- China

- /

- Electronic Equipment and Components

- /

- SZSE:002990

High Growth Tech And 2 Other Prominent Stocks With Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have been buoyant, with U.S. indices such as the Dow Jones Industrial Average and the S&P 500 Index reaching record highs, while small-cap stocks like those in the Russell 2000 Index also joined their peers in achieving new milestones. This optimistic market environment highlights the potential for high-growth tech stocks and other prominent companies to capitalize on economic stability and consumer strength, making them attractive options for investors seeking growth opportunities amidst evolving geopolitical and domestic policy landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 22.02% | 28.64% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cicor Technologies (SWX:CICN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cicor Technologies Ltd. is a global company that develops and manufactures electronic components, devices, and systems, with a market capitalization of CHF253.94 million.

Operations: Cicor Technologies Ltd. generates revenue primarily through its Advanced Substrates (AS) Division and Electronic Manufacturing Services (EMS) Division, with the EMS Division contributing CHF377.46 million to the total revenue. The AS Division adds CHF46.24 million, highlighting a significant reliance on the EMS segment for overall financial performance.

Cicor Technologies has demonstrated a notable trajectory in earnings growth, with an anticipated increase of 28.3% per year, outpacing the broader Swiss market's average of 11.5%. This growth is supported by strategic mergers and acquisitions that have reshaped the company over the past four years, contributing to revenue growth forecasts of 7.4% annually—surpassing Switzerland's market average of 4.3%. Despite challenges like a high debt level and recent shareholder dilution, Cicor's commitment to expanding through acquisitions and its positive free cash flow position it as an evolving entity within the tech sector, particularly as it continues to seek further strategic opportunities as indicated in recent executive statements during financial events. While facing some industry headwinds such as negative earnings growth last year (-4.5%), Cicor’s aggressive M&A strategy and robust projected earnings growth suggest potential for future resilience and market adaptation. The firm’s focus on integrating acquisitions aligns with its ambition for sustained expansion, underpinning its proactive approach in navigating competitive pressures within the electronic components industry—a segment where innovation through R&D could significantly influence Cicor's long-term positioning and success.

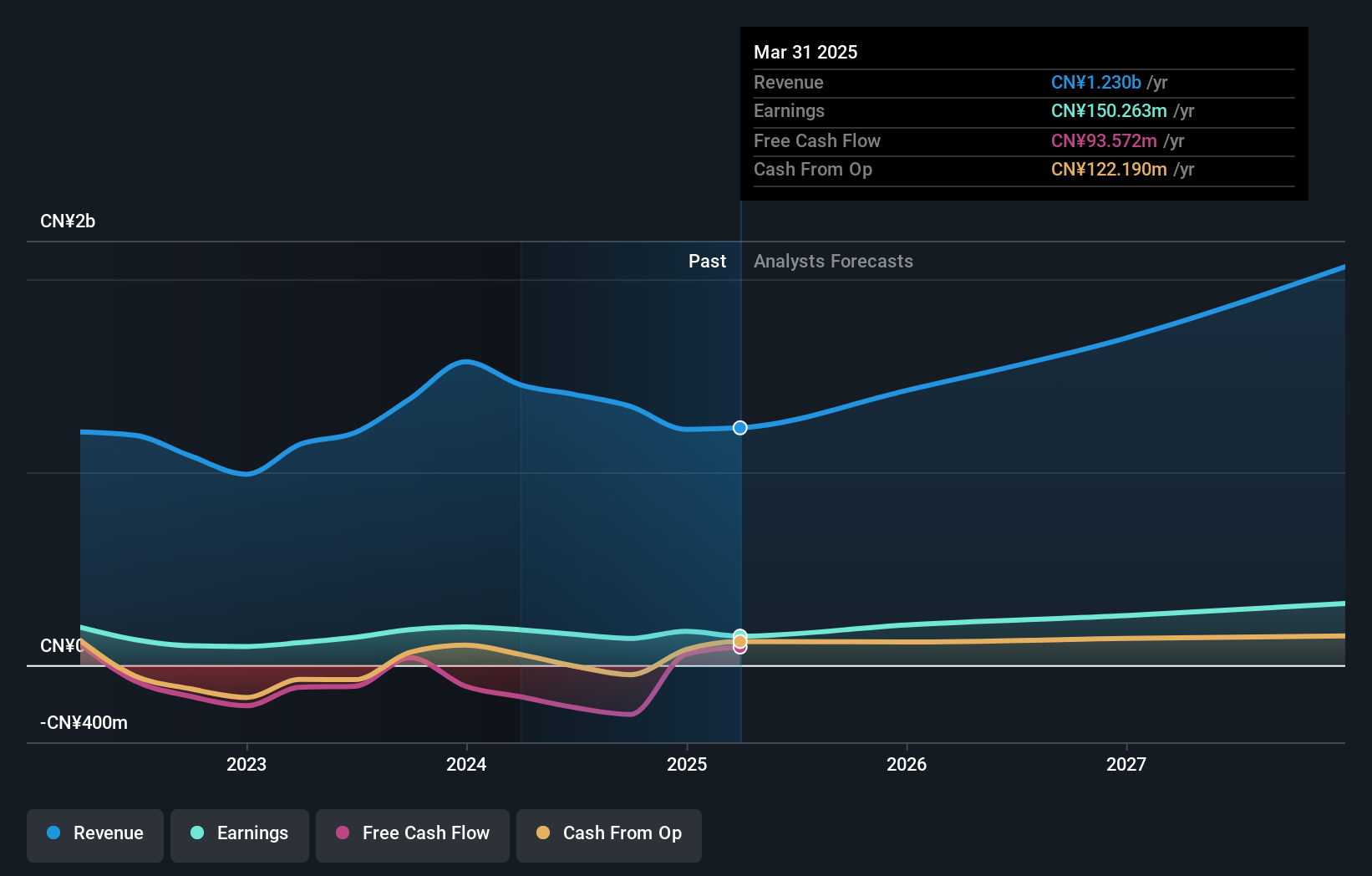

Maxvision Technology (SZSE:002990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maxvision Technology Corp. focuses on the research of artificial intelligence, big data, internet of things, and other information technology solutions with a market capitalization of CN¥6.68 billion.

Operations: The company generates revenue through its development and provision of advanced technology solutions in artificial intelligence, big data, and the internet of things. With a market capitalization of approximately CN¥6.68 billion, it leverages cutting-edge research to offer innovative IT solutions.

Maxvision Technology is navigating a complex landscape with a robust R&D focus, evidenced by its substantial investment in innovation. The company's R&D expenses are strategically aligned with its revenue growth, which is projected at an impressive 31.9% per year, significantly outpacing the industry average. Despite recent setbacks reflected in a revenue drop to CNY 912.16 million from CNY 1,143.98 million year-over-year and net income falling to CNY 110.05 million from CNY 169.91 million, Maxvision's commitment to research could pave the way for recovery and market differentiation. This approach is underscored by an anticipated earnings growth of 42.2% annually, suggesting potential resilience and adaptability in evolving tech landscapes.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health industry in China with a market capitalization of CN¥8.63 billion.

Operations: B-SOFT Ltd focuses on providing software and IT services tailored for the medical and health industry in China. The company generates revenue through its comprehensive suite of healthcare information technology solutions, which include hospital management systems, electronic medical records, and other digital healthcare services.

B-SOFTLtd's commitment to innovation is reflected in its R&D spending, which aligns closely with its revenue streams. In the last year, the company dedicated a significant portion of its budget to research, amounting to 17.1% of its total revenue. This investment is pivotal as earnings are forecasted to surge by 66.8% annually, signaling a strategic emphasis on long-term growth through technological advancements. Despite recent dips in net income from CNY 91.38 million to CNY 52.75 million and a modest increase in revenue from CNY 1,156.92 million to CNY 1,168.62 million year-over-year as reported in their latest earnings release on October 23, 2024, these figures underscore a resilient operational model that could potentially leverage R&D for recovery and competitive differentiation in future tech landscapes.

- Navigate through the intricacies of B-SOFTLtd with our comprehensive health report here.

Gain insights into B-SOFTLtd's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 1282 High Growth Tech and AI Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002990

Maxvision Technology

Engages in the research of artificial intelligence, big data, internet of things, and other information technology solutions.

Flawless balance sheet with high growth potential.