Stock Analysis

Koenig & Bauer (ETR:SKB) sheds €22m, company earnings and investor returns have been trending downwards for past five years

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Anyone who held Koenig & Bauer AG (ETR:SKB) for five years would be nursing their metaphorical wounds since the share price dropped 75% in that time. Shareholders have had an even rougher run lately, with the share price down 37% in the last 90 days.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Koenig & Bauer

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Koenig & Bauer moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The revenue fall of 1.2% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

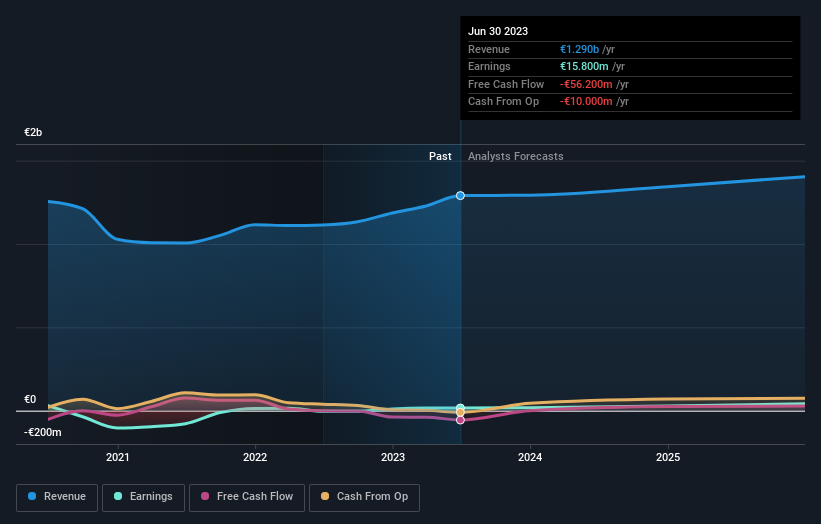

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Koenig & Bauer has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Koenig & Bauer in this interactive graph of future profit estimates.

A Different Perspective

Koenig & Bauer shareholders are up 2.4% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 12% per year, over five years. So this might be a sign the business has turned its fortunes around. Is Koenig & Bauer cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Koenig & Bauer is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SKB

Koenig & Bauer

Koenig & Bauer AG develops and manufactures printing and postprint systems worldwide.

Moderate growth potential with mediocre balance sheet.