Stock Analysis

Investing in Compagnie de l'Odet (EPA:ODET) five years ago would have delivered you a 99% gain

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Compagnie de l'Odet share price has climbed 97% in five years, easily topping the market return of 47% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 2.2% in the last year , including dividends .

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Compagnie de l'Odet

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Compagnie de l'Odet has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So it might be better to look at other metrics to try to understand the share price.

We doubt the modest 0.2% dividend yield is attracting many buyers to the stock. It is not great to see that revenue has dropped by 6.9% per year over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

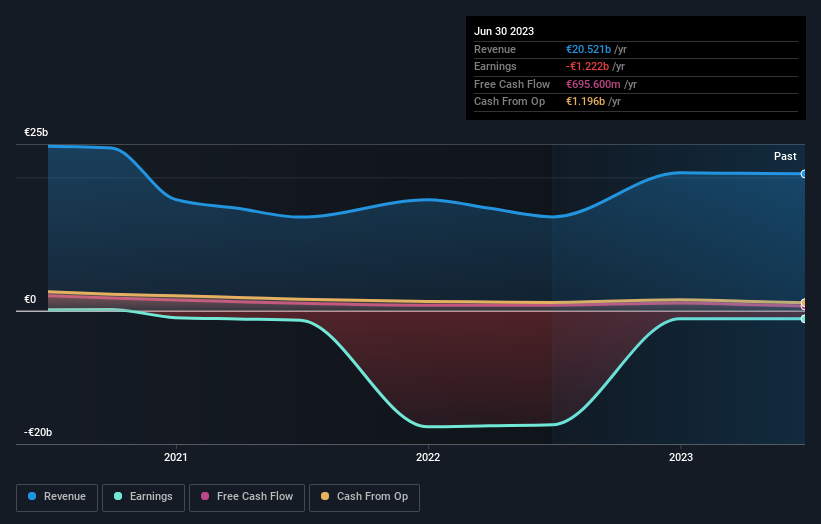

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Compagnie de l'Odet's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Compagnie de l'Odet, it has a TSR of 99% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Compagnie de l'Odet shareholders are up 2.2% for the year (even including dividends). Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 15% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Compagnie de l'Odet you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Compagnie de l'Odet is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ODET

Compagnie de l'Odet

Compagnie de l'Odet operates transportation and logistics, communication, and industry business in France, Africa, the Americas, the Asia-Pacific, and other European countries.

Flawless balance sheet and good value.