- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

High Growth Tech Stocks in Hong Kong for September 2024

Reviewed by Simply Wall St

As global markets experience mixed performance and cautious optimism, the Hong Kong market has shown resilience, with the Hang Seng Index gaining 2.14% recently. In this context, high-growth tech stocks in Hong Kong present intriguing opportunities for investors looking to capitalize on technological advancements and innovation-driven growth. Identifying strong candidates involves assessing their ability to navigate current economic conditions and leverage emerging trends effectively.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Joy Spreader Group | 35.36% | 107.63% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.23% | ★★★★★★ |

| Akeso | 32.52% | 55.08% | ★★★★★★ |

| Innovent Biologics | 21.45% | 59.82% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 25.22% | 9.81% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 44 stocks from our SEHK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

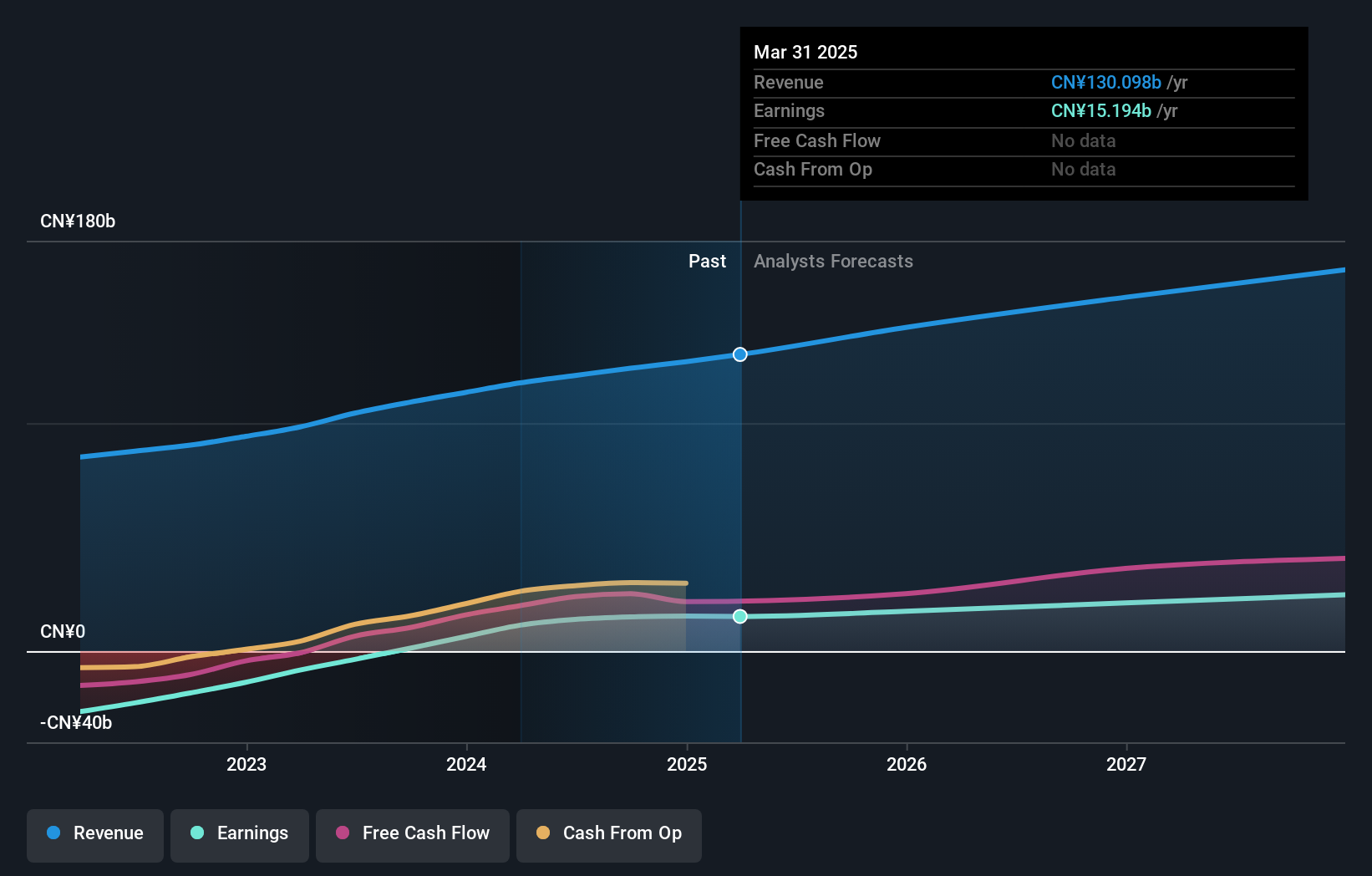

Overview: Kuaishou Technology, an investment holding company with a market cap of HK$173.41 billion, offers live streaming, online marketing, and other services in the People’s Republic of China.

Operations: Kuaishou Technology generates revenue primarily from domestic operations (CN¥117.32 billion) and a smaller portion from overseas markets (CN¥3.57 billion). The company focuses on live streaming and online marketing services in China.

Kuaishou Technology's recent earnings report highlights significant growth, with Q2 sales reaching ¥30.98 billion, up from ¥27.74 billion a year ago, and net income surging to ¥3.98 billion from ¥1.48 billion. The company's R&D expenses reflect its commitment to innovation; in 2023 alone, it invested approximately 9% of its revenue into R&D efforts aimed at enhancing AI capabilities like Kling AI for video generation. This robust focus on technological advancements positions Kuaishou favorably within the competitive tech landscape of Hong Kong.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

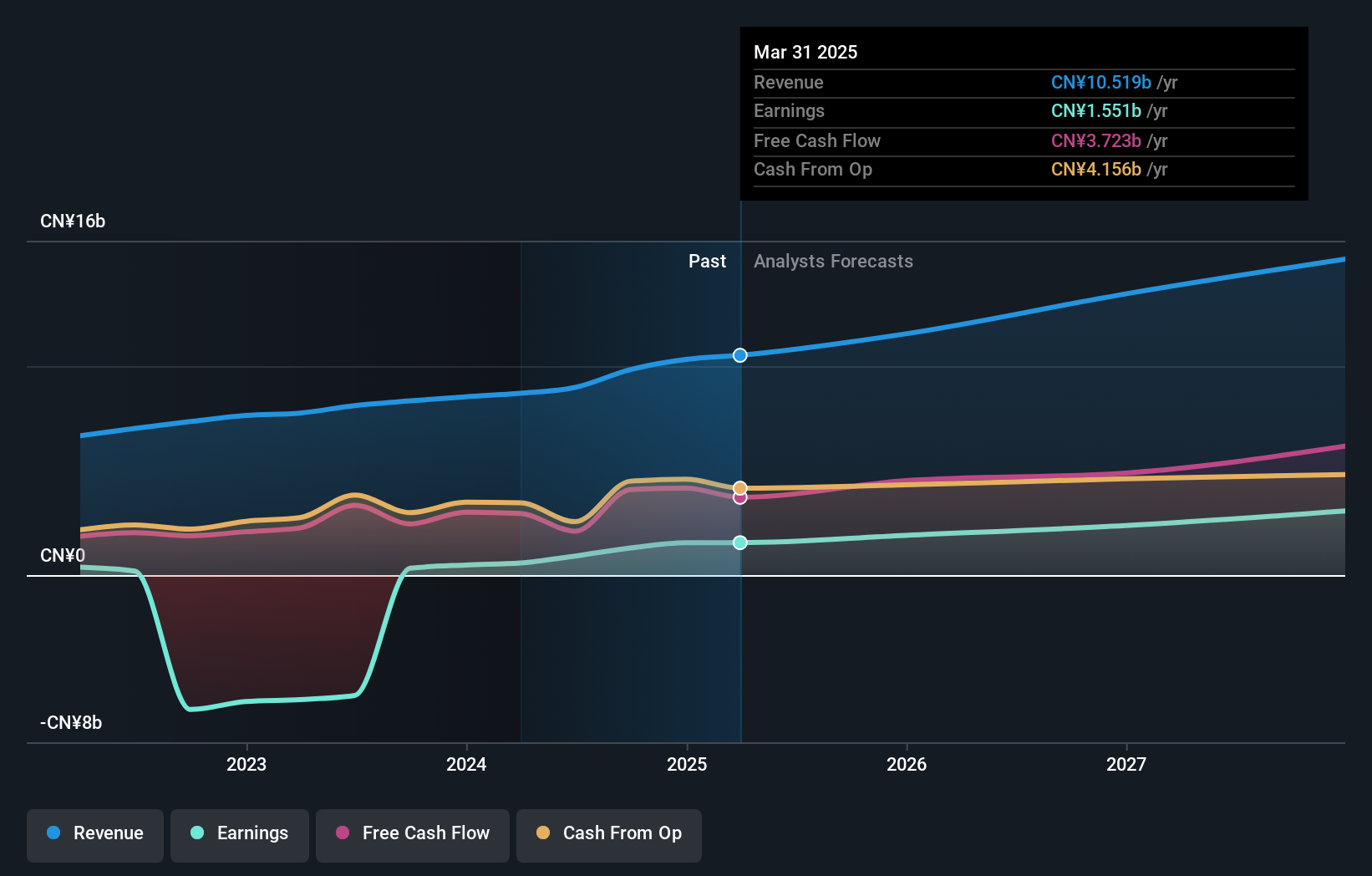

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of HK$28.59 billion.

Operations: Kingsoft Corporation Limited generates revenue primarily from its office software and services segment, which brought in CN¥4.80 billion, and its entertainment software segment, which earned CN¥4.18 billion. The company operates across Mainland China, Hong Kong, and internationally.

Kingsoft's Q2 2024 earnings surged with revenue hitting ¥2.47 billion, up from ¥2.19 billion a year prior, and net income jumping to ¥393.35 million from ¥57.19 million. The company has invested significantly in R&D, dedicating approximately 12% of its revenue to innovation efforts aimed at enhancing its software offerings and AI capabilities. Additionally, Kingsoft's earnings are forecasted to grow at an impressive 24.5% annually over the next three years, outpacing the Hong Kong market’s expected growth rate of 12%.

- Navigate through the intricacies of Kingsoft with our comprehensive health report here.

Examine Kingsoft's past performance report to understand how it has performed in the past.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

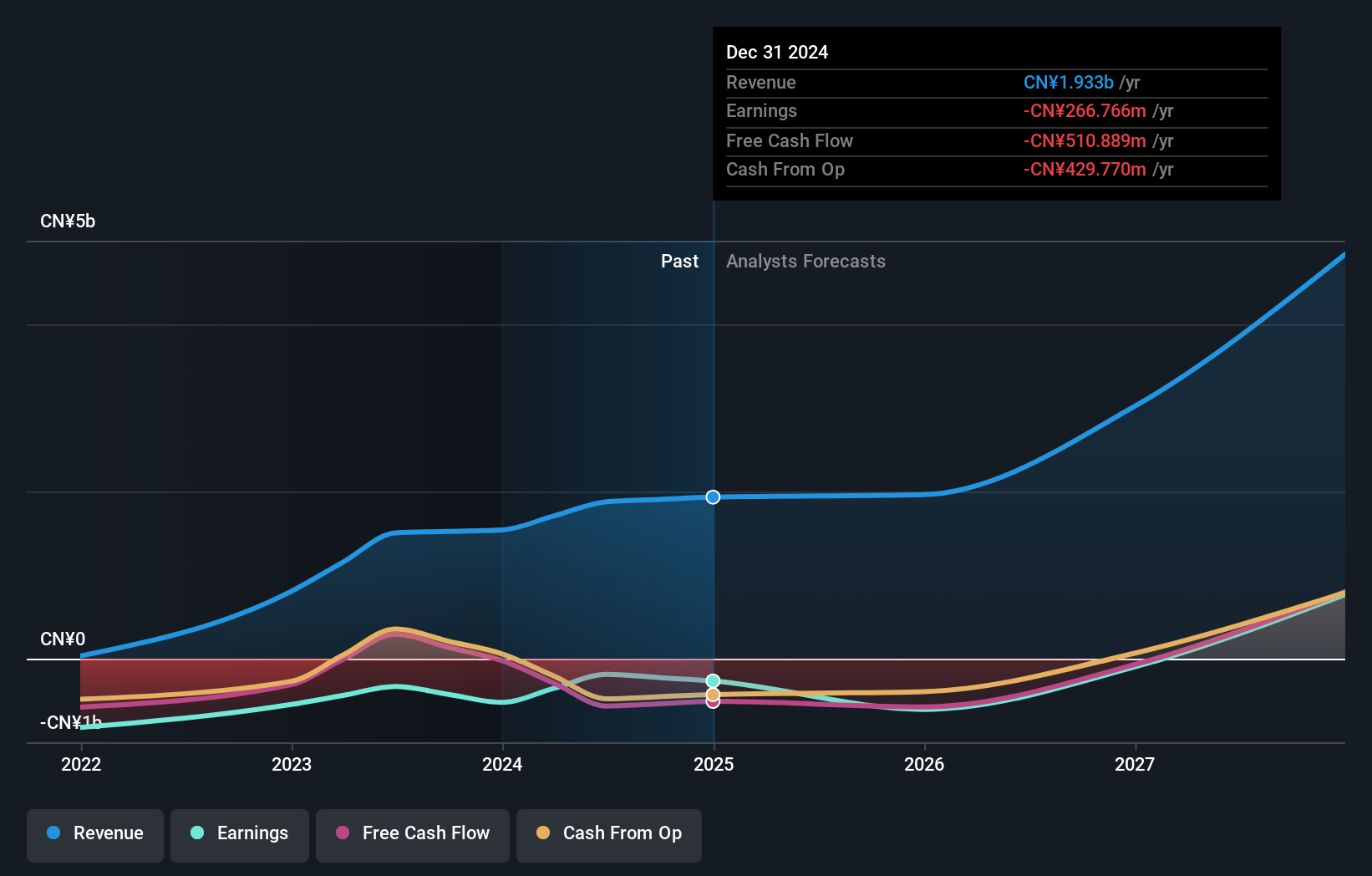

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs in China and internationally, with a market cap of HK$37.64 billion.

Operations: Kelun-Biotech generates revenue primarily from its pharmaceuticals segment, amounting to CN¥1.88 billion. The company focuses on developing and commercializing novel drugs for unmet medical needs in China and international markets.

Sichuan Kelun-Biotech Biopharmaceutical's recent half-year earnings report showed a significant revenue increase to ¥1.38 billion from ¥1.05 billion, with net income rising to ¥310.23 million compared to a previous loss of ¥31.13 million. The company has focused heavily on R&D, allocating 25.2% of its revenue towards innovation, particularly in developing drugs like sacituzumab tirumotecan (sac-TMT) for advanced cancer treatments, which has shown promising clinical results and is under priority review by the NMPA. The biotech sector's shift towards targeted therapies and personalized medicine continues to drive growth opportunities for companies like Sichuan Kelun-Biotech Biopharmaceutical, positioning them well within the competitive landscape of high-growth tech in Hong Kong.

- Dive into the specifics of Sichuan Kelun-Biotech Biopharmaceutical here with our thorough health report.

Learn about Sichuan Kelun-Biotech Biopharmaceutical's historical performance.

Where To Now?

- Gain an insight into the universe of 44 SEHK High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Flawless balance sheet with reasonable growth potential.