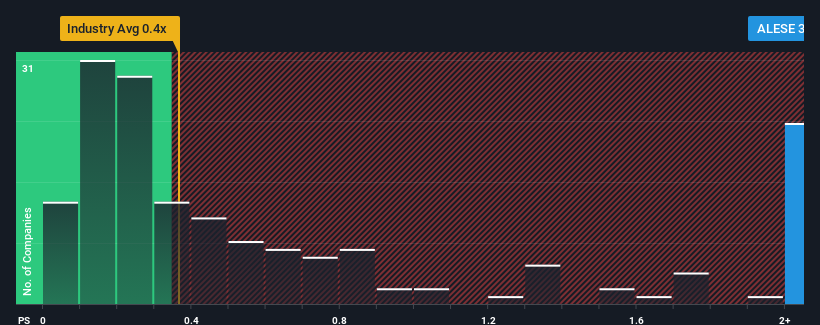

Entech SA's (EPA:ALESE) price-to-sales (or "P/S") ratio of 3.2x may look like a poor investment opportunity when you consider close to half the companies in the Construction industry in France have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Entech

How Has Entech Performed Recently?

Recent times have been advantageous for Entech as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Entech.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Entech's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 56% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 54% each year over the next three years. With the industry only predicted to deliver 4.4% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Entech's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Entech's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Entech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Construction industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Entech has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Entech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Entech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALESE

Entech

Engages in the storage, conversion, and management of renewable energies in France and internationally.

Exceptional growth potential with adequate balance sheet.