Stock Analysis

- Germany

- /

- Real Estate

- /

- XTRA:DMRE

DEMIRE Deutsche Mittelstand Real Estate's (ETR:DMRE) earnings have declined over five years, contributing to shareholders 75% loss

DEMIRE Deutsche Mittelstand Real Estate AG (ETR:DMRE) shareholders should be happy to see the share price up 25% in the last month. But that doesn't change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 82% lower after that period. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the stock has risen 14% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for DEMIRE Deutsche Mittelstand Real Estate

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

DEMIRE Deutsche Mittelstand Real Estate became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

The revenue decline of 0.09% isn't too bad. But if the market expected durable top line growth, then that could explain the share price weakness.

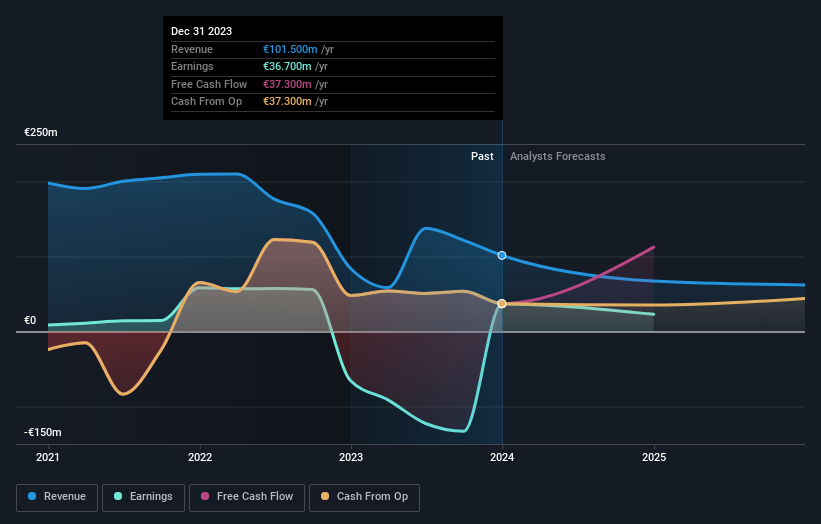

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how DEMIRE Deutsche Mittelstand Real Estate has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between DEMIRE Deutsche Mittelstand Real Estate's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. DEMIRE Deutsche Mittelstand Real Estate's TSR of was a loss of 75% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

DEMIRE Deutsche Mittelstand Real Estate shareholders are down 55% for the year, but the market itself is up 5.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with DEMIRE Deutsche Mittelstand Real Estate (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

But note: DEMIRE Deutsche Mittelstand Real Estate may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether DEMIRE Deutsche Mittelstand Real Estate is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DMRE

DEMIRE Deutsche Mittelstand Real Estate

DEMIRE Deutsche Mittelstand Real Estate AG engages in the acquisition, management, and leasing of commercial real estate properties for medium-sized companies in Germany.

Slightly overvalued with questionable track record.