Stock Analysis

- China

- /

- Communications

- /

- SHSE:688027

Three High-Growth Chinese Companies With Up To 26% Insider Ownership On The Shanghai Exchange

Reviewed by Simply Wall St

Amid a backdrop of modest movements in the Chinese equity markets, where recent government interventions aim to stabilize critical sectors like real estate, investors continue to seek solid opportunities. High insider ownership can be an indicator of confidence in a company's future prospects, making such stocks potentially attractive in the current economic climate.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

| Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

| Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.5% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's take a closer look at a couple of our picks from the screened companies.

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. specializes in the production of quantum information technology-enabled security products and services for the ICT sector in China, with a market capitalization of approximately CN¥15.08 billion.

Operations: The company specializes in quantum information technology-enabled security products and services for the ICT sector, generating revenues entirely from this segment.

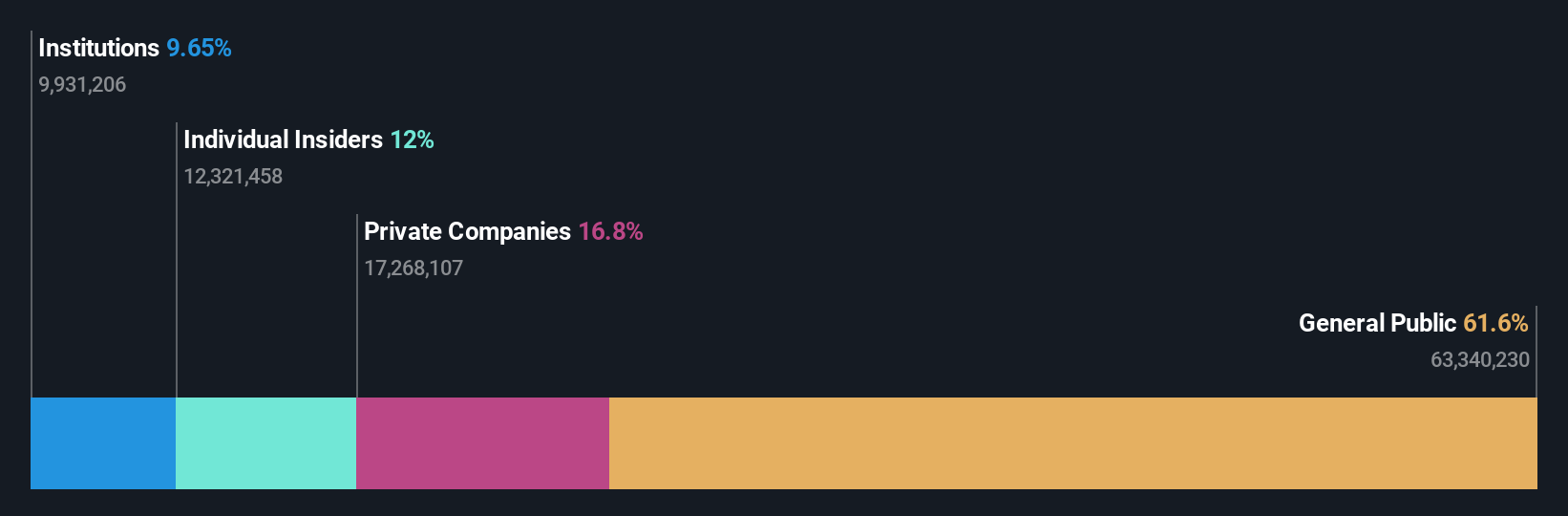

Insider Ownership: 15.7%

QuantumCTek, a growth-oriented company in China, is expected to see significant revenue expansion at 47.8% annually, outpacing the broader Chinese market's 14% growth rate. Despite recent financial struggles, including a substantial net loss in Q1 2024 and declining sales from the previous year, the company is forecast to become profitable within three years. This transition reflects an aggressive profit growth expectation of 141.8% per year. However, QuantumCTek faces high share price volatility and lacks recent insider trading activity to affirm strong insider confidence directly during this period of financial challenges and strategic repositioning through substantial private placements.

- Click here to discover the nuances of QuantumCTek with our detailed analytical future growth report.

- Our valuation report here indicates QuantumCTek may be overvalued.

Songcheng Performance DevelopmentLtd (SZSE:300144)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Songcheng Performance Development Co., Ltd. specializes in the performing arts sector in China, with a market capitalization of approximately CN¥27.77 billion.

Operations: The company generates its revenue primarily from the performing arts sector in China.

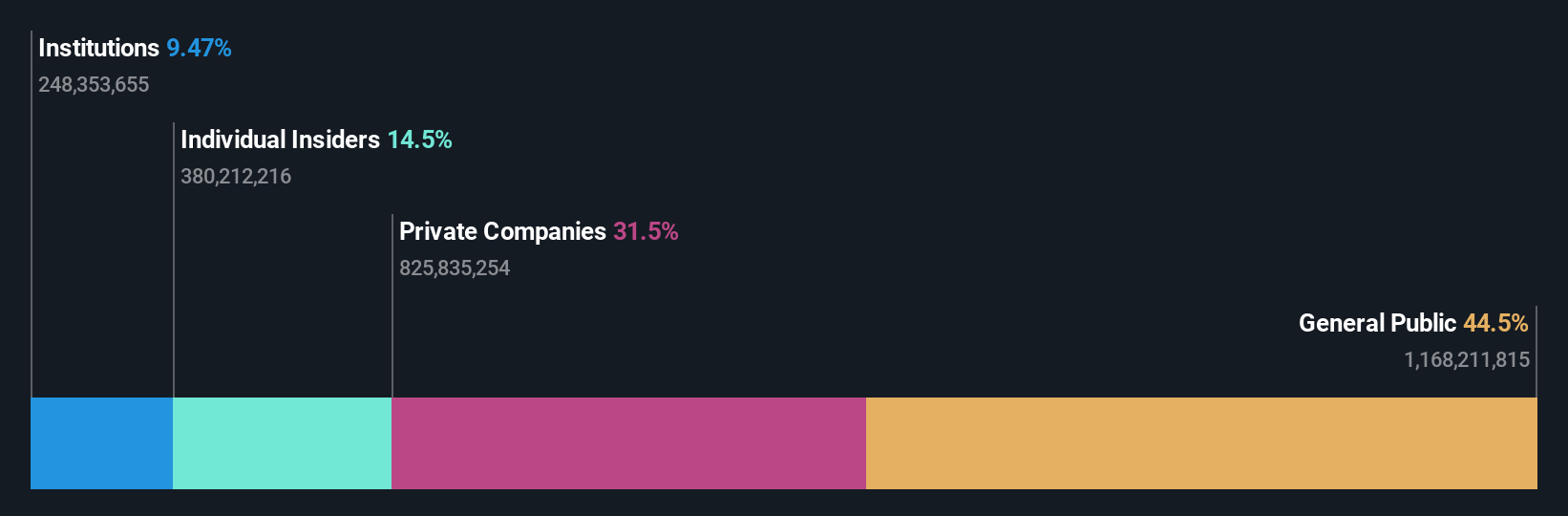

Insider Ownership: 13.4%

Songcheng Performance Development Co.,Ltd, a player in China's entertainment sector, has shown robust growth with recent Q1 earnings more than quadrupling year-on-year to CNY 251.69 million. This performance is part of a broader trend where the company's revenue and earnings are expected to outpace the market, growing at 15.7% and 50.14% per year respectively. However, concerns persist regarding its low return on equity forecast at 16% and profit margins that have decreased from last year’s levels. The proposed dividend increase suggests confidence but raises questions about sustainability given its coverage issues.

- Navigate through the intricacies of Songcheng Performance DevelopmentLtd with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Songcheng Performance DevelopmentLtd's current price could be inflated.

Sai MicroElectronics (SZSE:300456)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sai MicroElectronics Inc. specializes in the development of micro-electro-mechanical system processes in China, with a market capitalization of CN¥12.97 billion.

Operations: The company specializes in micro-electro-mechanical system processes, generating revenues predominantly from this segment in China.

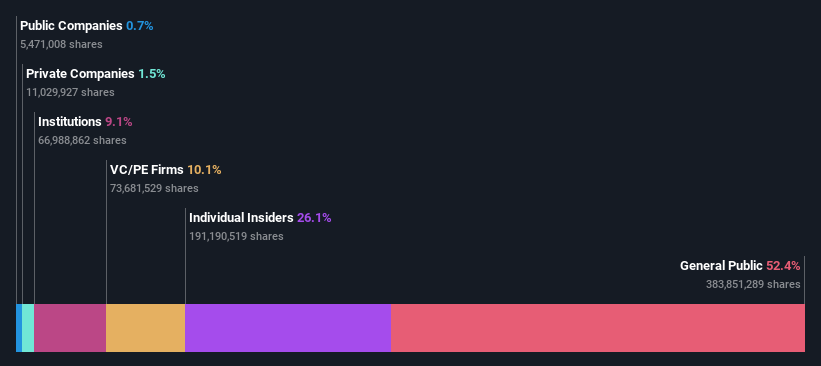

Insider Ownership: 26.1%

Sai MicroElectronics recently transitioned to profitability, with last year's net income reaching CNY 103.61 million after a previous loss, indicating a significant turnaround. Despite this recovery, the company reported a net loss of CNY 11.66 million in Q1 2024, reflecting ongoing volatility in financial performance. Forecasts suggest robust annual earnings growth at 51.65% and revenue increases at 23% per year, outpacing the broader Chinese market. However, quality concerns arise from large one-off items impacting results, hinting at potential earnings inconsistency moving forward.

- Delve into the full analysis future growth report here for a deeper understanding of Sai MicroElectronics.

- According our valuation report, there's an indication that Sai MicroElectronics' share price might be on the expensive side.

Next Steps

- Dive into all 411 of the Fast Growing Chinese Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether QuantumCTek is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688027

QuantumCTek

Manufactures quantum information technology enabled information and communication technology security products and services in China.

Flawless balance sheet with high growth potential.