- Hong Kong

- /

- Construction

- /

- SEHK:3996

Should You Be Adding China Energy Engineering (HKG:3996) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China Energy Engineering (HKG:3996). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide China Energy Engineering with the means to add long-term value to shareholders.

View our latest analysis for China Energy Engineering

How Quickly Is China Energy Engineering Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. China Energy Engineering managed to grow EPS by 12% per year, over three years. That's a good rate of growth, if it can be sustained. EPS growth figures have also been helped by share buybacks, showing the market that the company is in a position of financial strength, allowing it to return capital to shareholders.

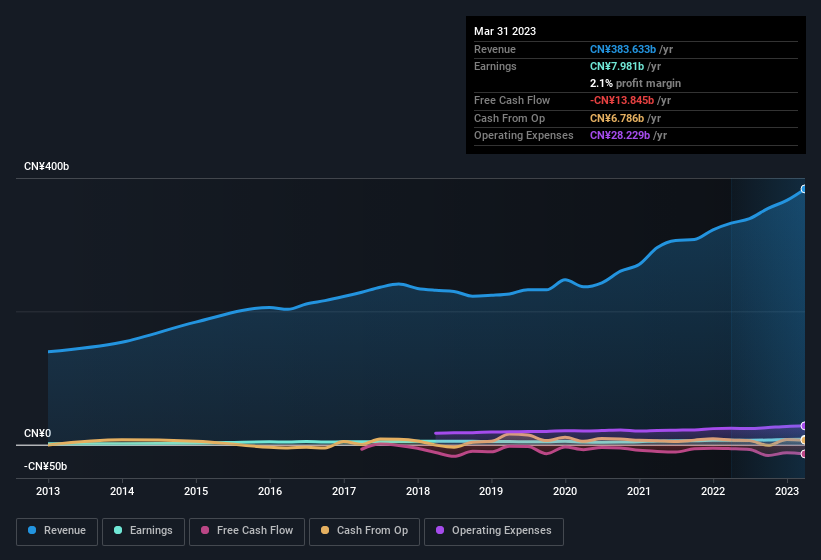

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for China Energy Engineering remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to CN¥384b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are China Energy Engineering Insiders Aligned With All Shareholders?

Owing to the size of China Energy Engineering, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. Given insiders own a significant chunk of shares, currently valued at CN¥608m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations over CN¥58b, like China Energy Engineering, the median CEO pay is around CN¥6.9m.

The CEO of China Energy Engineering only received CN¥1.5m in total compensation for the year ending December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is China Energy Engineering Worth Keeping An Eye On?

As previously touched on, China Energy Engineering is a growing business, which is encouraging. The fact that EPS is growing is a genuine positive for China Energy Engineering, but the pleasant picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. We should say that we've discovered 2 warning signs for China Energy Engineering (1 is significant!) that you should be aware of before investing here.

Although China Energy Engineering certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3996

China Energy Engineering

Provides solutions and services in energy power and infrastructure sectors in the People’s Republic of China and internationally.

Solid track record with mediocre balance sheet.