Stock Analysis

- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1888

High Growth Tech And 2 Other Promising Stocks To Watch

Reviewed by Simply Wall St

Amidst a backdrop of declining major stock indexes, the technology-heavy Nasdaq Composite has reached a new milestone, surpassing the 20,000 mark for the first time. With growth stocks continuing to outpace their value counterparts and small-cap stocks underperforming large-caps, investors are keenly watching high-growth tech companies that have shown resilience and potential in this shifting economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ParTec AG specializes in the development, manufacturing, and supply of supercomputer and quantum computer solutions, with a market cap of €576 million.

Operations: The company focuses on providing advanced computing solutions, including supercomputers and quantum computers. It operates within a niche market, leveraging its expertise in cutting-edge technology to cater to specialized computational needs.

ParTec AG, amidst a landscape where tech companies grapple with innovation costs, stands out with its significant commitment to R&D, earmarking 41.5% of its revenue towards these efforts. This strategic allocation is mirrored by an anticipated revenue surge at an annual rate of 41.5%, outpacing the broader German market's growth forecast of 5.8%. Furthermore, earnings are expected to climb by 41.7% annually, positioning ParTec on a trajectory towards profitability within three years—a stark contrast to its current unprofitable status. Recent presentations at various international forums underscore ParTec's active engagement in the tech community and commitment to growth through innovation. Notably, their financial performance in the first half of 2024 reported sales reaching €5 million and net income at €5.67 million, reflecting a robust operational stance despite market challenges. These developments suggest that ParTec is not only investing heavily in future technologies but also beginning to see the financial benefits of these investments materialize.

- Delve into the full analysis health report here for a deeper understanding of ParTec.

Explore historical data to track ParTec's performance over time in our Past section.

Kingboard Laminates Holdings (SEHK:1888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingboard Laminates Holdings Limited is an investment holding company that manufactures and sells laminates across the People's Republic of China, Europe, other Asian countries, and the United States, with a market cap of HK$21.87 billion.

Operations: The company primarily generates revenue from its laminates segment, contributing HK$17.06 billion, while smaller revenue streams include properties and investments at HK$121.11 million and HK$99.14 million respectively.

Kingboard Laminates Holdings has demonstrated a robust pattern of growth, with earnings surging by 139.9% over the past year, significantly outpacing the electronics industry's average of 11.7%. This momentum is anticipated to continue, with projected annual earnings growth of 33.7%, far exceeding Hong Kong's market forecast of 11.4%. Despite these impressive figures, revenue growth is more tempered at an expected rate of 12.2% per year, suggesting a strategic focus on profitability rather than volume expansion. The firm’s commitment to innovation is evident in its R&D investments which are crucial for maintaining competitive advantage in the rapidly evolving tech landscape.

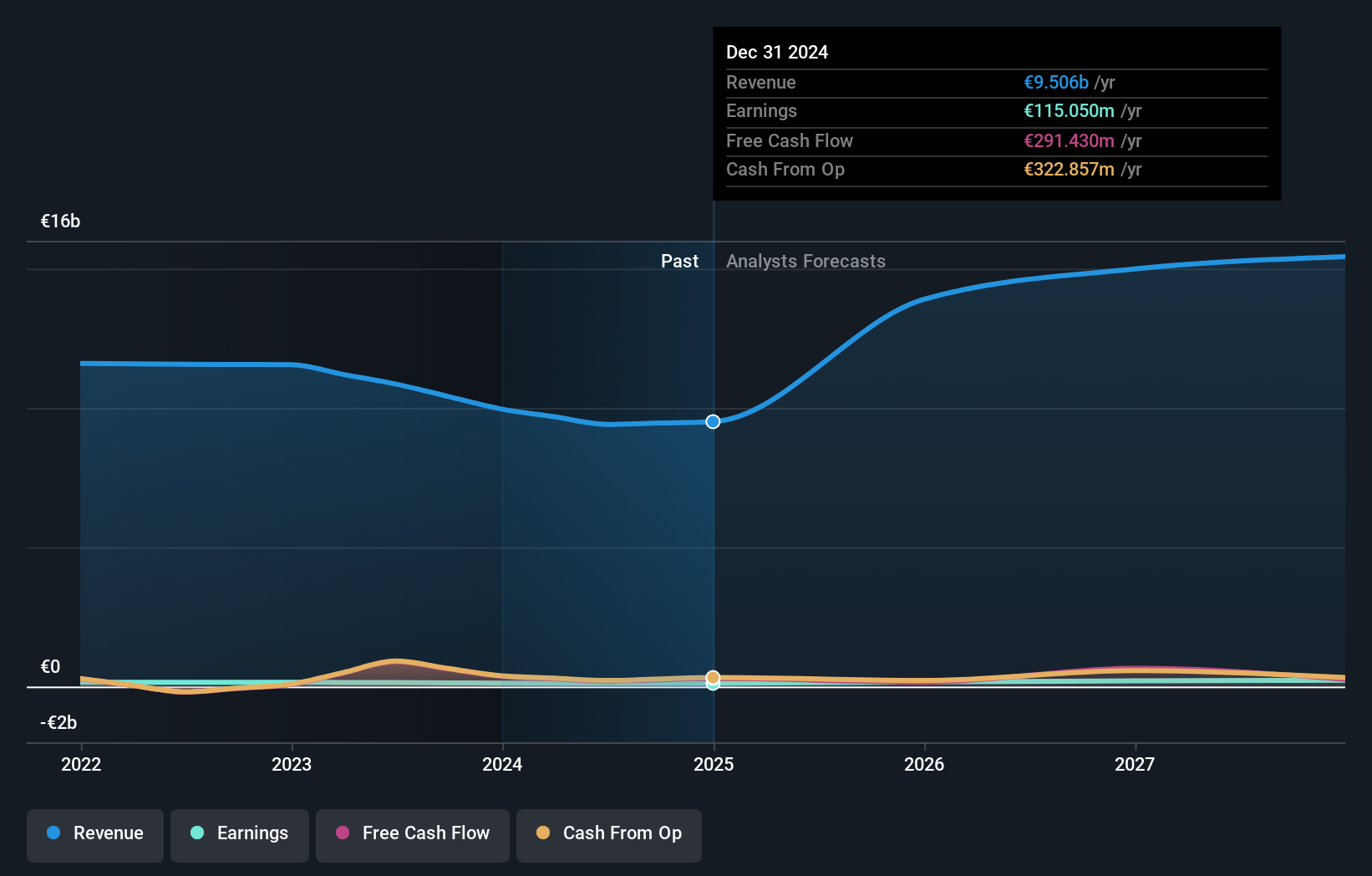

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG is a technology services provider for the ICT industry, operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF2.79 billion.

Operations: The company generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion).

ALSO Holding AG is navigating the tech landscape with notable strides in revenue and earnings growth, outpacing the Swiss market significantly. With an expected annual profit surge of 27.6% juxtaposed against a broader market average of 11.6%, and revenue growth projected at 12.5% annually, ALSO is setting a robust pace in its sector. This financial vigor is underpinned by strategic R&D investments, crucial for sustaining innovation and competitive edge in evolving markets. At the recent Baader Investment Conference, ALSO showcased initiatives likely to bolster future prospects, affirming its commitment to leveraging technology for growth despite past challenges like last year's earnings contraction of 20.4%.

- Click here to discover the nuances of ALSO Holding with our detailed analytical health report.

Assess ALSO Holding's past performance with our detailed historical performance reports.

Make It Happen

- Unlock our comprehensive list of 1287 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingboard Laminates Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1888

Kingboard Laminates Holdings

An investment holding company, manufactures and sells laminates in the People's Republic of China, Europe, other Asian countries, and the United States.