Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- LSE:ENOG

3 UK Growth Companies With High Insider Ownership And At Least 24% Earnings Growth

Reviewed by Sasha Jovanovic

The UK market has experienced fluctuations, influenced by global economic indicators and specific corporate developments. Amid these conditions, growth companies with high insider ownership stand out as potentially resilient investment choices, reflecting confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Growth Rating |

| Getech Group (AIM:GTC) | 17.2% | ★★★★★★ |

| Gulf Keystone Petroleum (LSE:GKP) | 10.6% | ★★★★★★ |

| Petrofac (LSE:PFC) | 16.6% | ★★★★★★ |

| Spectra Systems (AIM:SPSY) | 23.3% | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | ★★★★★☆ |

| Velocity Composites (AIM:VEL) | 29.5% | ★★★★★☆ |

| TEAM (AIM:TEAM) | 28.3% | ★★★★★☆ |

| Surface Transforms (AIM:SCE) | 18% | ★★★★★☆ |

| Afentra (AIM:AET) | 38.2% | ★★★★★☆ |

| Judges Scientific (AIM:JDG) | 11.6% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company that specializes in the exploration, mining, processing, and sale of gold and silver in the Americas, with a market capitalization of approximately £821.08 million.

Operations: The company generates its revenue primarily from three key mines: San Jose ($242.46 million), Inmaculada ($396.64 million), and Pallancata ($54.05 million).

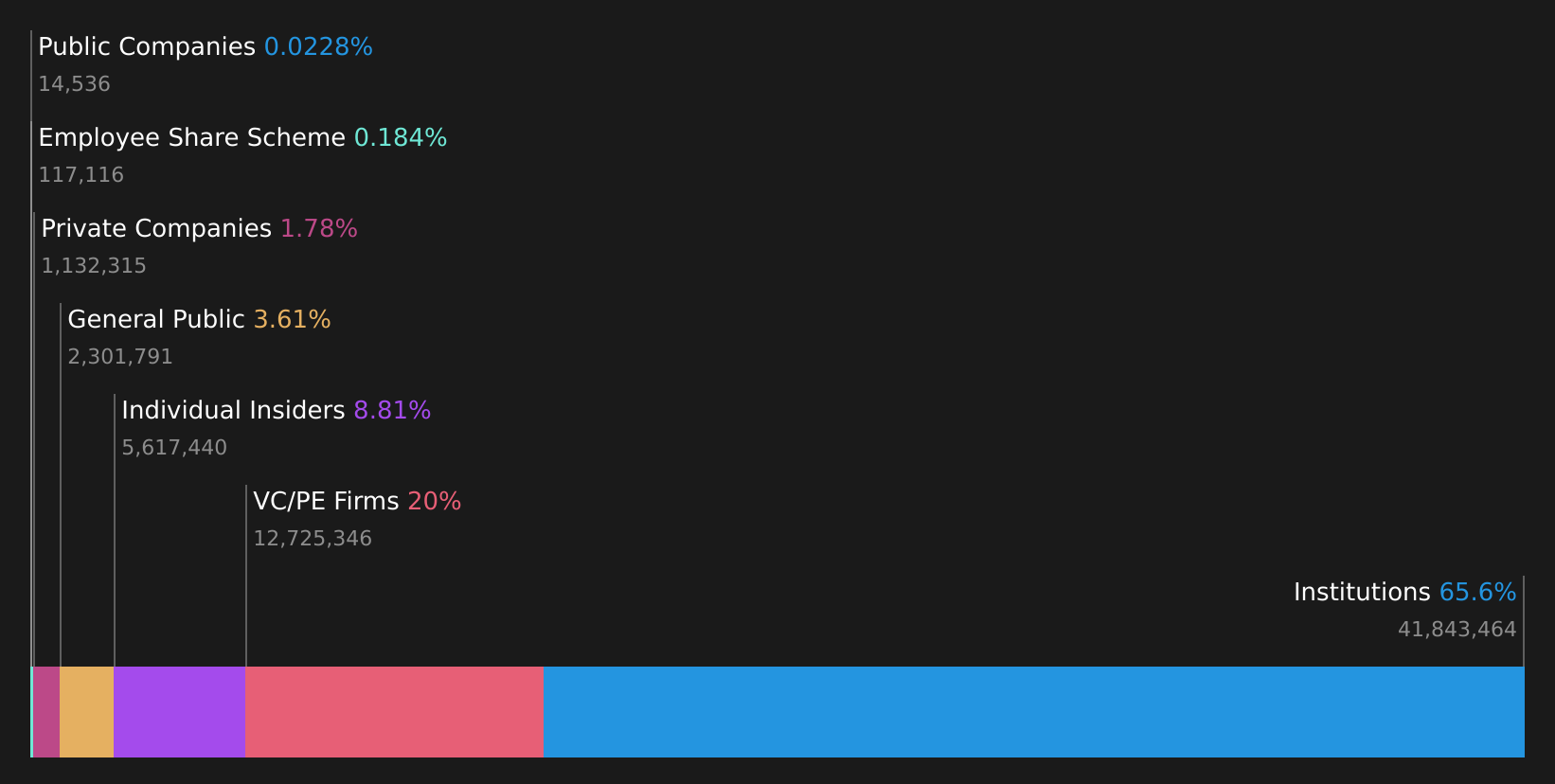

Insider Ownership: 38.3%

Earnings Growth Forecast: 61.7% p.a.

Hochschild Mining, a growth-oriented company with high insider ownership in the UK, is forecast to become profitable within the next three years, with expected revenue growth outpacing the UK market at 7.4% annually. Despite a low return on equity projection of 15.9%, earnings are anticipated to surge by 61.7% per year. Recent operational updates reveal stable production with an ambitious outlook for 2024, targeting up to 360,000 gold equivalent ounces while actively pursuing value-accretive mergers and acquisitions in Latin America focused on projects like Monte Do Carmo similar in scale and investment to Mara Rosa.

- Dive into the specifics of Hochschild Mining here with our thorough growth forecast report.

- Our valuation report unveils the possibility Hochschild Mining's shares may be trading at a premium.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, specializes in managing residential real estate properties with a market capitalization of approximately £236.85 million.

Operations: The company generates revenue through two primary segments: Financial Services (£1.50 million) and Property Franchising (£25.78 million).

Insider Ownership: 12.7%

Earnings Growth Forecast: 36.7% p.a.

Property Franchise Group, notable for its high insider ownership, trades at a substantial discount to estimated fair value. Despite shareholder dilution over the past year and an unstable dividend track record, the company is poised for significant growth. Revenue is expected to increase by 40.4% annually, outstripping the UK market's 3.4% growth rate, while earnings are projected to surge by 36.7% per year. Recent financials show a slight increase in net income and earnings per share from the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of Property Franchise Group.

- In light of our recent valuation report, it seems possible that Property Franchise Group is trading behind its estimated value.

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on the exploration, development, and production of resources, with a market capitalization of approximately £1.98 billion.

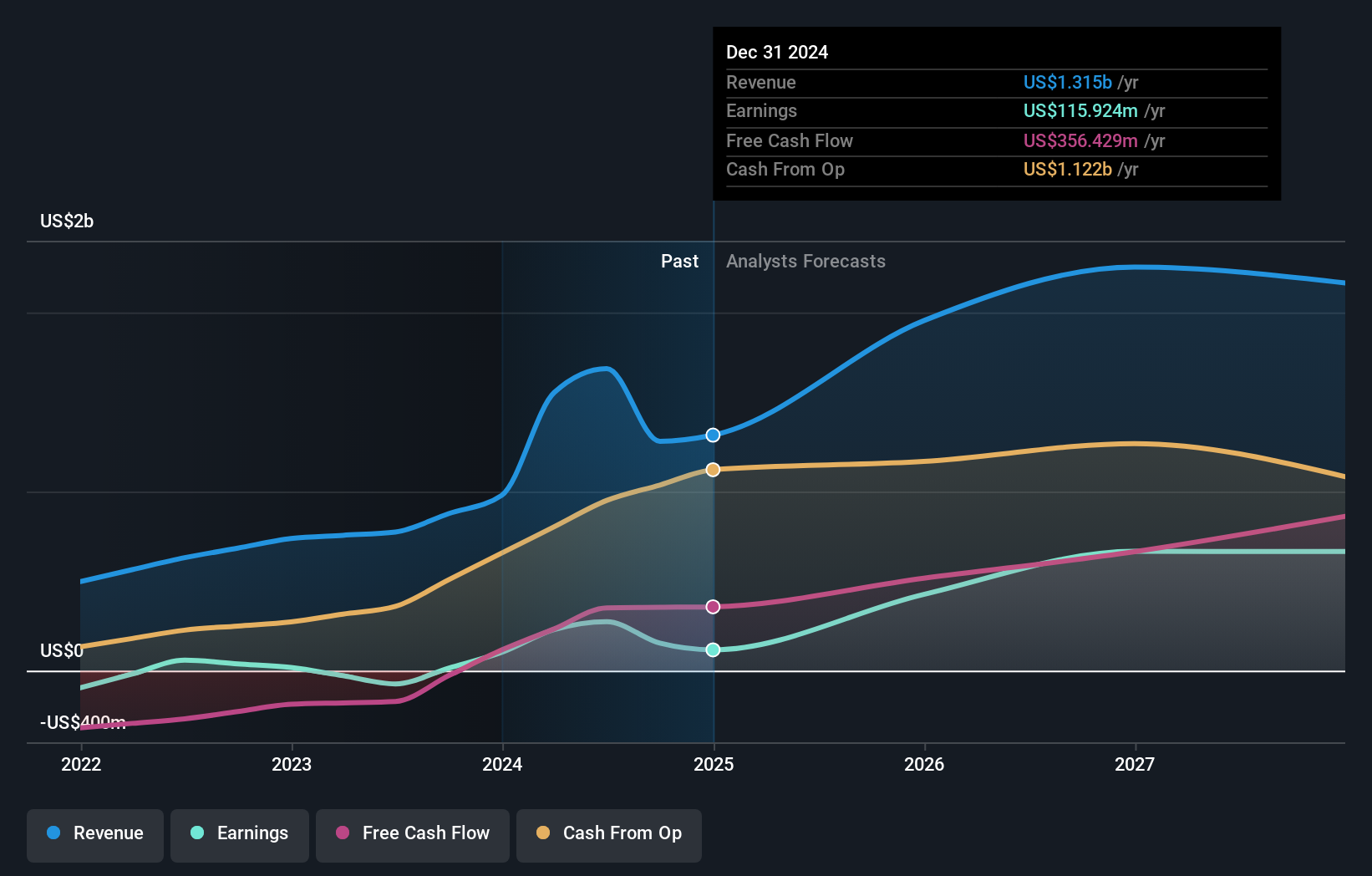

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling approximately $1.42 billion.

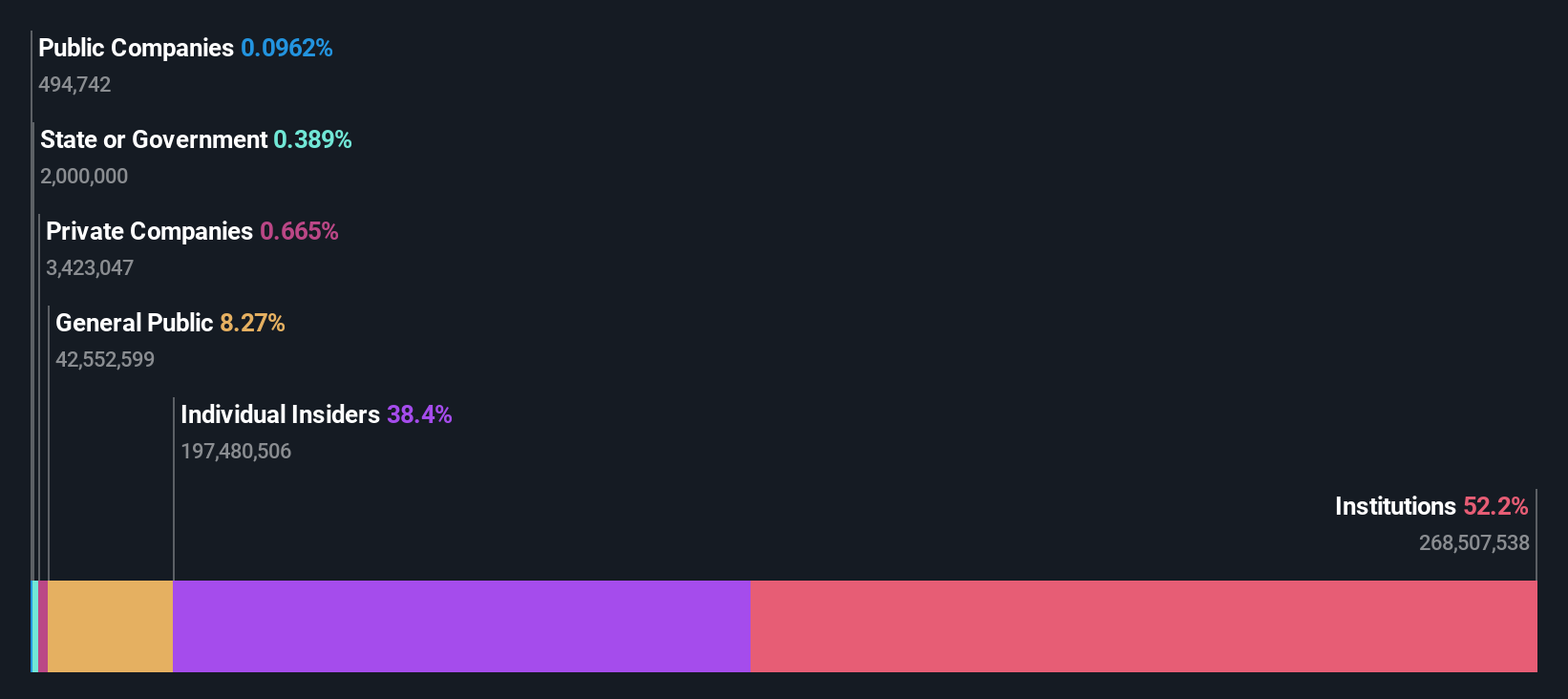

Insider Ownership: 10.7%

Earnings Growth Forecast: 24.3% p.a.

Energean, distinguished by high insider ownership, is trading at a 39.4% discount to its fair value, signaling potential undervaluation. The company's earnings have surged by a very large margin over the past year and are expected to grow by 24.3% annually, outpacing the UK market's growth. Despite carrying a high level of debt and experiencing shareholder dilution last year, recent reaffirmations of its robust production guidance for 2024 underscore operational stability and growth prospects.

- Navigate through the intricacies of Energean with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Energean's share price might be on the cheaper side.

Taking Advantage

- Access the full spectrum of 65 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Valuation is complex, but we're helping make it simple.

Find out whether Energean is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENOG

Energean

Energean plc engages in the exploration, development, and production of oil and gas.

Solid track record and good value.