Stock Analysis

- United Kingdom

- /

- Hospitality

- /

- LSE:DPEU

DP Eurasia N.V.'s (LON:DPEU) 35% Price Boost Is Out Of Tune With Earnings

DP Eurasia N.V. (LON:DPEU) shareholders have had their patience rewarded with a 35% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 72%.

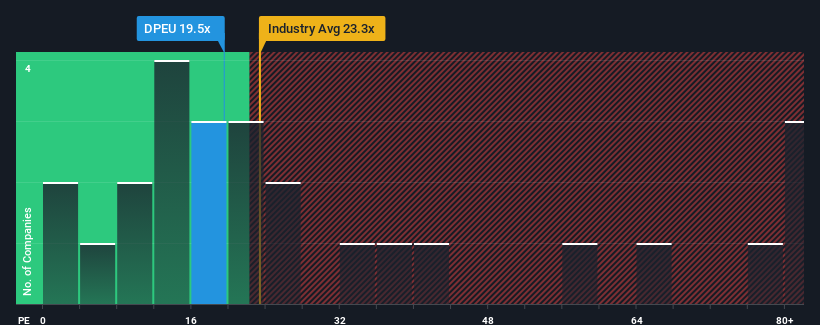

After such a large jump in price, given around half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 15x, you may consider DP Eurasia as a stock to potentially avoid with its 19.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Earnings have risen firmly for DP Eurasia recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for DP Eurasia

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as DP Eurasia's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a decent 7.6% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that DP Eurasia's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

DP Eurasia shares have received a push in the right direction, but its P/E is elevated too. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of DP Eurasia revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for DP Eurasia (1 is concerning!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether DP Eurasia is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DPEU

DP Eurasia

DP Eurasia N.V., together with its subsidiaries, engages in the operation of corporate-owned and franchised stores under the Domino’s Pizza brand name in Turkey, Russia, Azerbaijan, and Georgia.

Acceptable track record with worrying balance sheet.