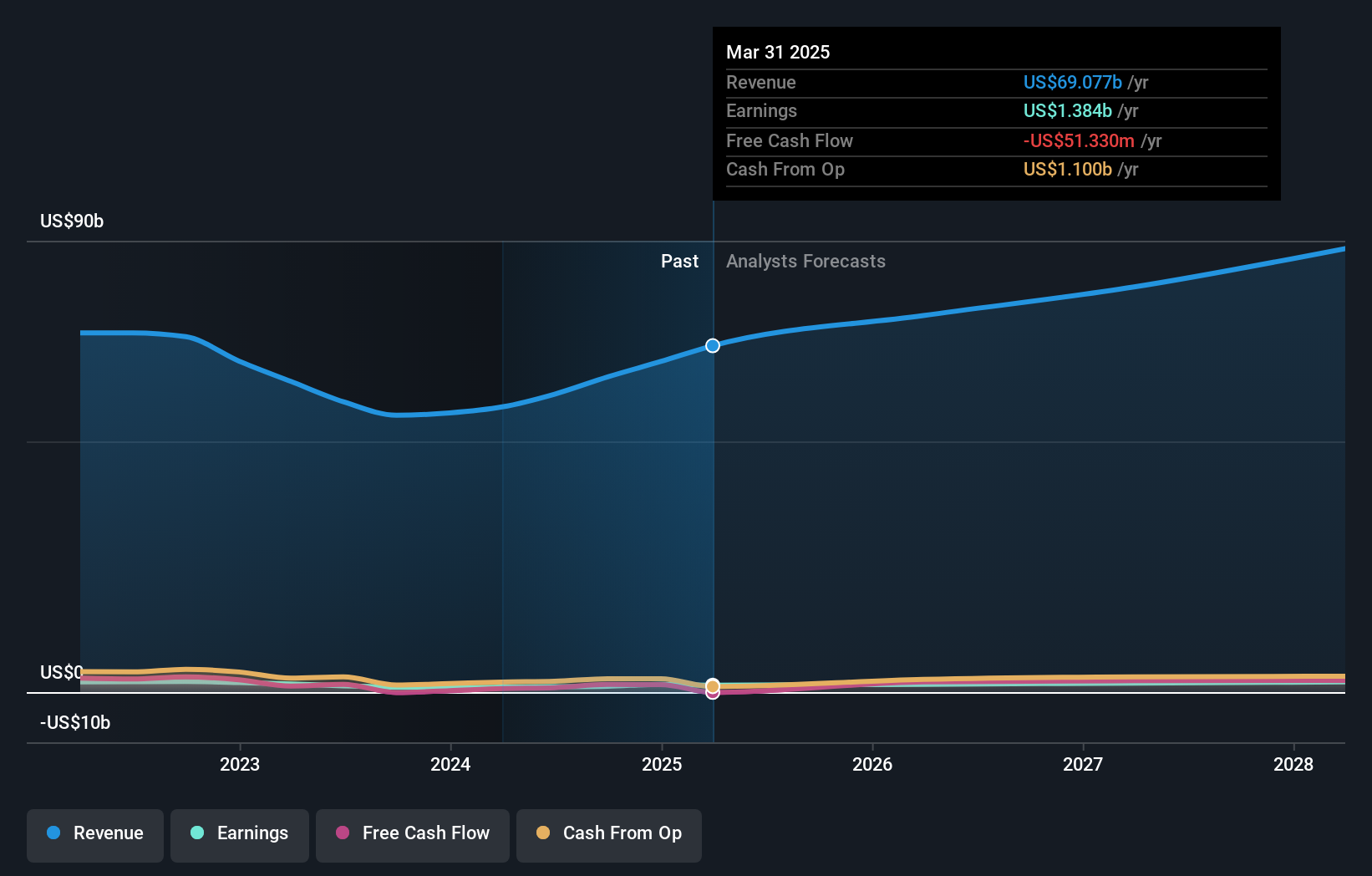

Lenovo Group's recent Q1 2024 earnings report showed a notable increase in sales to $15.45 billion from $12.90 billion a year ago, with net income rising to $243.37 million from $176.53 million previously. The company's R&D expenses, which account for approximately 7.9% of its revenue, highlight its commitment to innovation in AI and hybrid cloud solutions—crucial for future growth as enterprises increasingly adopt these technologies. Additionally, Lenovo's forecasted annual profit growth rate of 18.6% surpasses the Hong Kong market average of 10.8%, indicating robust potential despite past shareholder dilution concerns.

- Take a closer look at Lenovo Group's potential here in our health report.

Gain insights into Lenovo Group's historical performance by reviewing our past performance report.

Where To Now?

- Gain an insight into the universe of 48 SEHK High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides solutions for smart devices in Mainland China, Hong Kong Special Administrative Region of the People’s Republic of China, Taiwan, other Asian countries, the United States, and Europe.