Stock Analysis

Global markets have recently experienced significant shifts, with U.S. stocks rallying to record highs following a Republican electoral sweep, leading to expectations of accelerated earnings growth and reduced regulatory burdens. Amidst these developments, the small-cap Russell 2000 Index has shown impressive gains, highlighting the potential opportunities within high-growth tech stocks as investors seek companies that can thrive under favorable economic policies and lower corporate taxes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1278 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zealand Pharma (CPSE:ZEAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zealand Pharma A/S is a biotechnology company focused on discovering, developing, and commercializing peptide-based medicines in Denmark, with a market cap of DKK61.99 billion.

Operations: Zealand Pharma generates its revenue primarily from its biotechnology segment, amounting to DKK76.87 million. The company is engaged in the discovery, development, and commercialization of peptide-based medicines.

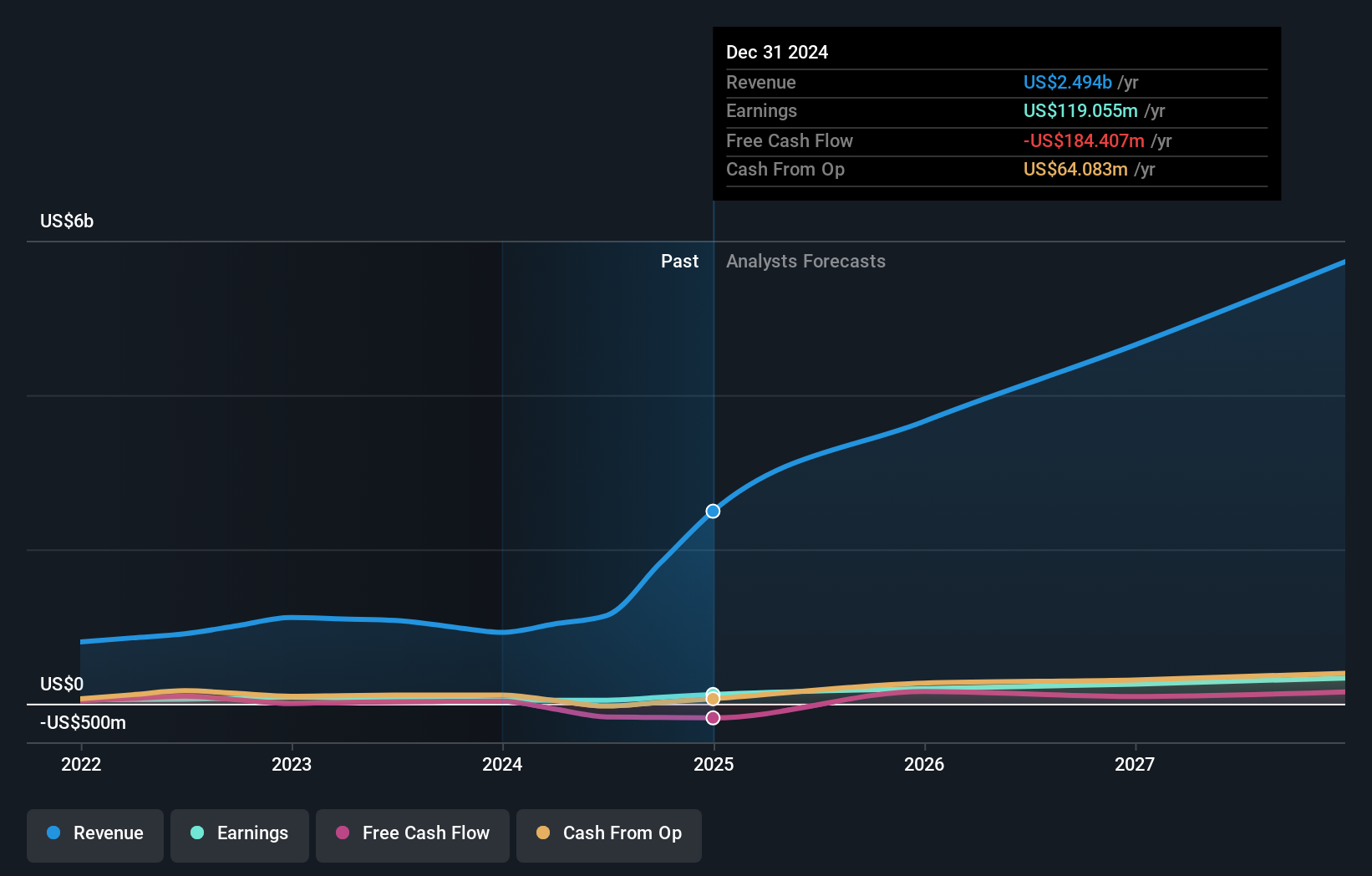

Zealand Pharma's recent trajectory illustrates a challenging phase, with a significant revenue drop to DKK 4.42 million in Q3 2024 from DKK 295.52 million the previous year and escalating losses, signaling intense development focus rather than market performance. This period of heavy investment in R&D is evident as the firm navigates regulatory hurdles, such as the FDA's response requiring further data for dasiglucagon’s application. Despite these setbacks, Zealand Pharma remains committed to innovation in biopharmaceuticals, aiming to transform treatment landscapes for metabolic and gastrointestinal diseases—a strategy that might redefine its growth path amid high industry expectations marked by a forecasted annual revenue increase of 50.1%.

- Click here to discover the nuances of Zealand Pharma with our detailed analytical health report.

Assess Zealand Pharma's past performance with our detailed historical performance reports.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures, and sells optical modules and systems integration products for smartphones and other mobile devices across several international markets, with a market cap of approximately HK$22.51 billion.

Operations: The company primarily generates revenue from the sale of photographic equipment and supplies, amounting to $1.14 billion. It operates in markets including China, India, and Korea, focusing on optical modules and systems integration products for various mobile devices.

Cowell e Holdings has demonstrated a robust half-year performance with sales soaring to $585.93 million, up from $366.73 million in the previous period, showcasing a significant 32% revenue growth year-over-year. Despite this surge, net income slightly dipped to $16.04 million from $18.03 million, reflecting a challenging cost environment but underscoring strong sales dynamics. The firm's commitment to innovation is evident in its R&D strategy, crucial for sustaining its competitive edge in the fast-evolving tech landscape where it forecasts an impressive 35% earnings growth annually over the next three years—well above Hong Kong's market average of 11.8%. This strategic focus on high-quality earnings and substantial investment in development positions Cowell e Holdings uniquely among peers as it navigates future tech demands.

- Get an in-depth perspective on Cowell e Holdings' performance by reading our health report here.

Evaluate Cowell e Holdings' historical performance by accessing our past performance report.

Asiainfo Security TechnologiesLtd (SHSE:688225)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asiainfo Security Technologies Co., Ltd. specializes in providing network security software both in China and internationally, with a market capitalization of CN¥8.50 billion.

Operations: Asiainfo Security Technologies Co., Ltd. generates revenue primarily from its network security software offerings, serving clients in China and abroad. The company's market capitalization is approximately CN¥8.50 billion, reflecting its position in the industry.

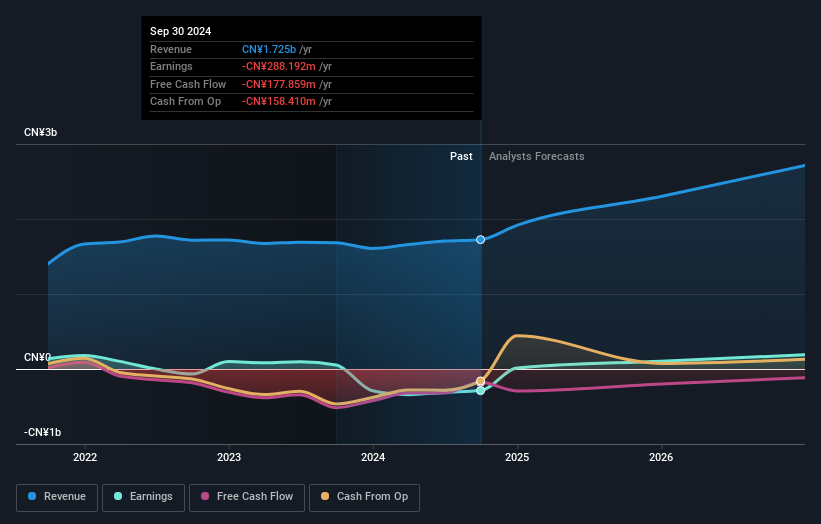

Despite a challenging backdrop, Asiainfo Security Technologies Co., Ltd. has shown resilience with a revenue uptick to CNY 1.11 billion from CNY 991.86 million year-over-year, marking a notable growth of 19.6%. This increase comes amidst slight improvements in net losses—CNY 208.34 million compared to last year's CNY 211.23 million—highlighting cautious optimism in operational efficiencies and market adaptation strategies. The company's focus on R&D remains robust, aligning with industry shifts towards enhanced security solutions and innovations in tech infrastructure, crucial for staying relevant in the competitive landscape of software and AI technologies. Looking ahead, Asiainfo is positioned to pivot from its current unprofitable status to anticipated profitability with an impressive forecasted annual earnings growth rate of 115.2%. Such projections are supported by strategic investments in technology development that not only aim to bolster service offerings but also enhance client engagements across various sectors—a vital move as industries increasingly prioritize cybersecurity measures amidst evolving digital threats.

Seize The Opportunity

- Click here to access our complete index of 1278 High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zealand Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ZEAL

Zealand Pharma

A biotechnology company, engages in the discovery, development, and commercialization of peptide-based medicines in Denmark.