The Hong Kong market has seen notable activity recently, with the Hang Seng Index advancing amidst a backdrop of cautious global sentiment and light economic calendars. This environment sets the stage for examining high-growth tech stocks that could potentially thrive under these conditions. In this article, we will explore three promising tech stocks in Hong Kong, focusing on their potential to capitalize on current market dynamics and economic indicators.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.71% | 25.80% | ★★★★★☆ |

| Be Friends Holding | 33.82% | 32.27% | ★★★★★★ |

| Inspur Digital Enterprise Technology | 21.83% | 38.02% | ★★★★★☆ |

| iDreamSky Technology Holdings | 29.81% | 104.11% | ★★★★★★ |

| Cowell e Holdings | 30.96% | 35.72% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.21% | 50.78% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 8.64% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.35% | 100.10% | ★★★★★☆ |

| Beijing Airdoc Technology | 31.64% | 83.90% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our SEHK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology, an investment holding company, offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$176.76 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations, totaling CN¥117.32 billion, with a smaller contribution of CN¥3.57 billion from overseas markets. The company's business model includes live streaming and online marketing services in China.

Kuaishou Technology's recent earnings report highlights a significant growth trajectory, with Q2 2024 sales reaching ¥30.98 billion, up from ¥27.74 billion the previous year, and net income soaring to ¥3.98 billion from ¥1.48 billion. The company’s innovative Kling AI model has seen substantial upgrades, enhancing video quality and user engagement through new subscription tiers priced between RMB66 and RMB666 monthly. R&D expenses are pivotal to their strategy; last year alone saw an expenditure of 19.9% of revenue on R&D initiatives, underscoring their commitment to technological advancement.

Shanghai Henlius Biotech (SEHK:2696)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Henlius Biotech, Inc. engages in the research and development of biologic medicines with a focus on oncology, autoimmune diseases, and ophthalmic diseases, with a market cap of HK$12.45 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, which reported CN¥5.39 billion. Focus areas include oncology, autoimmune diseases, and ophthalmic diseases.

Shanghai Henlius Biotech's recent financial performance underscores its growth potential in the biotech sector, with half-year sales reaching ¥2.75 billion, up from ¥2.50 billion last year and net income climbing to ¥386.3 million from ¥240 million. The company has committed 15.8% of its revenue to R&D, driving advancements like the HLX53 clinical trial for hepatocellular carcinoma treatment. With earnings forecasted to grow 15.77% annually and a notable focus on innovative therapies such as HANSIZHUANG, Henlius is positioning itself strongly within the competitive landscape of biotech innovation in Hong Kong.

- Take a closer look at Shanghai Henlius Biotech's potential here in our health report.

Evaluate Shanghai Henlius Biotech's historical performance by accessing our past performance report.

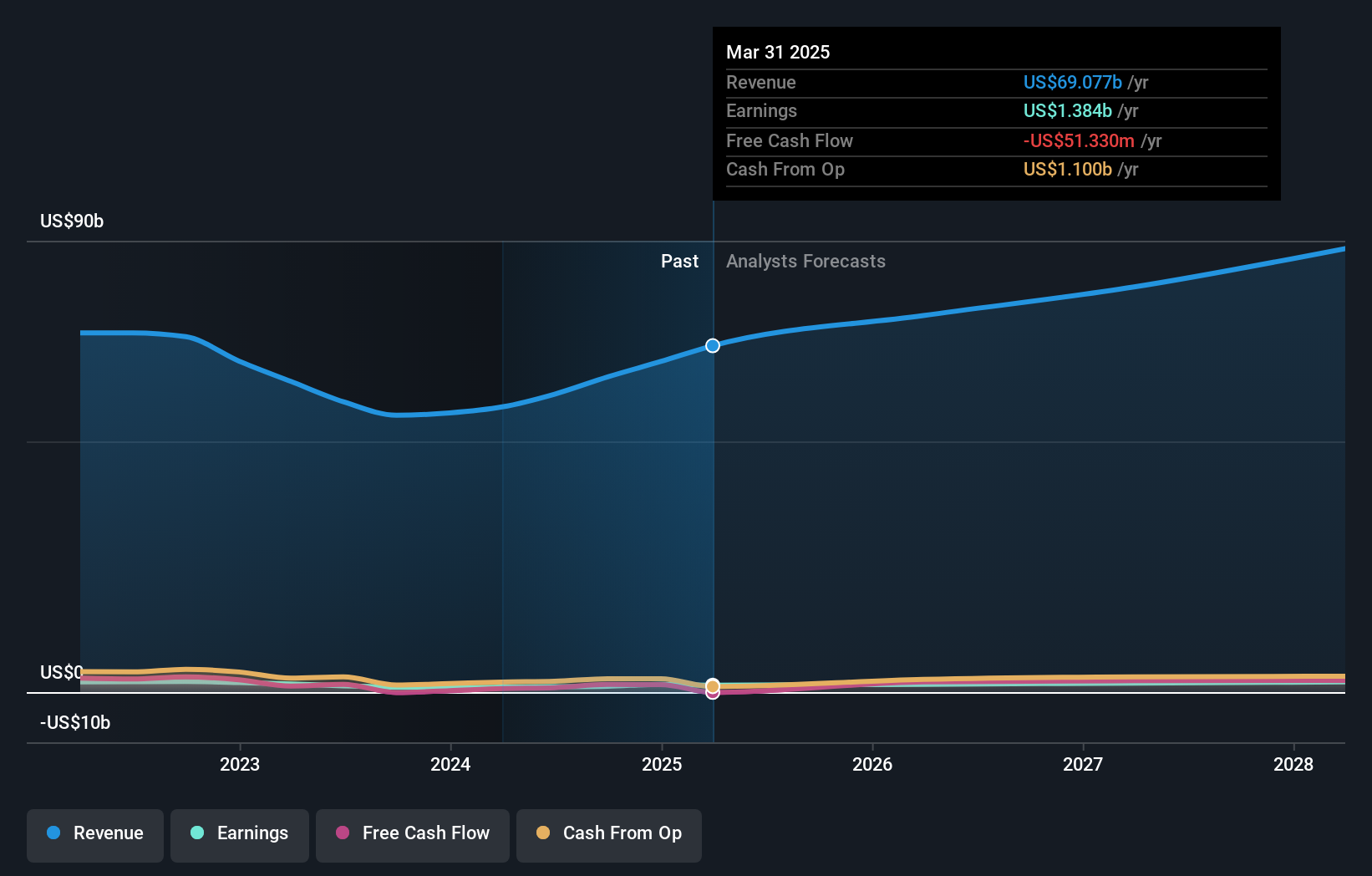

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited, an investment holding company with a market cap of HK$116.98 billion, develops, manufactures, and markets technology products and services.

Operations: Lenovo Group Limited generates revenue through three primary segments: Intelligent Devices Group (IDG) with $45.76 billion, Solutions and Services Group (SSG) at $7.64 billion, and Infrastructure Solutions Group (ISG) contributing $10.17 billion. The company focuses on developing, manufacturing, and marketing a wide range of technology products and services.

Lenovo Group's Q1 2024 earnings reveal a robust performance with sales hitting $15.45 billion, up from $12.90 billion last year, and net income rising to $243.37 million from $176.53 million. The company has committed 7.9% of its revenue to R&D expenses, focusing on innovations like the AD1 domain controller for autonomous driving, which boasts an impressive 2100 TOPS@FP8/INT8 computing power. Additionally, earnings are projected to grow at a rate of 18.6% annually over the next few years, outpacing the Hong Kong market's average growth rate of 10.9%.

- Delve into the full analysis health report here for a deeper understanding of Lenovo Group.

Gain insights into Lenovo Group's past trends and performance with our Past report.

Seize The Opportunity

- Delve into our full catalog of 48 SEHK High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2696

Shanghai Henlius Biotech

Engages in the research and development of biologic medicines with a focus on oncology, autoimmune diseases, and ophthalmic diseases.

Good value with reasonable growth potential.