High Growth Tech Stocks To Watch In Hong Kong September 2024

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic indicators, Hong Kong's technology sector has shown resilience, with the Hang Seng Index gaining 2.14% recently. In this dynamic environment, identifying high-growth tech stocks involves looking for companies with robust innovation capabilities and strong market positions that can capitalize on emerging trends and consumer demands.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Akeso | 32.76% | 55.08% | ★★★★★★ |

| Cowell e Holdings | 31.40% | 35.53% | ★★★★★★ |

| Innovent Biologics | 21.24% | 60.09% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 9.08% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 34.77% | 92.44% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, operates in value-added services (VAS), online advertising, fintech, and business services both in China and internationally with a market cap of HK$3.53 trillion.

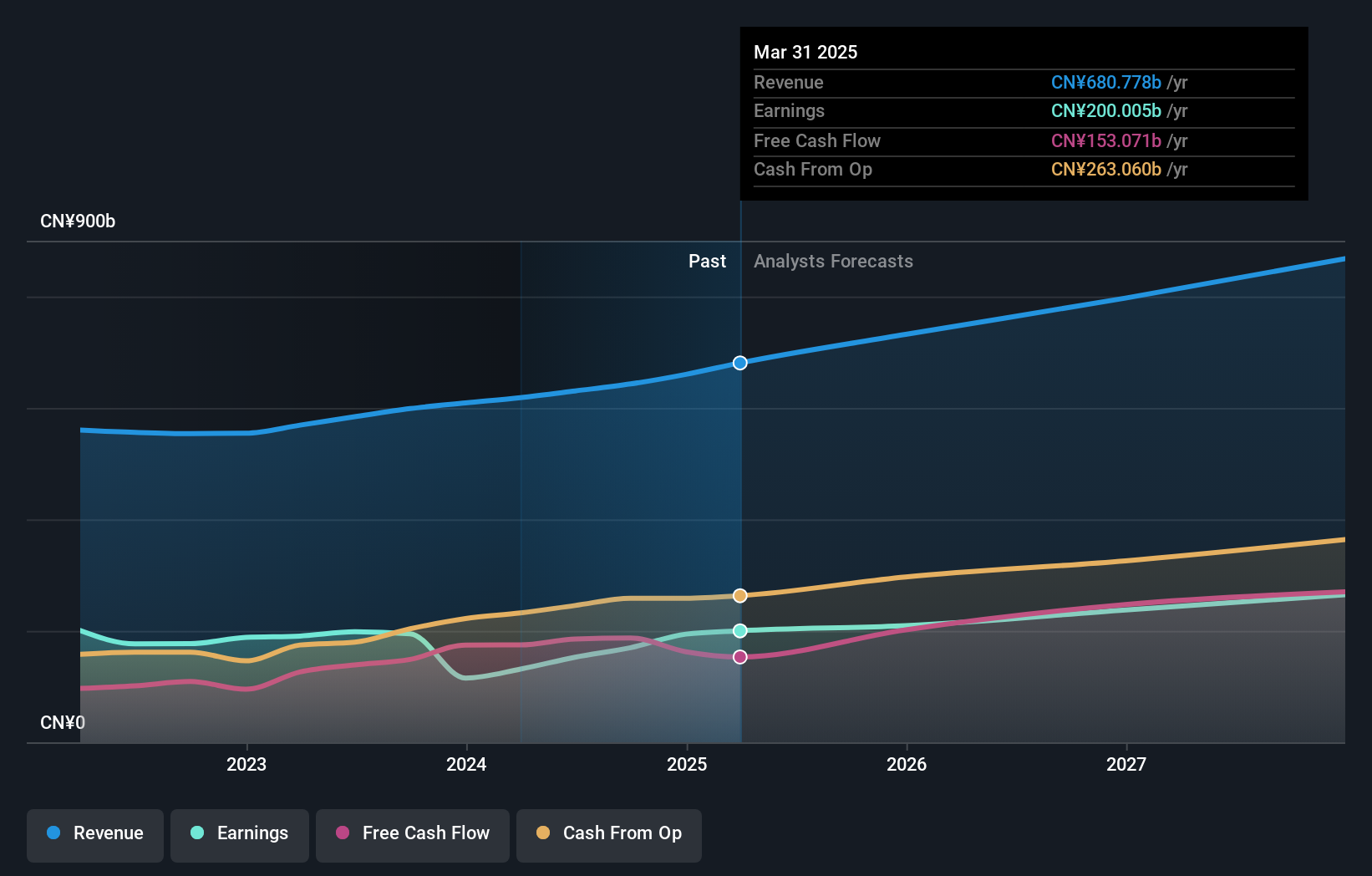

Operations: Tencent's primary revenue streams include value-added services (VAS) generating CN¥302.28 billion, fintech and business services contributing CN¥209.17 billion, and online advertising with CN¥111.89 billion. The company's diverse operations span both China and international markets, leveraging its strong presence in multiple sectors to drive significant financial performance.

Tencent Holdings reported a robust second quarter in 2024, with revenue rising to ¥161.12 billion from ¥149.21 billion the previous year, and net income surging to ¥47.63 billion from ¥26.17 billion. Earnings per share more than doubled, reflecting strong operational performance and strategic investments in AI and cloud services, which are increasingly driving growth across its business segments. The company's R&D expenses have been substantial but focused, contributing to an expected annual earnings growth of 12.9%, outpacing the Hong Kong market's 10.9%.

- Take a closer look at Tencent Holdings' potential here in our health report.

Review our historical performance report to gain insights into Tencent Holdings''s past performance.

Lenovo Group (SEHK:992)

Simply Wall St Growth Rating: ★★★★☆☆

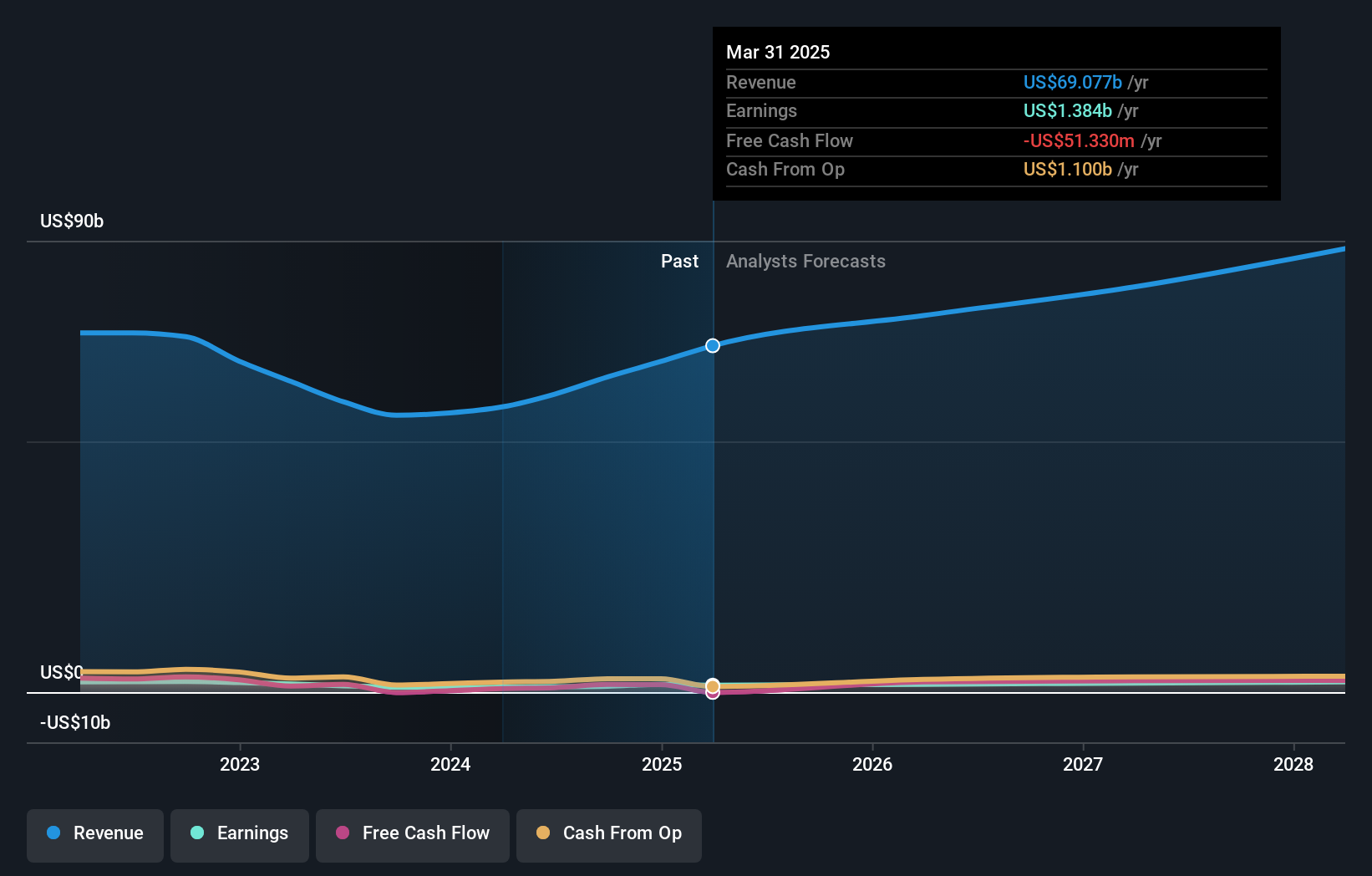

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market cap of HK$118.96 billion.

Operations: The company's revenue streams are primarily derived from its Intelligent Devices Group (IDG) at $45.76 billion, Solutions and Services Group (SSG) at $7.64 billion, and Infrastructure Solutions Group (ISG) at $10.17 billion. The diverse product portfolio includes technology products and services across these segments.

Lenovo Group's Q1 2024 earnings showed a significant rise in sales to $15.45 billion from $12.90 billion, with net income increasing to $243.37 million from $176.53 million last year. The company repurchased shares recently, reflecting confidence in its growth trajectory. Lenovo's R&D expenses were substantial yet strategic, contributing to advancements like the AD1 domain controller for autonomous driving and new AI-ready endpoint devices through partnerships with IGEL and Databricks, enhancing their hybrid cloud and AI services portfolio.

- Delve into the full analysis health report here for a deeper understanding of Lenovo Group.

Examine Lenovo Group's past performance report to understand how it has performed in the past.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$42.51 billion.

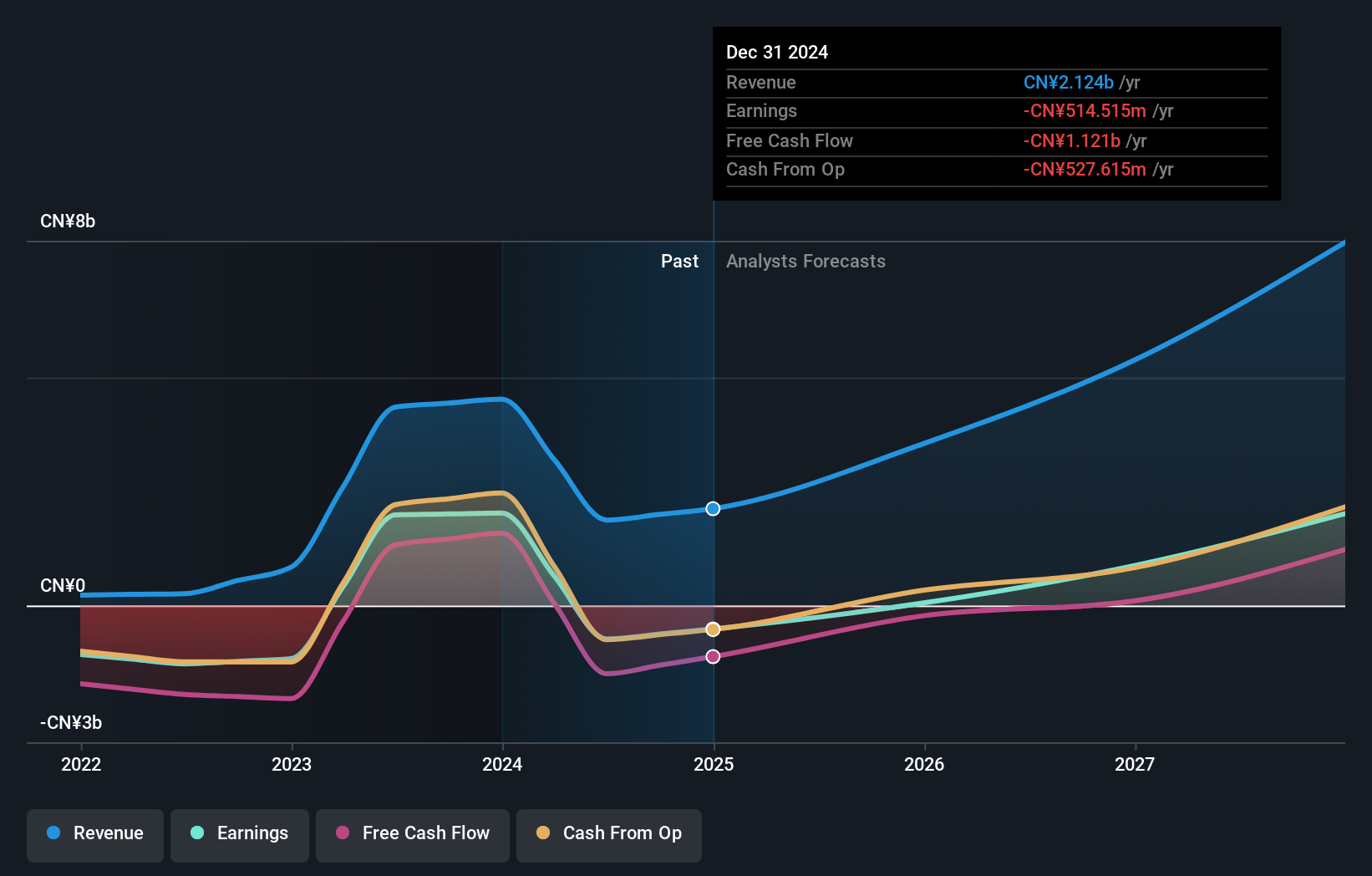

Operations: Akeso focuses on the research, development, production, and sale of biopharmaceutical products, generating CN¥1.87 billion in revenue. The company operates within the antibody drug market segment.

Akeso's recent earnings report shows a stark contrast with last year, with revenue dropping to ¥1.02 billion from ¥3.68 billion and a net loss of ¥238.59 million compared to a net income of ¥2.53 billion previously. Despite this, the company is making strides in innovative treatments like ivonescimab, which has shown significant clinical value in treating non-small cell lung cancer (NSCLC). The company's R&D expenses have been substantial yet strategic; for instance, its investment in ivonescimab's development underscores its commitment to pioneering bi-specific antibody therapies that could redefine standards of care in oncology.

- Unlock comprehensive insights into our analysis of Akeso stock in this health report.

Gain insights into Akeso's past trends and performance with our Past report.

Where To Now?

- Explore the 49 names from our SEHK High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs.

Exceptional growth potential with adequate balance sheet.