- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

Top 3 High Growth Tech Stocks In Hong Kong To Watch

Reviewed by Simply Wall St

As global markets navigate through mixed trading sessions and economic indicators, the Hong Kong market has shown resilience with the Hang Seng Index gaining 2.14%. Amidst these fluctuations, investors are keenly watching high-growth tech stocks that have the potential to outperform in such dynamic conditions. In light of current market trends and economic signals, identifying a good stock often involves looking for companies with robust growth prospects, strong financial health, and innovative capabilities.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Joy Spreader Group | 35.36% | 107.63% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.23% | ★★★★★★ |

| Akeso | 32.46% | 55.03% | ★★★★★★ |

| Innovent Biologics | 21.45% | 59.82% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 25.22% | 9.81% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

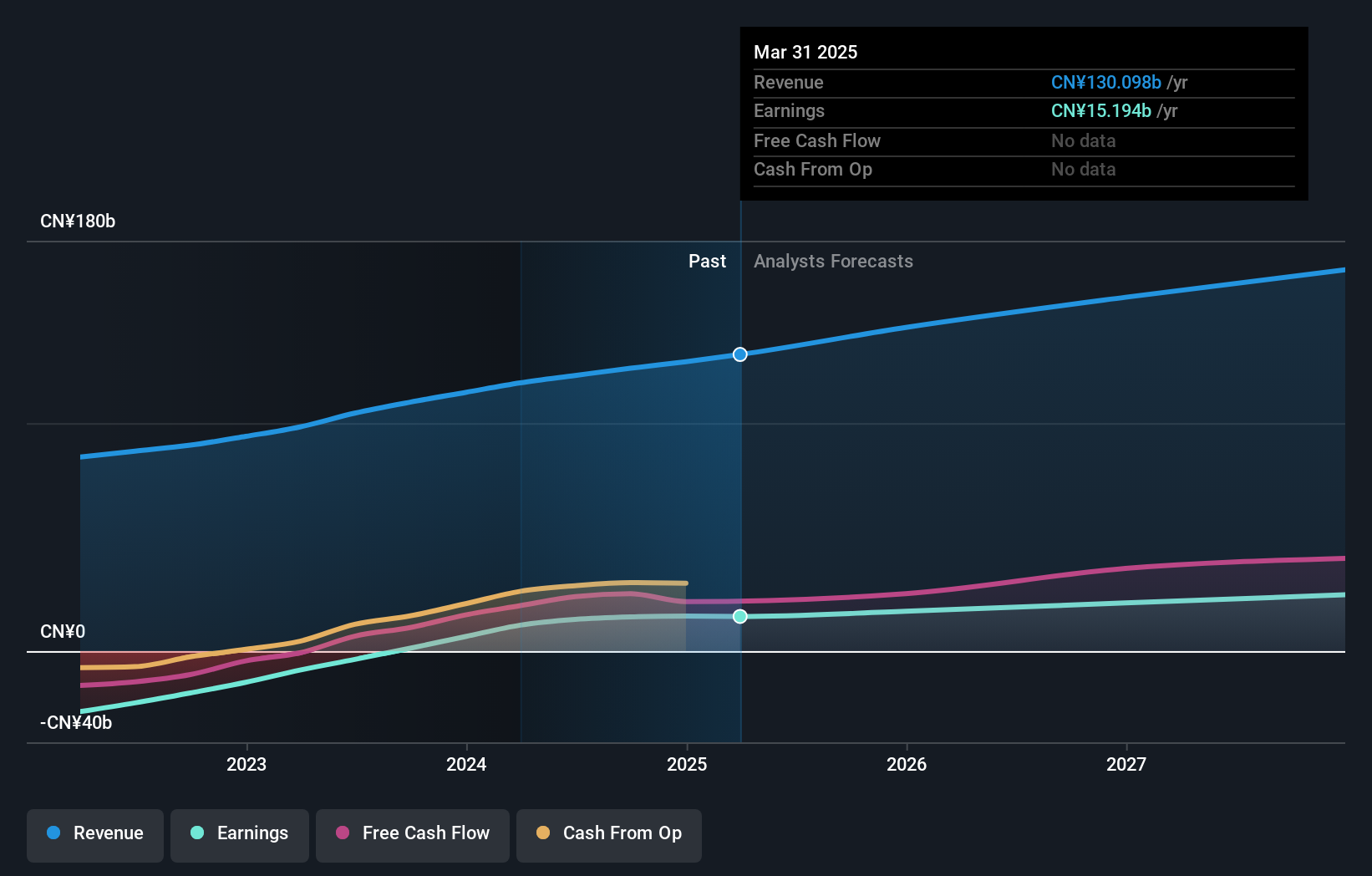

Overview: Kuaishou Technology, an investment holding company, offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$171.03 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations (CN¥117.32 billion) and a smaller portion from overseas markets (CN¥3.57 billion). The company's business model includes live streaming and online marketing services in China.

Kuaishou Technology's recent earnings report highlights robust growth, with Q2 2024 sales reaching ¥30.98 billion, a notable increase from ¥27.74 billion the previous year. Net income surged to ¥3.98 billion from ¥1.48 billion, reflecting strong operational performance and strategic investments in AI technologies like Kling AI. The company's R&D expenses underscore its commitment to innovation, contributing significantly to future prospects as it continues enhancing video generation capabilities for over 300,000 early access users globally.

- Unlock comprehensive insights into our analysis of Kuaishou Technology stock in this health report.

Explore historical data to track Kuaishou Technology's performance over time in our Past section.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs in China and internationally, with a market cap of HK$37.64 billion.

Operations: Kelun-Biotech generates revenue primarily from its pharmaceuticals segment, which reported CN¥1.88 billion. The company is involved in the entire lifecycle of novel drug development, from research and manufacturing to commercialization, targeting unmet medical needs both domestically and internationally.

Sichuan Kelun-Biotech Biopharmaceutical's recent earnings report shows significant growth, with half-year sales reaching ¥1.38 billion, up from ¥1.05 billion the previous year. Net income surged to ¥310 million from a net loss of ¥31 million, reflecting strong operational performance and strategic investments in innovative drug development like sac-TMT for NSCLC and TNBC treatments. The company's R&D expenses are substantial, highlighting its commitment to innovation with a forecasted revenue growth rate of 25.2% annually compared to the market's 7.4%.

- Click here to discover the nuances of Sichuan Kelun-Biotech Biopharmaceutical with our detailed analytical health report.

Understand Sichuan Kelun-Biotech Biopharmaceutical's track record by examining our Past report.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$42.30 billion.

Operations: Akeso, Inc. generates revenue primarily through the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion. The company is engaged in the end-to-end process of antibody drug development and commercialization.

Akeso's recent half-year earnings report shows revenue at ¥1.02 billion, a stark contrast to the previous year's ¥3.68 billion, with a net loss of ¥238.59 million compared to a net income of ¥2.53 billion last year. Despite this, Akeso's R&D expenses highlight its commitment to innovation, particularly in AI-driven drug development and bi-specific antibodies like ivonescimab for NSCLC treatment, which has shown significant clinical value and market potential. The company forecasts an impressive 32.5% annual revenue growth rate over the next three years, outpacing the Hong Kong market's 7.4%.

- Click to explore a detailed breakdown of our findings in Akeso's health report.

Gain insights into Akeso's past trends and performance with our Past report.

Taking Advantage

- Navigate through the entire inventory of 45 SEHK High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet and undervalued.