Stock Analysis

Novacyt (EPA:ALNOV investor three-year losses grow to 81% as the stock sheds €5.2m this past week

Over the last month the Novacyt S.A. (EPA:ALNOV) has been much stronger than before, rebounding by 36%. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 81% in that time. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

If the past week is anything to go by, investor sentiment for Novacyt isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Novacyt

Novacyt isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Novacyt saw its revenue shrink by 13% per year. That's not what investors generally want to see. The share price fall of 22% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

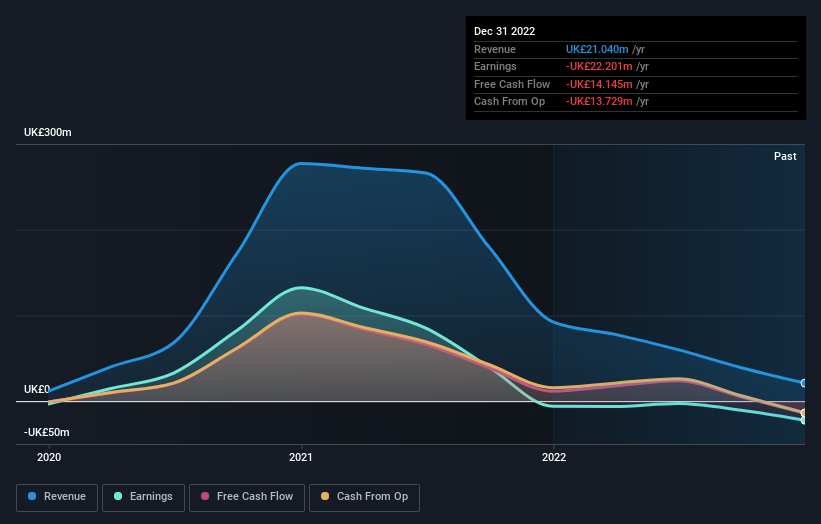

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Novacyt stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 14% in the last year, Novacyt shareholders lost 53%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Novacyt (1 shouldn't be ignored) that you should be aware of.

Of course Novacyt may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Novacyt is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNOV

Novacyt

Novacyt S.A., together with its subsidiaries, provides in vitro and molecular diagnostic tests for a range of infectious diseases in the United Kingdom, rest of Europe, the United States, the Asia Pacific, the Middle East, and Africa.

Flawless balance sheet and slightly overvalued.