Stock Analysis

- France

- /

- Interactive Media and Services

- /

- ENXTPA:ALDNX

Returns On Capital At DNXCorp (EPA:ALDNX) Have Hit The Brakes

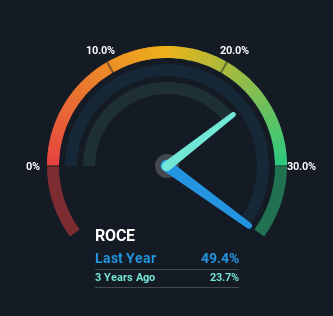

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, while the ROCE is currently high for DNXCorp (EPA:ALDNX), we aren't jumping out of our chairs because returns are decreasing.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for DNXCorp, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.49 = €6.7m ÷ (€22m - €8.5m) (Based on the trailing twelve months to June 2023).

So, DNXCorp has an ROCE of 49%. That's a fantastic return and not only that, it outpaces the average of 18% earned by companies in a similar industry.

Check out our latest analysis for DNXCorp

Historical performance is a great place to start when researching a stock so above you can see the gauge for DNXCorp's ROCE against it's prior returns. If you're interested in investigating DNXCorp's past further, check out this free graph covering DNXCorp's past earnings, revenue and cash flow.

The Trend Of ROCE

Things have been pretty stable at DNXCorp, with its capital employed and returns on that capital staying somewhat the same for the last five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So while the current operations are delivering respectable returns, unless capital employed increases we'd be hard-pressed to believe it's a multi-bagger going forward.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 38% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Key Takeaway

Although is allocating it's capital efficiently to generate impressive returns, it isn't compounding its base of capital, which is what we'd see from a multi-bagger. Yet to long term shareholders the stock has gifted them an incredible 704% return in the last five years, so the market appears to be rosy about its future. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

If you want to continue researching DNXCorp, you might be interested to know about the 2 warning signs that our analysis has discovered.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

Valuation is complex, but we're helping make it simple.

Find out whether DNXCorp is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALDNX

DNXCorp

DNXCorp SE engages in the development and promotion of internet-based audience in Luxembourg and internationally.

Outstanding track record with excellent balance sheet.