Stock Analysis

Over the last 7 days, the UK market has remained flat, but over the past 12 months, it has risen by 12%, with earnings forecast to grow by 14% annually. For investors willing to explore beyond well-known companies, penny stocks—often smaller or newer firms—can present unexpected opportunities. Despite their vintage name, these stocks can offer a blend of value and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.85 | £176.31M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £304.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.11 | £800.61M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.95 | £474.22M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.46 | £167.92M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.452 | £219.31M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.53 | £187.85M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.90 | £67.78M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.66 | £468.35M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Midwich Group (AIM:MIDW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Midwich Group plc, along with its subsidiaries, distributes audio visual solutions to trade customers across multiple regions including the UK, Ireland, Europe, the Middle East, Africa, Asia Pacific and North America; it has a market cap of £271.62 million.

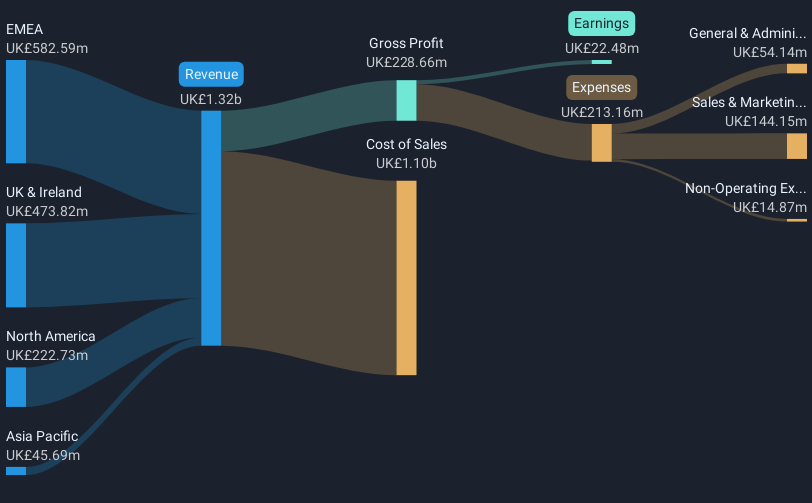

Operations: The company generates £1.32 billion in revenue from its wholesale distribution of computer peripherals.

Market Cap: £271.62M

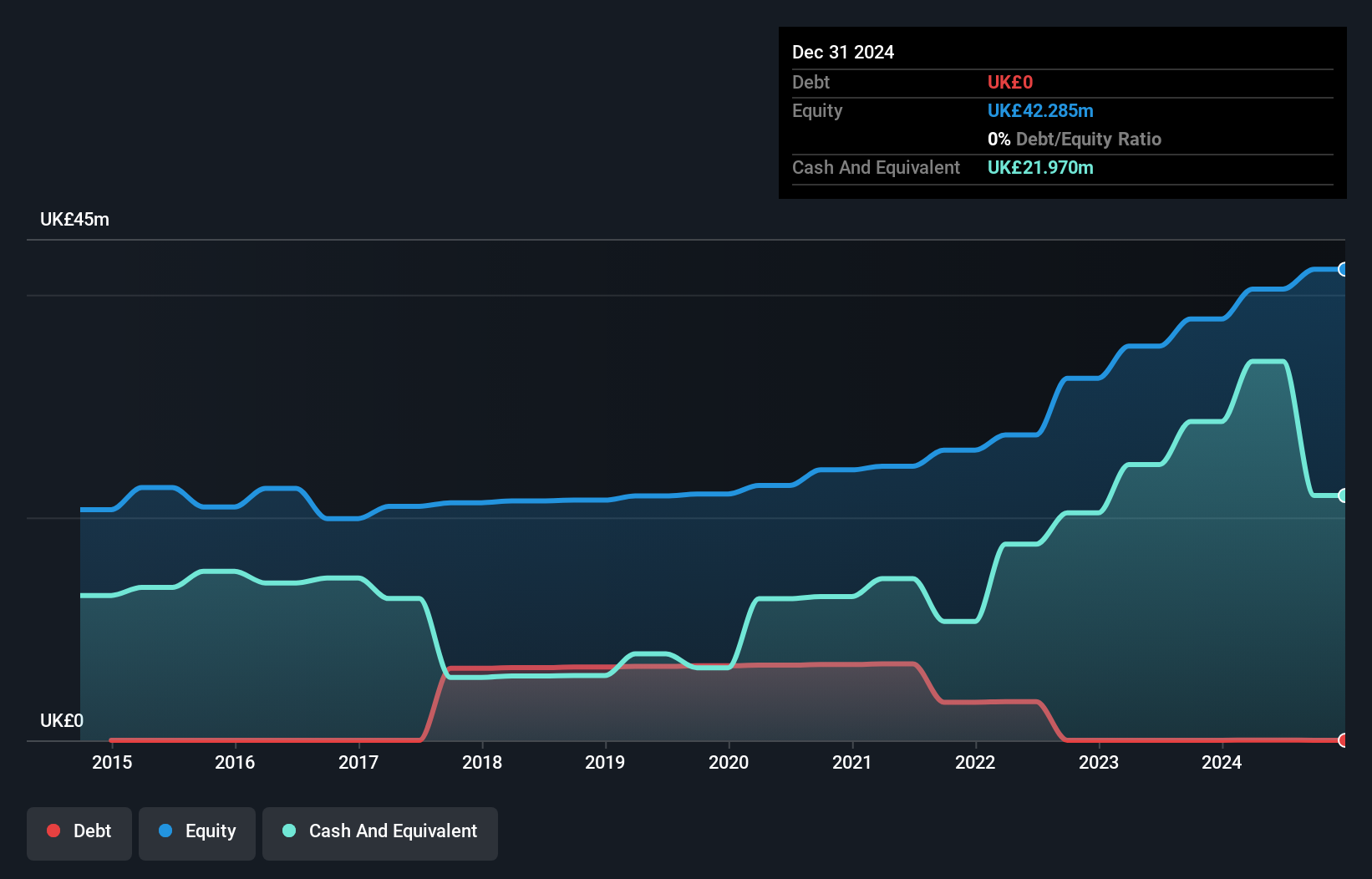

Midwich Group plc, with a market cap of £271.62 million and significant revenue generation of £1.32 billion, presents both opportunities and challenges as a penny stock. The company's debt is well-covered by operating cash flow, although it maintains a high net debt to equity ratio of 69.1%. Despite this leverage, Midwich's short-term assets comfortably cover both short and long-term liabilities. Recent earnings reports indicate stable revenue growth but declining net income year-over-year. Management has revised financial guidance amidst challenging market conditions, aiming for marginal revenue growth while implementing cost reductions to enhance profit margins in the future.

- Dive into the specifics of Midwich Group here with our thorough balance sheet health report.

- Gain insights into Midwich Group's future direction by reviewing our growth report.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Netcall plc is involved in the design, development, sale, and support of software products and services both in the United Kingdom and internationally with a market cap of £144.29 million.

Operations: The company's revenue of £39.06 million is derived from its operations in designing, developing, selling, and supporting software products and services.

Market Cap: £144.29M

Netcall plc, with a market cap of £144.29 million, shows promise in the penny stock realm through robust financials and strategic management. The company's operating cash flow significantly covers its debt, indicating strong liquidity. Despite shareholder dilution over the past year, Netcall's earnings growth of 39.2% outpaced industry averages, supported by high-quality earnings and improved profit margins from 11.7% to 15%. Recent results highlight revenue growth to £39.06 million and net income increase to £5.85 million year-over-year. A proposed dividend increase reflects confidence in sustained performance while an experienced board supports strategic direction amidst evolving market dynamics.

- Navigate through the intricacies of Netcall with our comprehensive balance sheet health report here.

- Evaluate Netcall's prospects by accessing our earnings growth report.

TMT Investments (AIM:TMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TMT Investments PLC is a venture capital and private equity firm focusing on startups, early stage, small and mid-sized companies, with a market cap of approximately $1 billion.

Operations: The company generates revenue of $10.44 million from its investments in the technology, media, and telecommunications sector.

Market Cap: $100.02M

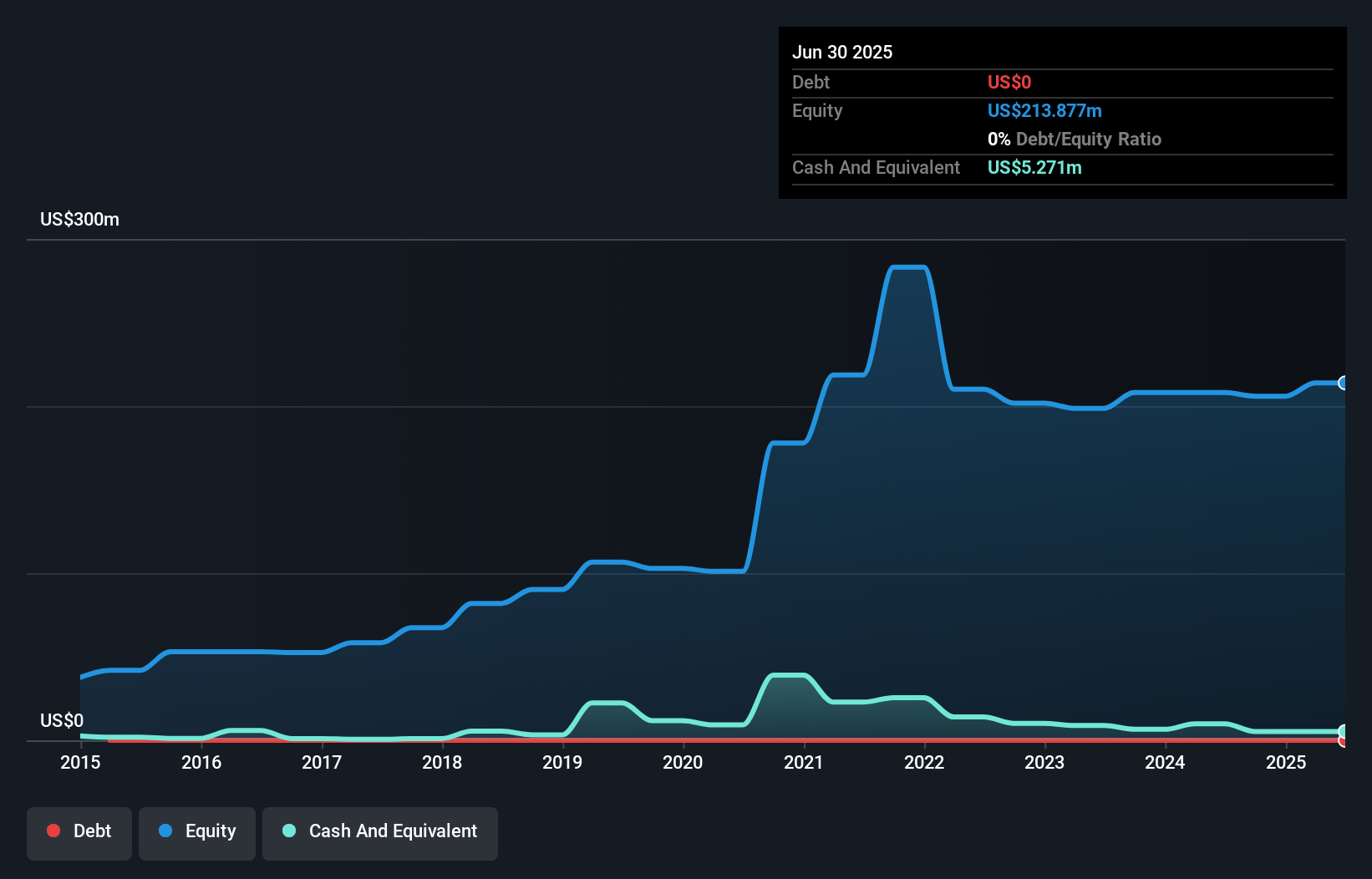

TMT Investments PLC, with a market cap of approximately US$1 billion, operates debt-free and has recently become profitable. The company's short-term assets of US$10 million comfortably exceed its liabilities, indicating solid financial health. Despite a 30.2% annual decline in earnings over the past five years, TMT's recent profitability marks a turnaround. Its Price-to-Earnings ratio of 10.6x suggests it may be undervalued compared to the UK market average of 16.2x. Recent earnings for the half-year show revenue at US$0.47 million and a significantly reduced net loss from the previous year, highlighting improved financial performance amidst stable volatility levels.

- Click here and access our complete financial health analysis report to understand the dynamics of TMT Investments.

- Gain insights into TMT Investments' historical outcomes by reviewing our past performance report.

Summing It All Up

- Click this link to deep-dive into the 472 companies within our UK Penny Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MIDW

Midwich Group

Distributes audio visual (AV) solutions to trade customers in the United Kingdom, Ireland, rest of Europe, the Middle East, Africa, the Asia Pacific, and North America.