- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

SEHK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets react to anticipated rate cuts by the Federal Reserve, Hong Kong's Hang Seng Index has shown resilience amid cautious investor sentiment. In this context, identifying growth companies with high insider ownership can be particularly compelling as it often indicates strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 41.4% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| iDreamSky Technology Holdings (SEHK:1119) | 18.8% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.1% |

| DPC Dash (SEHK:1405) | 38.2% | 106.6% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

Let's explore several standout options from the results in the screener.

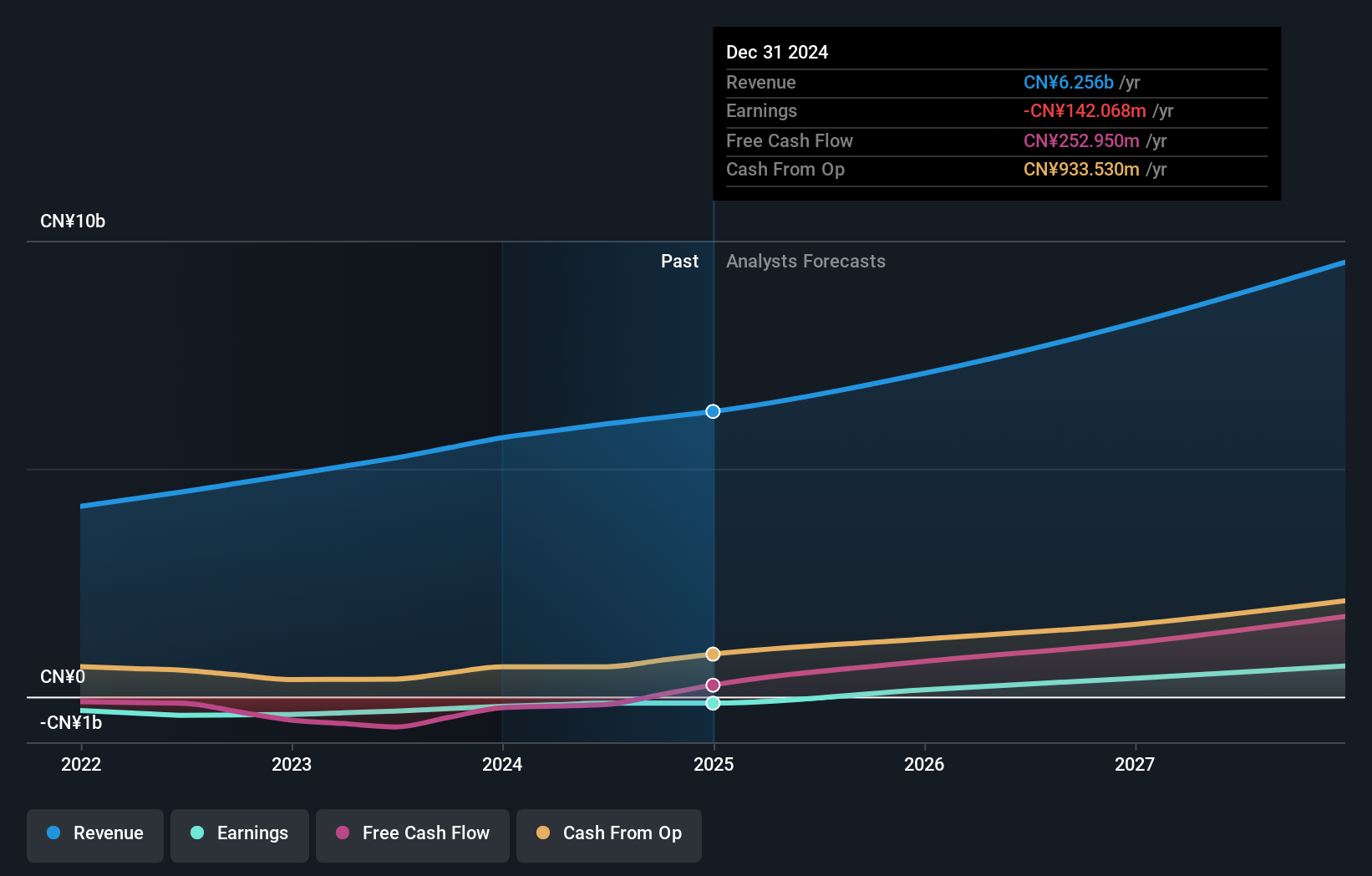

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingdee International Software Group Company Limited, with a market cap of HK$21.95 billion, operates in the enterprise resource planning business.

Operations: Kingdee International Software Group Company Limited generates revenue primarily from its Cloud Service Business (CN¥4.86 billion) and ERP Business (CN¥1.13 billion).

Insider Ownership: 19.7%

Kingdee International Software Group, a growth company with high insider ownership in Hong Kong, reported half-year sales of CNY 2.87 billion, up from CNY 2.57 billion a year ago. Despite a net loss reduction to CNY 217.85 million from CNY 283.54 million, the company is forecasted to become profitable within three years with annual revenue growth expected at 14%, outpacing the Hong Kong market's average of 7.3%. However, shareholders experienced dilution over the past year and return on equity is projected to be low at 3.7% in three years' time.

- Dive into the specifics of Kingdee International Software Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Kingdee International Software Group's share price might be too pessimistic.

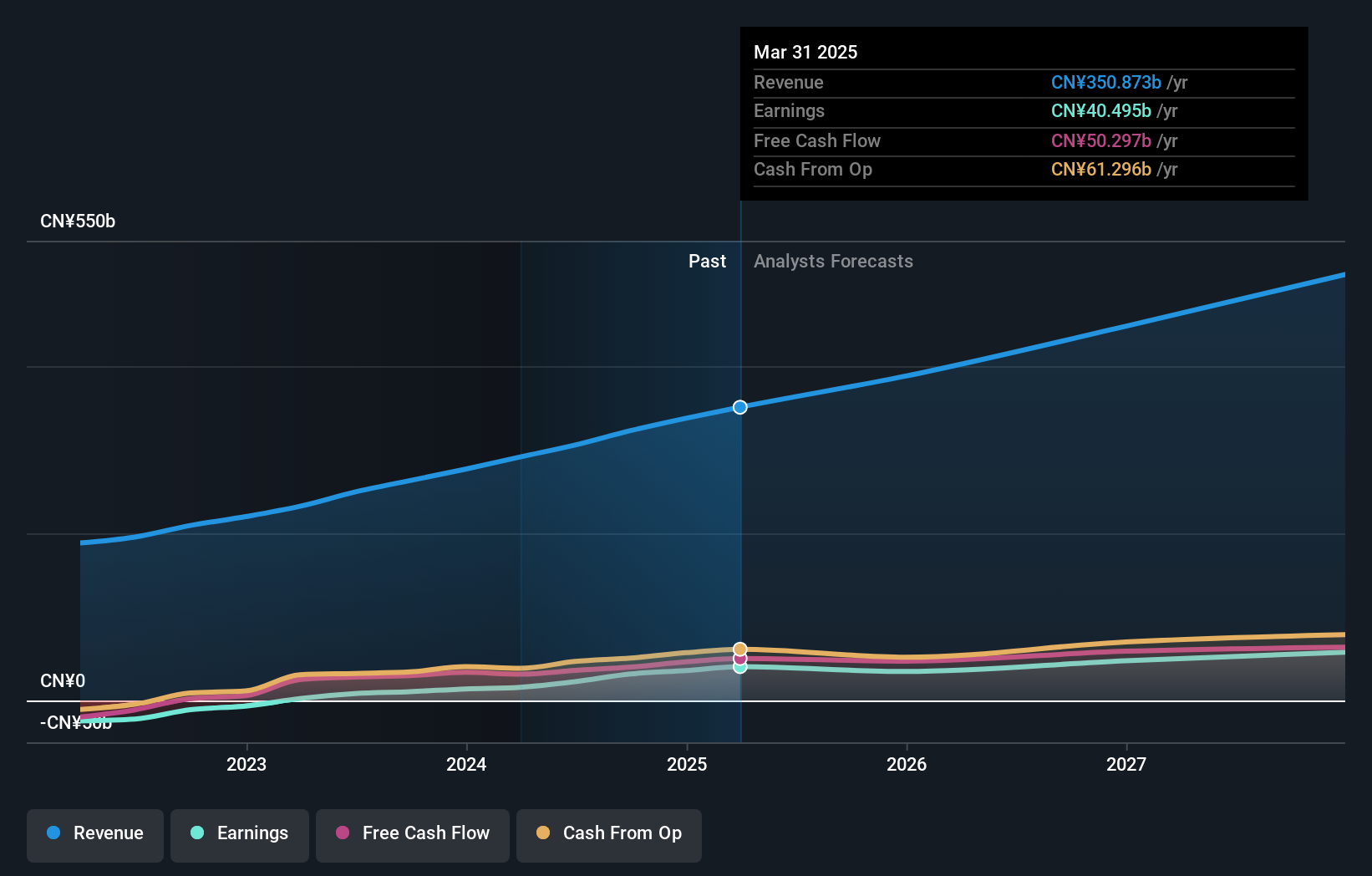

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan operates as a technology retail company in the People’s Republic of China with a market cap of HK$703.64 billion.

Operations: The company's revenue segments include New Initiatives, generating CN¥77.56 billion, and Core Local Commerce, contributing CN¥228.13 billion.

Insider Ownership: 11.6%

Meituan, a significant growth company in Hong Kong with high insider ownership, reported strong financial performance for the first half of 2024. Sales increased to CNY 155.53 billion from CNY 126.58 billion a year ago, and net income doubled to CNY 16.72 billion. The company also announced a share repurchase program worth $1 billion, signaling confidence in its valuation. Despite no substantial insider buying recently, earnings are forecasted to grow significantly at 25% annually over the next three years, outpacing market averages.

- Get an in-depth perspective on Meituan's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Meituan shares in the market.

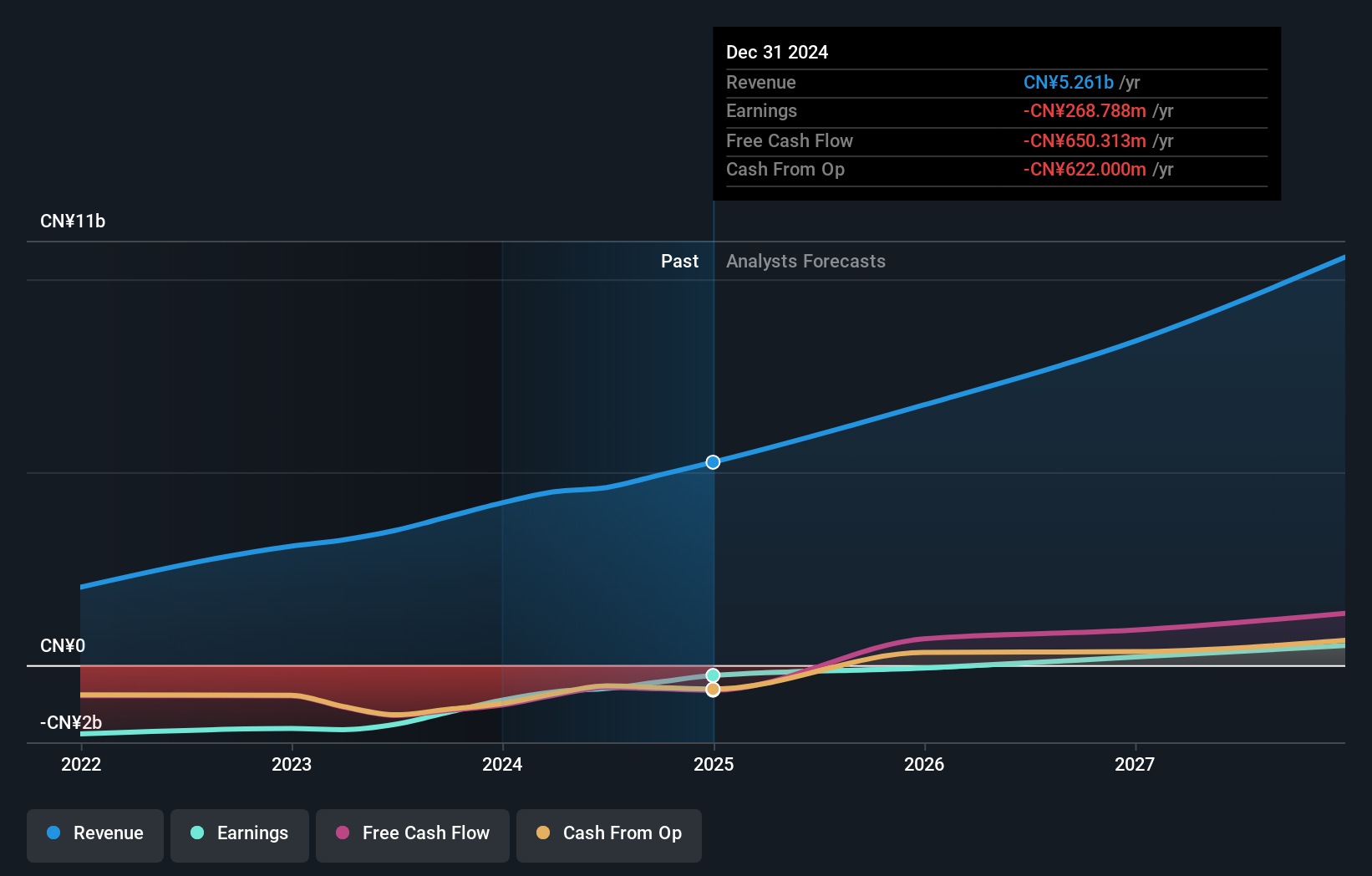

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence (AI) solutions in the People's Republic of China, with a market cap of HK$18.62 billion.

Operations: The company's revenue segments include CN¥3.00 billion from the Sage AI Platform, CN¥448.10 million from Sagegpt Aigs Services, and CN¥1.15 billion from Shift Intelligent Solutions.

Insider Ownership: 22.8%

Beijing Fourth Paradigm Technology, a growth company with high insider ownership in Hong Kong, reported a significant reduction in net loss for the first half of 2024 (CNY 151.6 million vs. CNY 456.07 million last year) alongside increased sales (CNY 1.87 billion). The firm has entered into strategic alliances to develop AI training programs and is expected to become profitable within three years, driven by above-market revenue growth forecasts of 19.6% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Beijing Fourth Paradigm Technology.

- The valuation report we've compiled suggests that Beijing Fourth Paradigm Technology's current price could be inflated.

Where To Now?

- Access the full spectrum of 52 Fast Growing SEHK Companies With High Insider Ownership by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology retail company in the People’s Republic of China.

Solid track record with excellent balance sheet.