Stock Analysis

As European inflation nears the central bank's target, the pan-European STOXX Europe 600 Index has reached record highs, with France's CAC 40 Index showing solid gains. This favorable economic environment sets a promising stage for high-growth tech stocks in France. When evaluating potential investments in this sector, it's important to consider companies that demonstrate strong innovation and adaptability to market conditions.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 16.18% | 35.08% | ★★★★★☆ |

| Cogelec | 11.32% | 24.06% | ★★★★★☆ |

| VusionGroup | 21.32% | 25.74% | ★★★★★★ |

| Munic | 26.68% | 149.17% | ★★★★★☆ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Valneva | 24.22% | 28.34% | ★★★★★☆ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

| beaconsmind | 31.75% | 106.73% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across multiple continents including Europe, the Americas, Asia, Oceania, and Africa with a market cap of €16.29 billion.

Operations: Bolloré SE generates revenue primarily from its communications segment (€14.87 billion) and Bollore Energy (€2.75 billion), with additional contributions from its industry sector (€352.70 million). The company's diverse operations span across multiple continents, including Europe, the Americas, Asia, Oceania, and Africa.

Bolloré's recent earnings report highlights a remarkable sales increase to €10.59 billion from €6.23 billion, while net income surged to €3.76 billion from €114 million year-over-year, reflecting strong performance in its entertainment segment. The company's R&D expenses have been strategically allocated, contributing to its projected annual earnings growth of 32.8%, outpacing the French market's 12.2%. With revenue forecasted to grow at 8.3% annually and a consistent interim dividend of €0.02 per share, Bolloré demonstrates robust financial health and promising future prospects in the tech sector.

- Navigate through the intricacies of Bolloré with our comprehensive health report here.

Review our historical performance report to gain insights into Bolloré's's past performance.

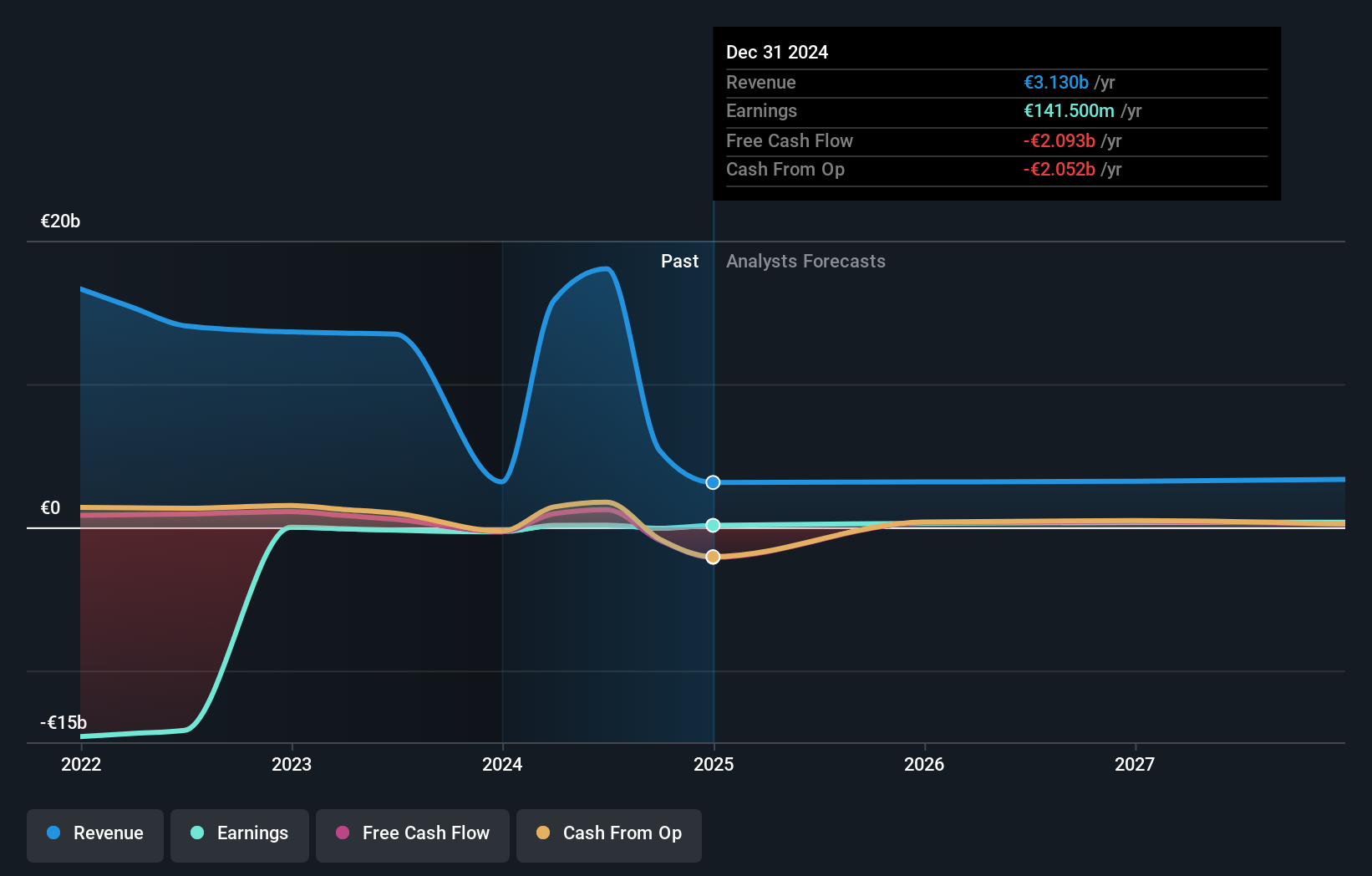

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE operates as an entertainment, media, and communication company across multiple continents including Europe, the Americas, Asia/Oceania, and Africa with a market cap of €10.23 billion.

Operations: Vivendi SE generates revenue primarily through its Canal+ Group (€6.20 billion) and Havas Group (€2.92 billion), with additional contributions from Gameloft (€304 million) and Prisma Media (€303 million). The company's diverse portfolio spans entertainment, media, and communication sectors across multiple continents.

Vivendi's recent half-year earnings report revealed sales of €9.05 billion, nearly doubling from €4.70 billion a year ago, though net income slightly dipped to €159 million from €174 million. The company repurchased 18.42 million shares for €184 million this year, reflecting strong capital management strategies. With R&D expenses contributing to its projected annual earnings growth of 30.6%, Vivendi is poised for a significant boost in profitability compared to the broader French market's 12.2% growth forecast.

- Unlock comprehensive insights into our analysis of Vivendi stock in this health report.

Explore historical data to track Vivendi's performance over time in our Past section.

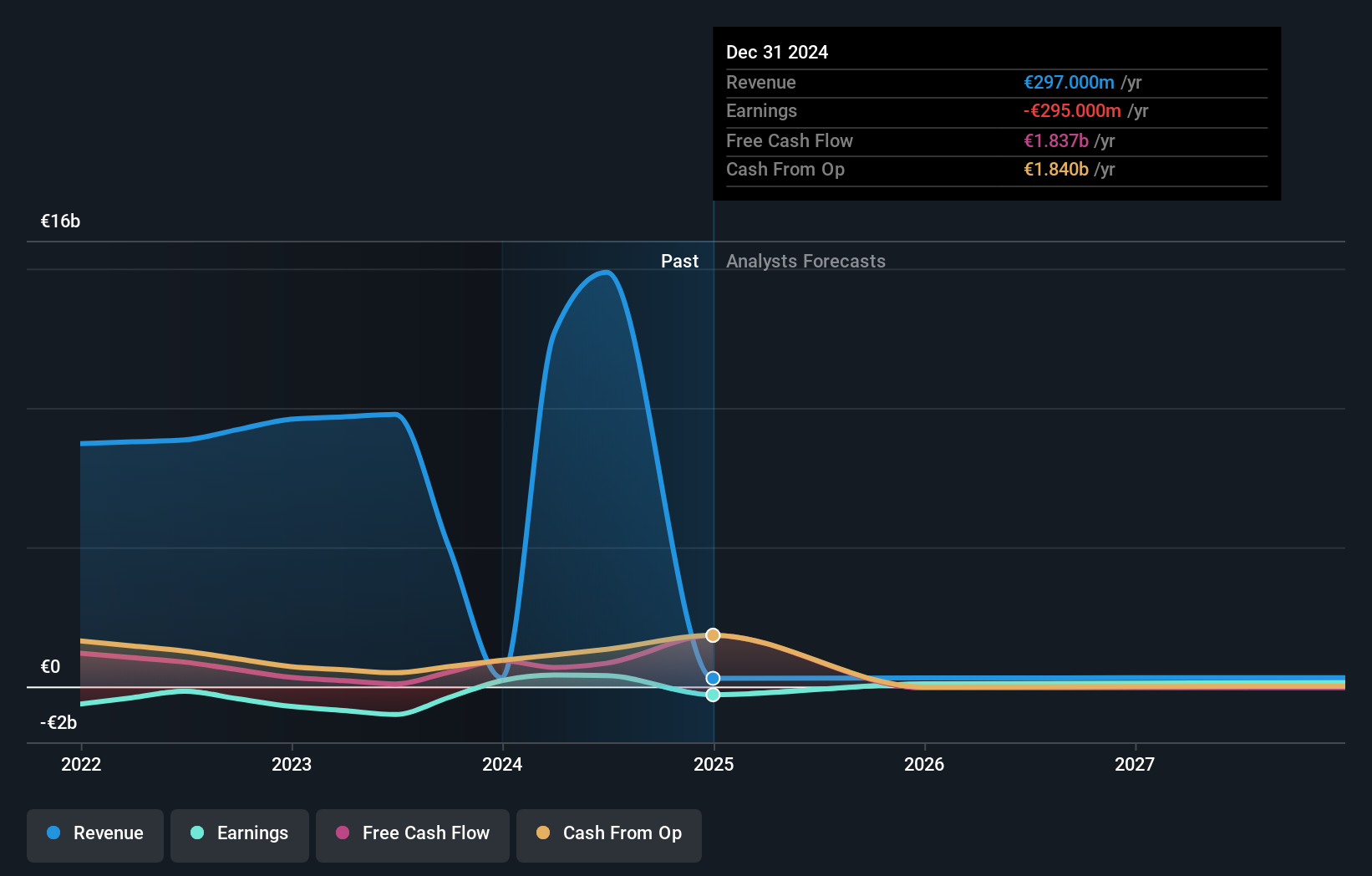

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of approximately €2.27 billion.

Operations: VusionGroup S.A. specializes in providing digitalization solutions for commerce, focusing on installing and maintaining electronic shelf labels, generating approximately €801.96 million in revenue. The company operates across Europe, Asia, and North America with a market cap of around €2.27 billion.

VusionGroup's recent partnership with Ace Hardware to deploy advanced digital shelf label (DSL) technology across over 5,000 stores highlights its innovative edge in the DIY retail sector. With a forecasted revenue growth of 21.3% annually and earnings expected to rise by 25.7% per year, VusionGroup is positioned for robust expansion. The company's R&D expenses, which have historically been substantial, continue to drive technological advancements like the VusionCloud platform and BLE IoT operating system, enhancing operational efficiencies and customer experience significantly.

- Click here and access our complete health analysis report to understand the dynamics of VusionGroup.

Gain insights into VusionGroup's historical performance by reviewing our past performance report.

Next Steps

- Navigate through the entire inventory of 44 Euronext Paris High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIV

Vivendi

Operates as an entertainment, media, and communication company in France, the rest of Europe, the Americas, Asia/Oceania, and Africa.