Stock Analysis

- Germany

- /

- Capital Markets

- /

- XTRA:MPCK

Exploring Bijou Brigitte modische Accessoires And Two More Top Dividend Stocks

Reviewed by Kshitija Bhandaru

As the Eurozone emerges from recession and Germany's DAX index shows signs of weakening, investors are keenly observing market trends and economic indicators for strategic opportunities. In this context, dividend stocks like Bijou Brigitte modische Accessoires offer a particular appeal due to their potential for providing steady income streams amidst fluctuating markets.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.30% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.82% | ★★★★★★ |

| FRoSTA (DB:NLM) | 3.15% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.31% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 7.31% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 5.62% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.70% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.24% | ★★★★★☆ |

| Bayerische Motoren Werke (XTRA:BMW) | 5.82% | ★★★★★☆ |

| K+S (XTRA:SDF) | 5.07% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bijou Brigitte modische Accessoires (XTRA:BIJ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bijou Brigitte modische Accessoires Aktiengesellschaft is a company that manufactures, imports, and sells fashion jewelry and accessories, with a market capitalization of approximately €302.17 million.

Operations: Bijou Brigitte modische Accessoires Aktiengesellschaft generates its revenue primarily through the sale of fashion and precious jewelry, as well as various accessory items.

Dividend Yield: 7.6%

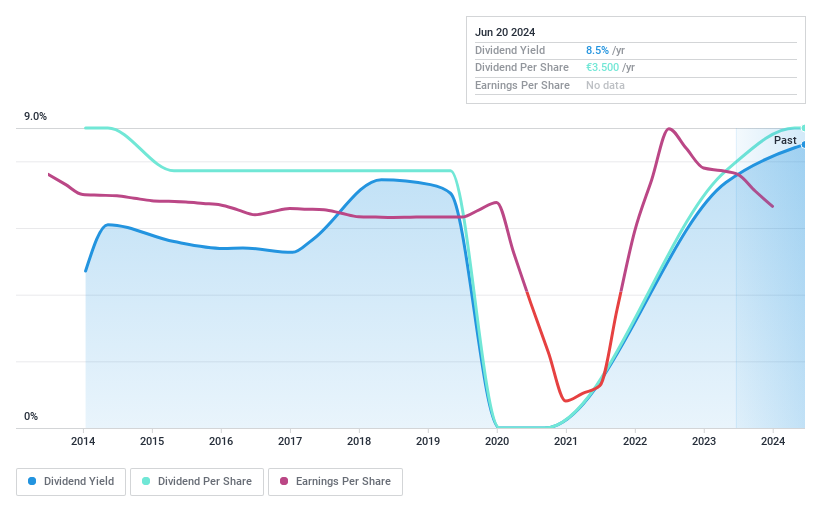

Bijou Brigitte modische Accessoires reported a decline in net income for 2023, with EUR 24.08 million compared to EUR 34.89 million the previous year, amid sales growth from EUR 307.11 million to EUR 328.57 million. Despite this profit drop, the company maintains a high dividend yield of 7.64%, supported by a sustainable payout ratio of 69.7% and cash payout ratio of 38.3%. However, its dividend history shows instability and volatility over the past decade, reflecting potential concerns for long-term dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Bijou Brigitte modische Accessoires.

- Our valuation report unveils the possibility Bijou Brigitte modische Accessoires' shares may be trading at a discount.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen specializes in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems across Germany and globally, with a market capitalization of approximately €125.53 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen generates €101.79 million from its Systems segment and €181.45 million from Displays.

Dividend Yield: 5.6%

DATA MODUL's dividend yield of 5.62% ranks well in the German market, supported by a low payout ratio of 48.7% and a cash payout ratio of 47.3%, ensuring dividends are well-covered by both earnings and cash flows. Despite this, the company has experienced volatility in its dividend payments over the past decade, which may concern investors looking for stable returns. Additionally, its recent earnings report shows a decrease in net income from €18.37 million to €14.49 million year-over-year, potentially impacting future dividend sustainability despite current affordability metrics like a below-market P/E ratio of 8.7x.

- Dive into the specifics of DATA MODUL Produktion und Vertrieb von elektronischen Systemen here with our thorough dividend report.

- Upon reviewing our latest valuation report, DATA MODUL Produktion und Vertrieb von elektronischen Systemen's share price might be too optimistic.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG operates as a publicly owned investment manager with a market capitalization of approximately €123.37 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue primarily through Management Services (€30.53 million) and Transaction Services (€7.04 million).

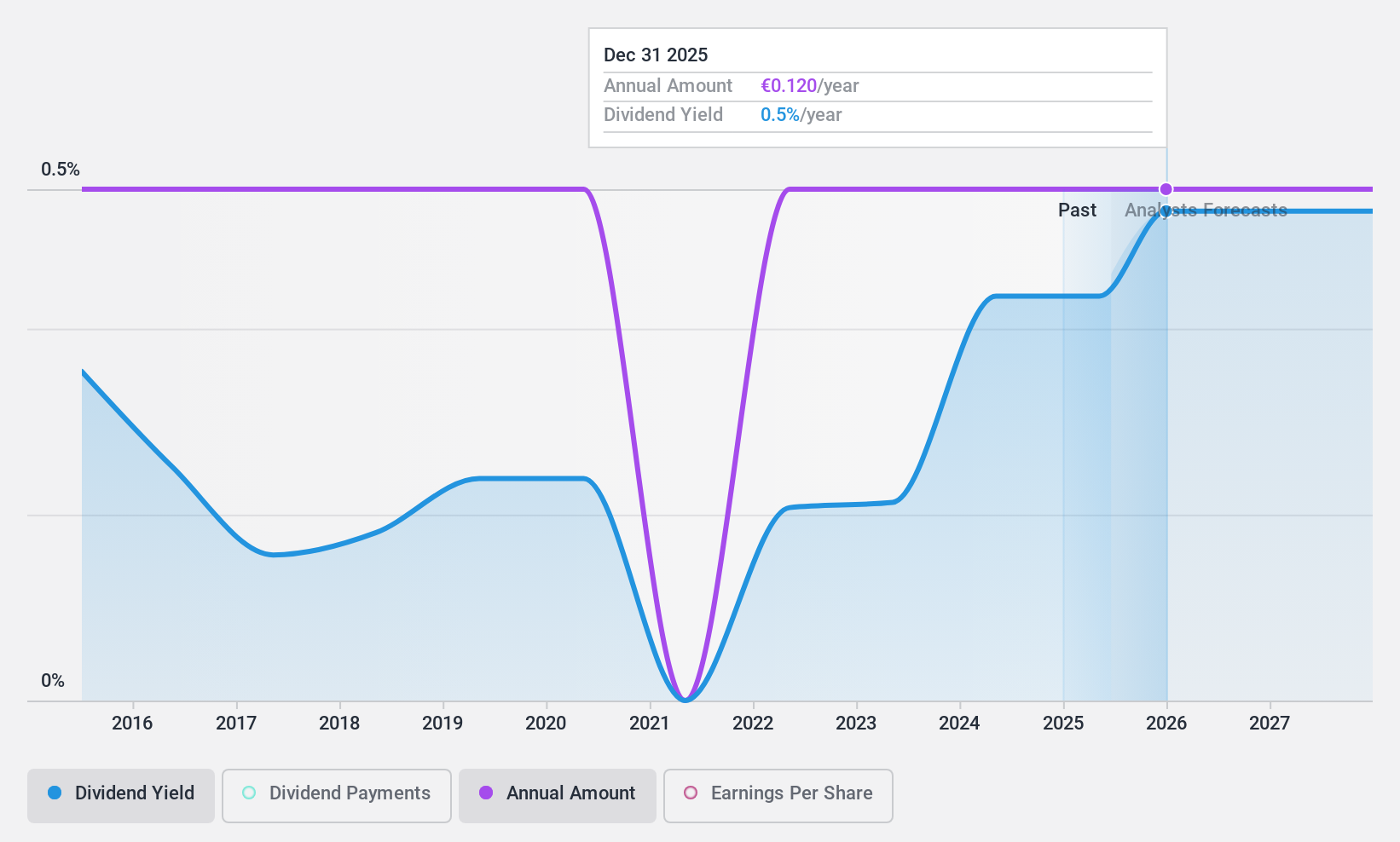

Dividend Yield: 7.7%

MPC Münchmeyer Petersen Capital AG, with a dividend yield of 7.71%, stands out in the German market. Despite a short dividend history and recent management changes, including Constantin Baack's appointment as CEO effective from 13 June 2024, the company maintains a reasonable payout ratio of 72.6%. However, its profit margin declined to 34.5% from last year's 71.2%, reflecting potential pressures on future dividend sustainability despite current coverage by earnings and cash flows with cash payout ratio at 73.6%.

- Delve into the full analysis dividend report here for a deeper understanding of MPC Münchmeyer Petersen Capital.

- Our valuation report here indicates MPC Münchmeyer Petersen Capital may be undervalued.

Key Takeaways

- Explore the 29 names from our Top Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether MPC Münchmeyer Petersen Capital is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MPCK

Flawless balance sheet, undervalued and pays a dividend.