Stock Analysis

- Greece

- /

- Hospitality

- /

- ATSE:INLOT

Intralot Integrated Lottery Systems and Services (ATH:INLOT) shareholder returns have been enviable, earning 569% in 3 years

For us, stock picking is in large part the hunt for the truly magnificent stocks. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One bright shining star stock has been Intralot S.A. Integrated Lottery Systems and Services (ATH:INLOT), which is 554% higher than three years ago. It's even up 8.4% in the last week. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the stock has added €53m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Intralot Integrated Lottery Systems and Services

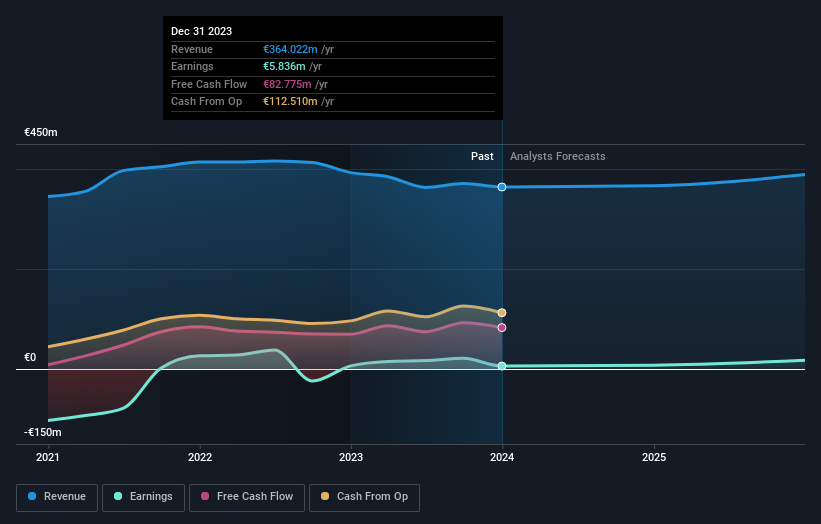

Given that Intralot Integrated Lottery Systems and Services only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Intralot Integrated Lottery Systems and Services saw its revenue shrink by 0.2% per year. This is in stark contrast to the strong share price growth of 87%, compound, per year. This clear lack of correlation between revenue and share price is surprising to see in a money losing company. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Intralot Integrated Lottery Systems and Services has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Intralot Integrated Lottery Systems and Services' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Intralot Integrated Lottery Systems and Services shareholders, and that cash payout contributed to why its TSR of 569%, over the last 3 years, is better than the share price return.

A Different Perspective

It's nice to see that Intralot Integrated Lottery Systems and Services shareholders have received a total shareholder return of 84% over the last year. That gain is better than the annual TSR over five years, which is 21%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Intralot Integrated Lottery Systems and Services you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Intralot Integrated Lottery Systems and Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:INLOT

Intralot Integrated Lottery Systems and Services

Intralot S.A. Integrated Lottery Systems and Services supplies integrated gaming and transaction processing systems, game content, sports betting management, and interactive gaming services to state-licensed gaming organizations in Greece and internationally.

Mediocre balance sheet with questionable track record.