Stock Analysis

Shareholders in Allgeier (ETR:AEIN) are in the red if they invested a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Allgeier SE (ETR:AEIN) share price is down 31% in the last year. That contrasts poorly with the market return of 6.1%. At least the damage isn't so bad if you look at the last three years, since the stock is down 19% in that time. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Allgeier

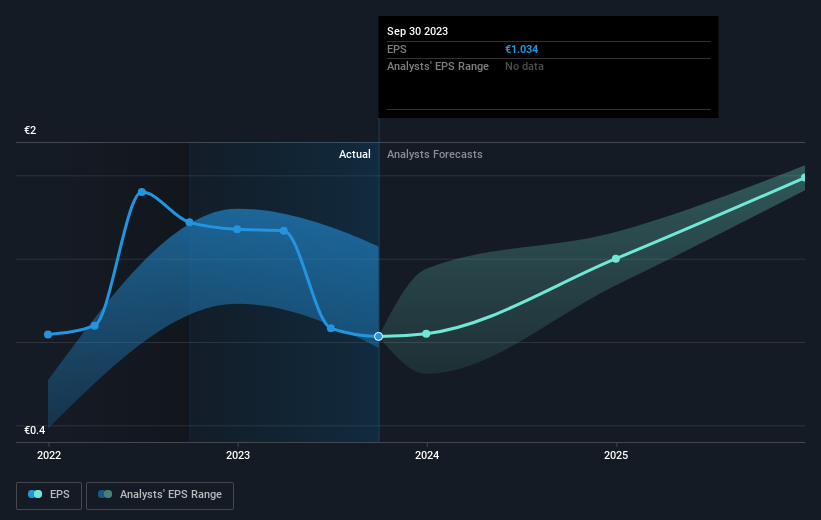

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Allgeier reported an EPS drop of 40% for the last year. This fall in the EPS is significantly worse than the 31% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Allgeier has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 6.1% in the last year, Allgeier shareholders lost 30% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 30%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Allgeier better, we need to consider many other factors. For instance, we've identified 3 warning signs for Allgeier (1 is significant) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Allgeier is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AEIN

Allgeier

Allgeier SE provides information technology (IT) solutions and software services in Germany.

Undervalued with reasonable growth potential.