Stock Analysis

- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:9911

Exploring Three High Growth Tech Stocks in Hong Kong

Reviewed by Simply Wall St

As global markets navigate a complex landscape, with the Hang Seng Index recently experiencing a decline amid broader economic shifts in China, the spotlight turns to high-growth tech opportunities in Hong Kong. In this dynamic environment, identifying stocks with robust innovation potential and adaptability to changing market conditions can be key for investors seeking growth.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 23.28% | 38.77% | ★★★★★☆ |

| RemeGen | 26.23% | 52.03% | ★★★★★☆ |

| Innovent Biologics | 22.11% | 59.31% | ★★★★★☆ |

| Akeso | 33.50% | 53.12% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

BOE Varitronix (SEHK:710)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BOE Varitronix Limited is an investment holding company that designs, manufactures, and sells liquid crystal displays and related products across various international markets, with a market cap of approximately HK$4.50 billion.

Operations: The company generates revenue primarily from the design, manufacture, and sale of liquid crystal displays and related products, amounting to HK$11.71 billion. The business operates in multiple international markets including China, Europe, the United States, and Korea.

BOE Varitronix, amidst a challenging landscape marked by a 16.7% dip in past earnings, still projects robust growth with earnings expected to surge by 21.3% annually, outpacing the Hong Kong market's 12.1%. This optimism is fueled by its substantial R&D commitment, which not only underscores innovation but also aligns with an anticipated revenue increase of 14.1% per year—double the local market average of 7.4%. Recent financials reveal a mixed scenario: while H1 sales rose to HKD 6.16 billion from HKD 5.21 billion year-over-year, net income slightly retracted to HKD 172.1 million from HKD 202.51 million, reflecting both resilience and areas for improvement in operational efficiency and market adaptation strategies. Despite these hurdles, BOE Varitronix's strategic investments in research and development could catalyze future technological advancements and customer acquisition within Hong Kong’s tech sector—a critical factor as it navigates through current profitability challenges and aims for sustained long-term growth.

- Click here and access our complete health analysis report to understand the dynamics of BOE Varitronix.

Gain insights into BOE Varitronix's historical performance by reviewing our past performance report.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Newborn Town Inc. is an investment holding company that operates in the global social networking industry with a market capitalization of HK$3.64 billion.

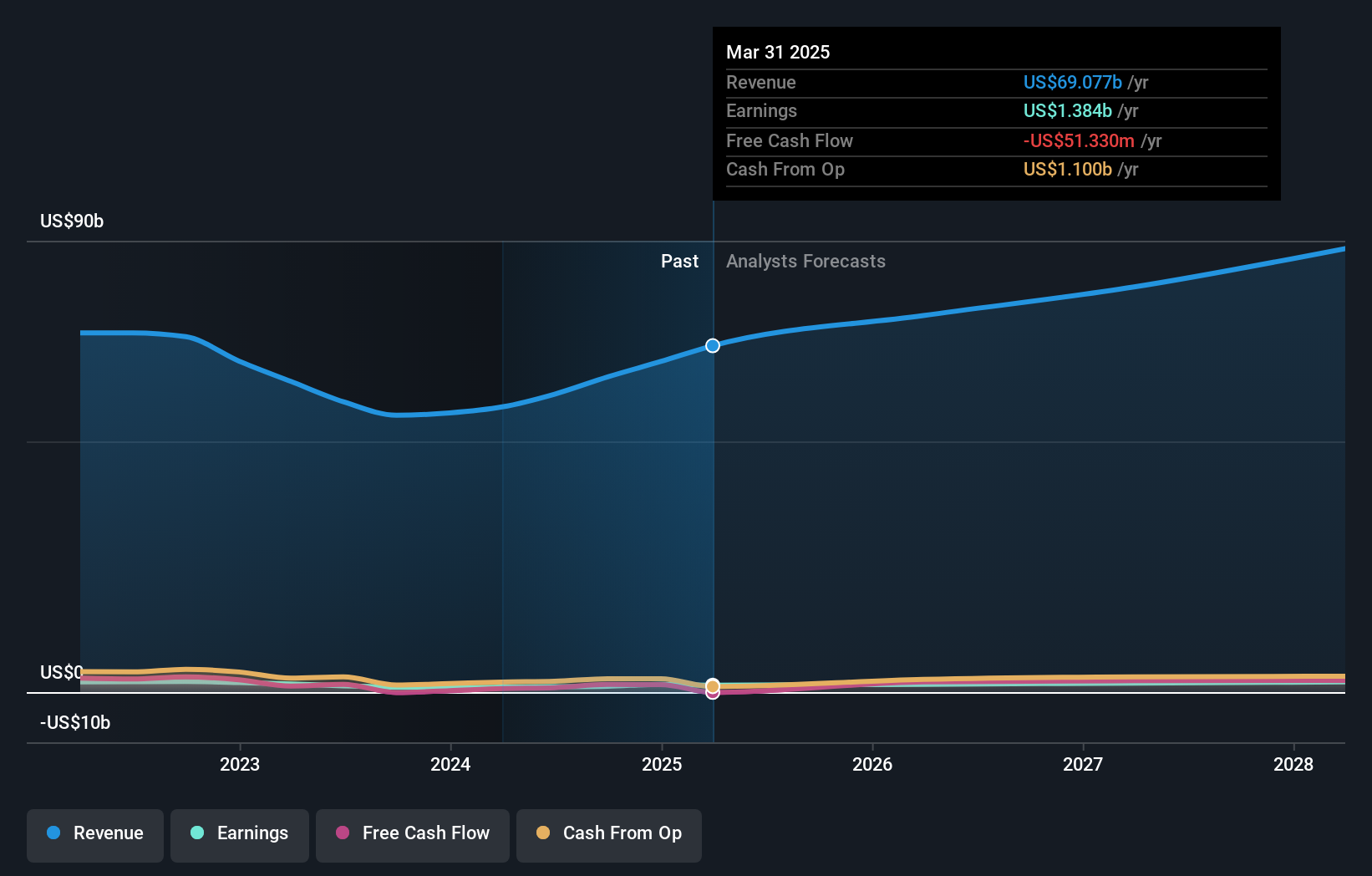

Operations: The company primarily generates revenue through its social networking business, contributing CN¥3.80 billion, with an additional CN¥406.28 million from its innovative business segment.

Newborn Town's recent performance showcases its potential in the high-growth tech sector of Hong Kong, with a notable revenue surge to CNY 2.27 billion, up from CNY 1.37 billion year-over-year, and an increase in net income to CNY 224.68 million from CNY 185.3 million. This growth is supported by a strategic focus on R&D, which has seen expenses rise significantly to foster innovation and maintain competitive advantage in diverse markets like the Middle East and North Africa. The appointment of Mr. LI Yongjie as COO could further streamline operations and enhance product development strategies, ensuring Newborn Town remains agile in a rapidly evolving tech landscape.

- Get an in-depth perspective on Newborn Town's performance by reading our health report here.

Review our historical performance report to gain insights into Newborn Town's's past performance.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market capitalization of HK$143.15 billion.

Operations: Lenovo Group's primary revenue streams are from its Intelligent Devices Group (IDG) at $45.76 billion and Infrastructure Solutions Group (ISG) at $10.17 billion, with additional contributions from the Solutions and Services Group (SSG) totaling $7.64 billion.

Lenovo Group's strategic embrace of AI and collaborations, such as with Red Hat for RHEL AI on ThinkSystem servers, underscores its commitment to enhancing AI capabilities. This initiative not only optimizes server performance for AI tasks but also simplifies the deployment of generative AI models, crucial for enterprises aiming to expedite innovation. Moreover, Lenovo's recent venture into Alzheimer’s Intelligence via an avatar demonstrates a pioneering approach in healthcare technology, blending real patient experiences with advanced AI to offer round-the-clock support and advice. These efforts are supported by a substantial 18.7% forecasted annual profit growth and an R&D focus that ensures Lenovo remains at the forefront of tech evolution in Hong Kong's competitive landscape.

- Click to explore a detailed breakdown of our findings in Lenovo Group's health report.

Explore historical data to track Lenovo Group's performance over time in our Past section.

Key Takeaways

- Take a closer look at our SEHK High Growth Tech and AI Stocks list of 43 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newborn Town might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9911

Newborn Town

An investment holding company, engages in the social networking business worldwide.