Stock Analysis

- Hong Kong

- /

- Entertainment

- /

- SEHK:1046

Universe Entertainment and Culture Group (HKG:1046) surges 15% this week, taking one-year gains to 63%

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Universe Entertainment and Culture Group Company Limited (HKG:1046) share price is up 63% in the last 1 year, clearly besting the market decline of around 13% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Unfortunately the longer term returns are not so good, with the stock falling 3.6% in the last three years.

Since the stock has added HK$63m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Universe Entertainment and Culture Group

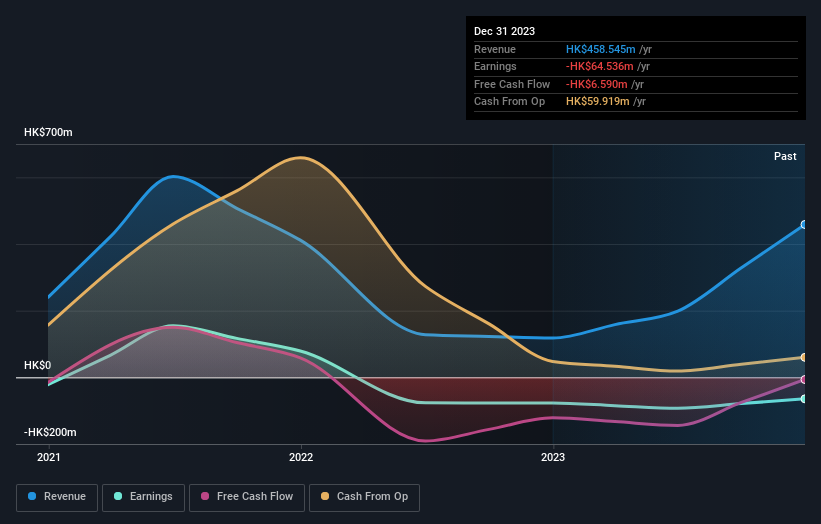

Given that Universe Entertainment and Culture Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Universe Entertainment and Culture Group grew its revenue by 289% last year. That's well above most other pre-profit companies. While the share price gain of 63% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Universe Entertainment and Culture Group in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Universe Entertainment and Culture Group's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Universe Entertainment and Culture Group shareholders have received a total shareholder return of 63% over one year. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Universe Entertainment and Culture Group better, we need to consider many other factors. For instance, we've identified 3 warning signs for Universe Entertainment and Culture Group (1 shouldn't be ignored) that you should be aware of.

We will like Universe Entertainment and Culture Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Universe Entertainment and Culture Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1046

Universe Entertainment and Culture Group

Universe Entertainment and Culture Group Company Limited, an investment holding company, engages in the film distribution and exhibition, and licensing and sub-licensing of film rights and television series businesses.

Adequate balance sheet and slightly overvalued.