- United Kingdom

- /

- Professional Services

- /

- AIM:DATA

3 UK Stocks That May Be Undervalued Based On Current Estimates

Reviewed by Simply Wall St

The UK stock market has been under pressure recently, with the FTSE 100 index closing lower amid weak trade data from China, highlighting concerns about global economic recovery. In such an environment, identifying undervalued stocks can present opportunities for investors looking to capitalize on potential growth when market conditions improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £29.90 | £58.31 | 48.7% |

| Gaming Realms (AIM:GMR) | £0.398 | £0.76 | 47.9% |

| Liontrust Asset Management (LSE:LIO) | £6.42 | £12.28 | 47.7% |

| Topps Tiles (LSE:TPT) | £0.488 | £0.91 | 46.5% |

| GlobalData (AIM:DATA) | £2.22 | £4.11 | 46% |

| Marks Electrical Group (AIM:MRK) | £0.65 | £1.27 | 48.8% |

| C&C Group (LSE:CCR) | £1.546 | £2.99 | 48.3% |

| AstraZeneca (LSE:AZN) | £130.18 | £250.51 | 48% |

| Mercia Asset Management (AIM:MERC) | £0.35 | £0.68 | 48.2% |

| Franchise Brands (AIM:FRAN) | £1.82 | £3.61 | 49.5% |

We'll examine a selection from our screener results.

GlobalData (AIM:DATA)

Overview: GlobalData Plc, with a market cap of £1.79 billion, provides business information through proprietary data, analytics, and insights across Europe, North America, and the Asia Pacific.

Operations: The company's revenue segments include £276.80 million from data, analytics, and insights.

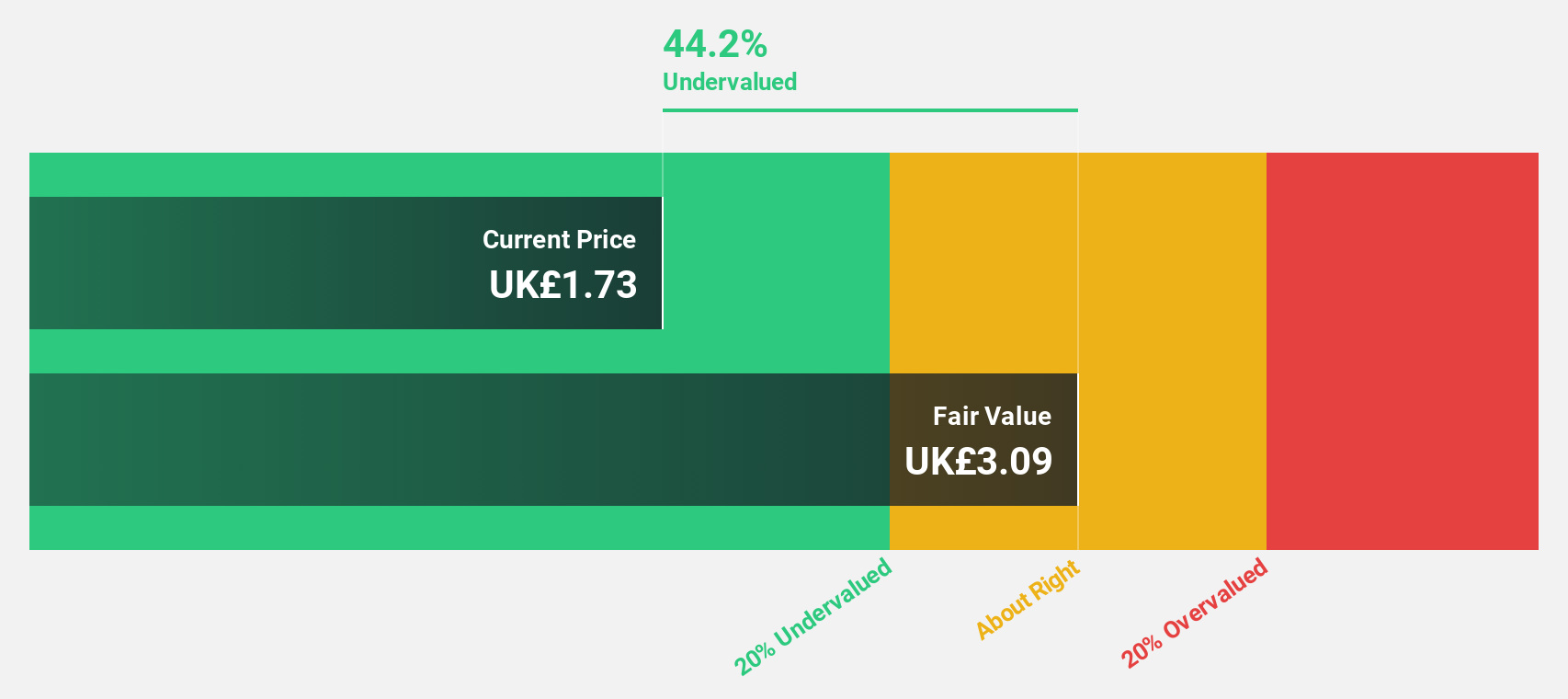

Estimated Discount To Fair Value: 46%

GlobalData appears undervalued based on cash flows, trading at 46% below its estimated fair value of £4.11 per share. Recent earnings show a net income increase to £20.1 million for H1 2024 from £17.8 million a year ago, and the company has initiated a significant share buyback program authorized until July 2025. Forecasts suggest robust annual profit growth of 28.8%, significantly outpacing the UK market's average growth rate of 14.4%.

- Insights from our recent growth report point to a promising forecast for GlobalData's business outlook.

- Dive into the specifics of GlobalData here with our thorough financial health report.

Tracsis (AIM:TRCS)

Overview: Tracsis plc, with a market cap of £197.12 million, provides software and hardware solutions as well as data analytics/GIS services for the rail, traffic data, and transportation industry.

Operations: The company's revenue segments are £34.59 million from Rail Technology & Services and £44.80 million from Data, Analytics, Consultancy & Events.

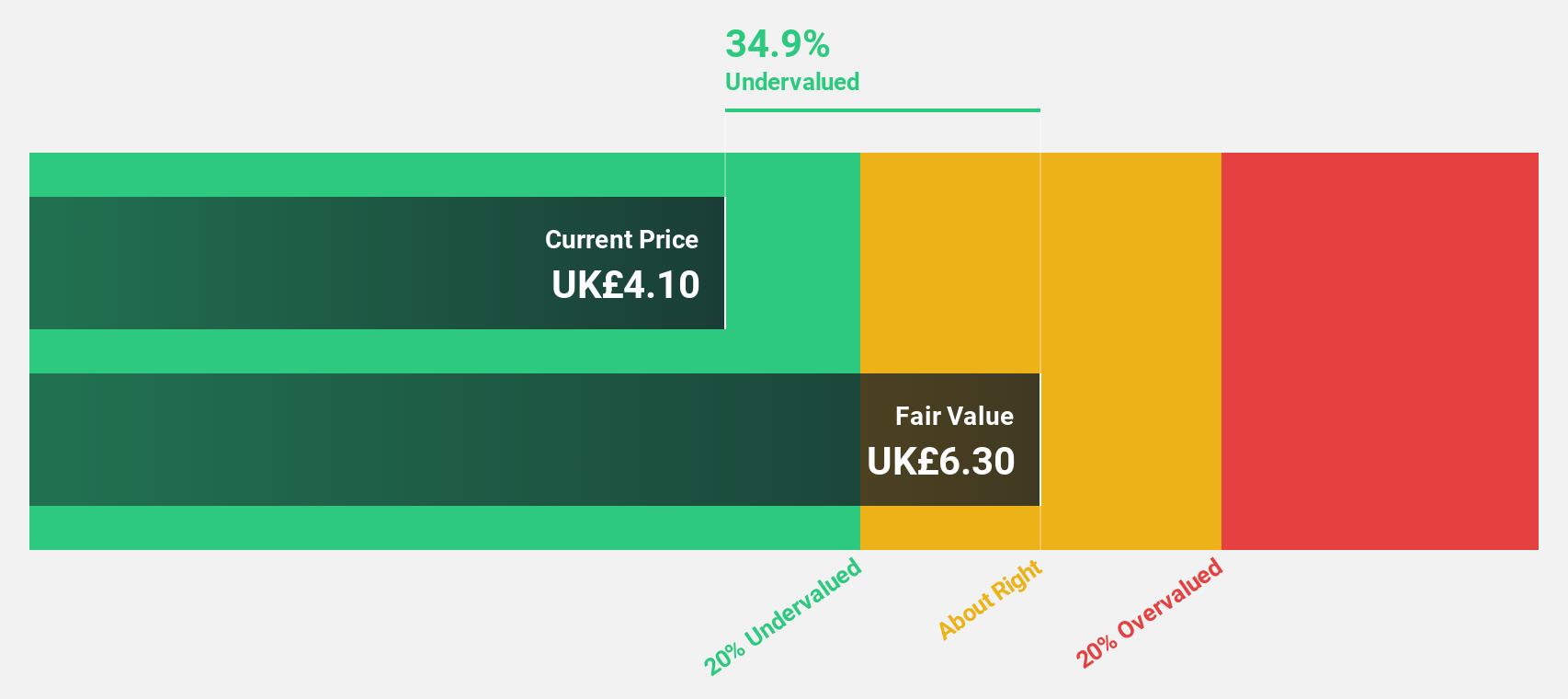

Estimated Discount To Fair Value: 43.9%

Tracsis appears undervalued based on cash flows, trading at £6.4 per share against an estimated fair value of £11.4. Analysts forecast earnings growth of 45.44% per year, significantly outpacing the UK market's 14.4%. Revenue is expected to grow at 9.1% annually, faster than the UK market's 3.7%. Despite recent strong earnings growth of 99.1%, Tracsis remains highly undervalued with a potential price increase projected by analysts at over 100%.

- According our earnings growth report, there's an indication that Tracsis might be ready to expand.

- Take a closer look at Tracsis' balance sheet health here in our report.

PageGroup (LSE:PAGE)

Overview: PageGroup plc, with a market cap of £1.26 billion, offers recruitment consultancy and ancillary services across the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific region, and the Americas.

Operations: The company generates £1.87 billion in revenue from recruitment services across its global operations.

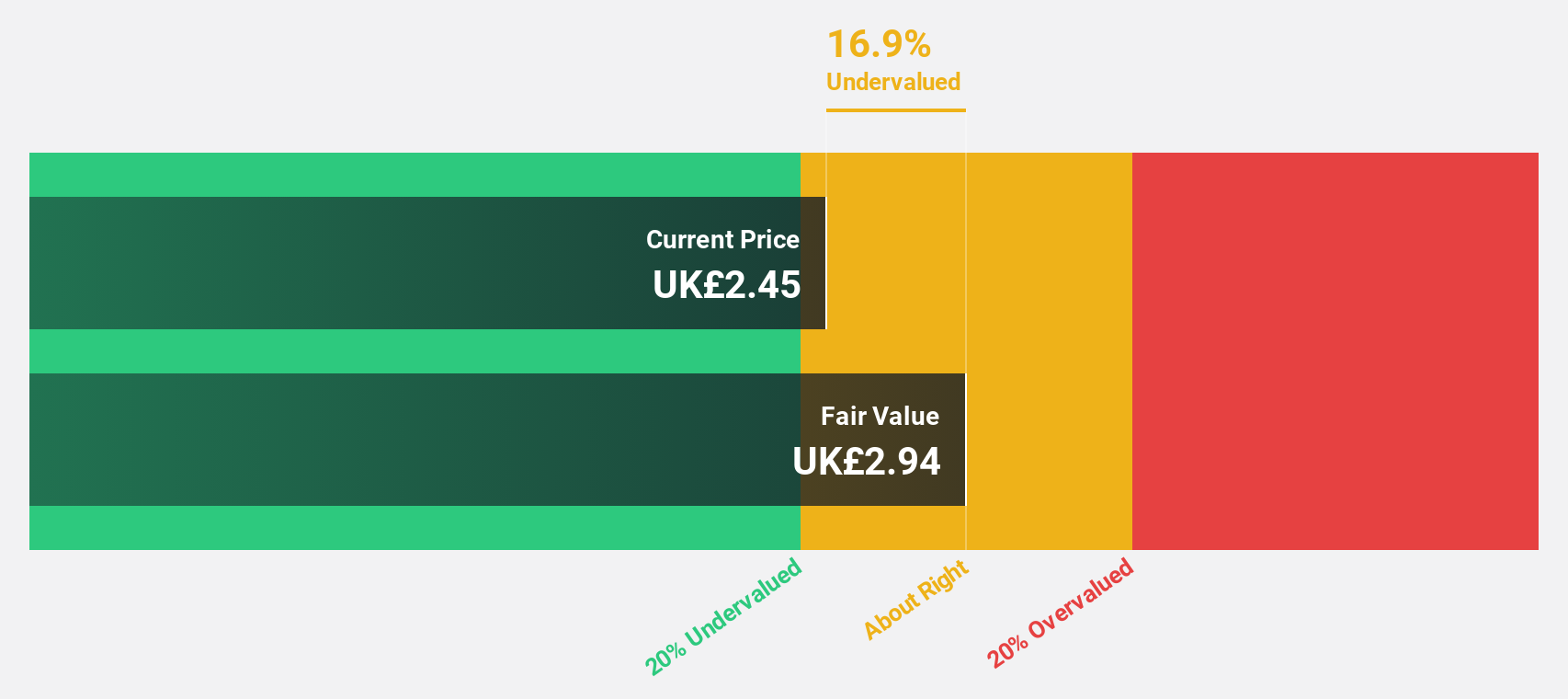

Estimated Discount To Fair Value: 23.3%

PageGroup is trading at £4.02, significantly below its estimated fair value of £5.24, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow 35.38% annually, outpacing the UK market's 14.4%, although revenue growth is slower at 3.2% per year compared to the market's 3.7%. Recent earnings show a decline in sales and net income for H1 2024, with profit margins also lower than last year’s figures.

- Our growth report here indicates PageGroup may be poised for an improving outlook.

- Navigate through the intricacies of PageGroup with our comprehensive financial health report here.

Next Steps

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 59 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DATA

GlobalData

Provides business information in the form of proprietary data, analytics, and insights in Europe, North America, and the Asia Pacific.

Flawless balance sheet with high growth potential.