Stock Analysis

Investors Still Aren't Entirely Convinced By J. & B. Ladenis Bros S.A. - Minerva - Knitwear Manufacturing Company's (ATH:MIN) Revenues Despite 38% Price Jump

J. & B. Ladenis Bros S.A. - Minerva - Knitwear Manufacturing Company (ATH:MIN) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 39%.

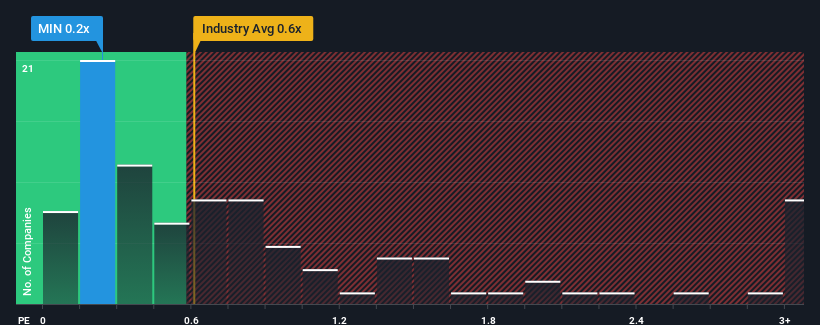

Even after such a large jump in price, you could still be forgiven for feeling indifferent about J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in Greece is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing

What Does J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing's Recent Performance Look Like?

For example, consider that J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Although there are no analyst estimates available for J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing?

In order to justify its P/S ratio, J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.1% shows it's noticeably more attractive.

In light of this, it's curious that J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 4 warning signs for J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing (3 make us uncomfortable!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:MIN

J. & B. Ladenis Bros - Minerva - Knitwear Manufacturing

J. & B. Ladenis Bros S.A. - Minerva - Knitwear Manufacturing Company manufactures and sells underwear, sleepwear, and other products in Greece and internationally.

Slightly overvalued with questionable track record.