Stock Analysis

- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

Exploring Kingsoft And 2 Other High Growth Tech Stocks In Hong Kong

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties and tech stocks face heightened scrutiny, the Hong Kong market presents unique opportunities for investors. In this article, we explore three high-growth tech stocks in Hong Kong, starting with Kingsoft, to understand what makes them stand out amid current market conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 21.45% | 59.82% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.75% | 54.99% | ★★★★★★ |

| Sichuan Kelun-Biotech Biopharmaceutical | 25.22% | 9.81% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally, with a market cap of HK$27.92 billion.

Operations: Kingsoft generates revenue primarily from two segments: Office Software and Services (CN¥4.80 billion) and Entertainment Software (CN¥4.18 billion). The company operates in Mainland China, Hong Kong, and internationally.

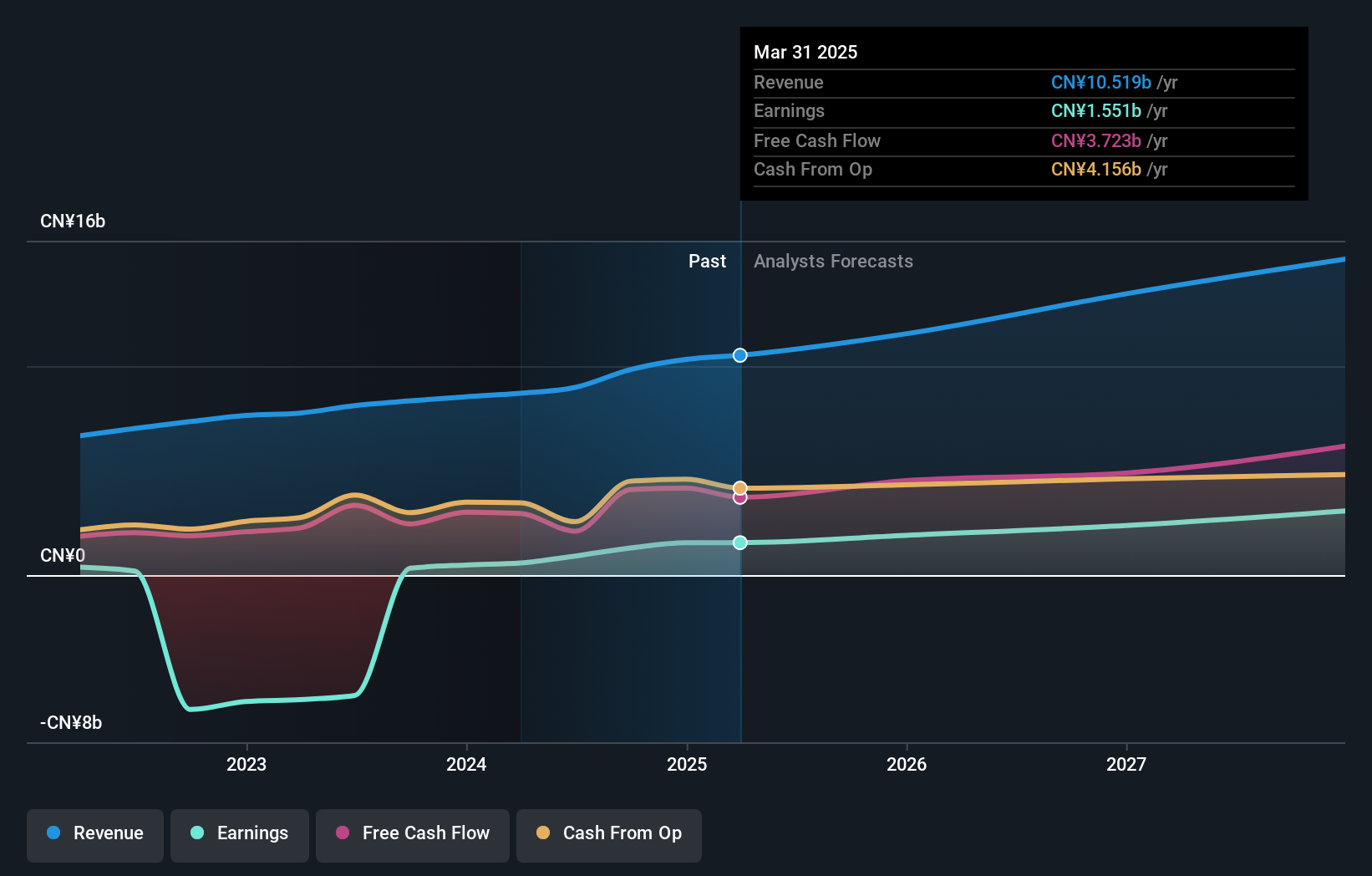

Kingsoft's recent earnings report highlights a strong performance, with Q2 revenue at ¥2.47 billion, up from ¥2.19 billion last year, and net income soaring to ¥393.35 million from ¥57.19 million. The company repurchased shares in June 2024 to enhance EPS and NAV per share, reflecting confidence in its financial health. R&D expenses have been substantial, contributing to innovation and growth; Kingsoft's earnings are projected to grow at 24.5% annually while revenue is expected to increase by 12.9% per year.

- Click here to discover the nuances of Kingsoft with our detailed analytical health report.

Explore historical data to track Kingsoft's performance over time in our Past section.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs for unmet medical needs in China and internationally, with a market cap of HK$37.21 billion.

Operations: Kelun-Biotech generates revenue primarily through its pharmaceutical segment, which reported CN¥1.88 billion in sales. The company is engaged in the entire lifecycle of novel drug development from research to commercialization, targeting unmet medical needs both domestically and internationally.

Sichuan Kelun-Biotech Biopharmaceutical has shown impressive growth, with revenue increasing by 24.7% over the past year and a forecasted annual revenue growth of 25.2%. Despite being unprofitable, the company is expected to become profitable in the next three years, aligning with its robust R&D investments. Significant progress in their sacituzumab tirumotecan (sac-TMT) trials for various cancers highlights innovation potential; recent Phase 3 results demonstrated a median progression-free survival of 5.6 months versus 2.7 months for standard treatments in TNBC patients.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$48.31 billion.

Operations: The company generates revenue primarily through the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1874.14 million. Its operations encompass the entire lifecycle of antibody drugs from inception to market.

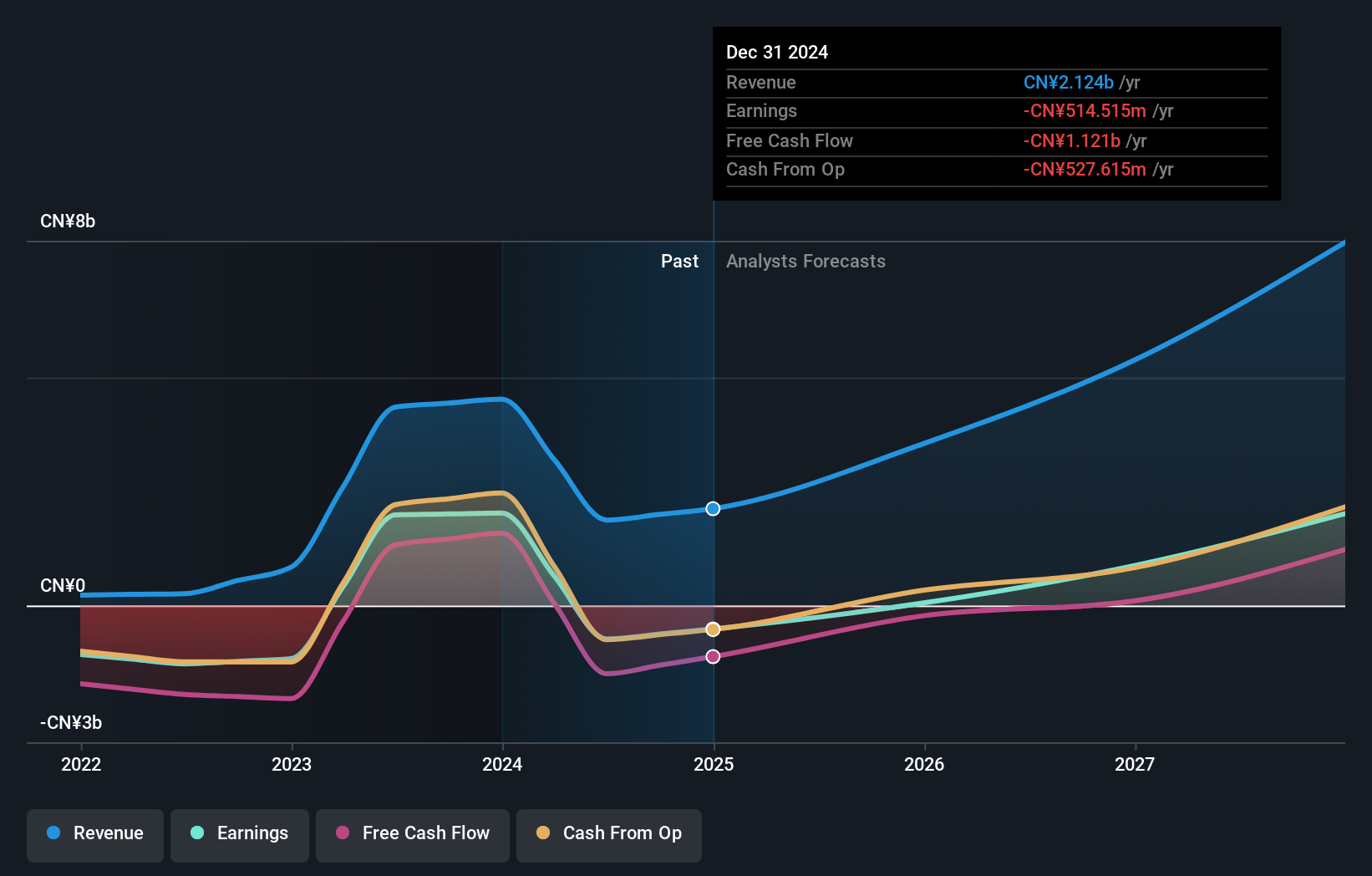

Akeso's recent earnings report shows a significant drop in revenue to ¥1.02 billion from ¥3.68 billion, with a net loss of ¥238.59 million compared to last year's net income of ¥2.53 billion. Despite these figures, the company's R&D expenses highlight its commitment to innovation, particularly in developing ivonescimab for NSCLC treatment, which has shown promising results with a 32.7% increase in efficacy over standard treatments and ongoing trials covering 16 indications globally. Akeso's strategic focus on bi-specific antibodies and robust pipeline positions it well for future growth amid the evolving biotech landscape in Hong Kong.

- Get an in-depth perspective on Akeso's performance by reading our health report here.

Evaluate Akeso's historical performance by accessing our past performance report.

Next Steps

- Navigate through the entire inventory of 45 SEHK High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.