Stock Analysis

High Growth Tech And These 2 Promising Stocks To Watch

Reviewed by Simply Wall St

As global markets experience mixed results ahead of the holiday weekend, with the Nasdaq Composite notably impacted by a significant drop in NVIDIA's stock, investors are keenly observing economic indicators that suggest subdued inflation and resilient consumer spending. In this context, identifying high-growth tech stocks becomes particularly intriguing as they offer potential opportunities amidst fluctuating market sentiments. A good stock in this environment typically demonstrates strong revenue growth, innovative product offerings, and resilience to broader market volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 20.33% | 23.17% | ★★★★★★ |

| Imeik Technology DevelopmentLtd | 25.24% | 23.27% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| Scandion Oncology | 41.84% | 75.34% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

Click here to see the full list of 1278 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

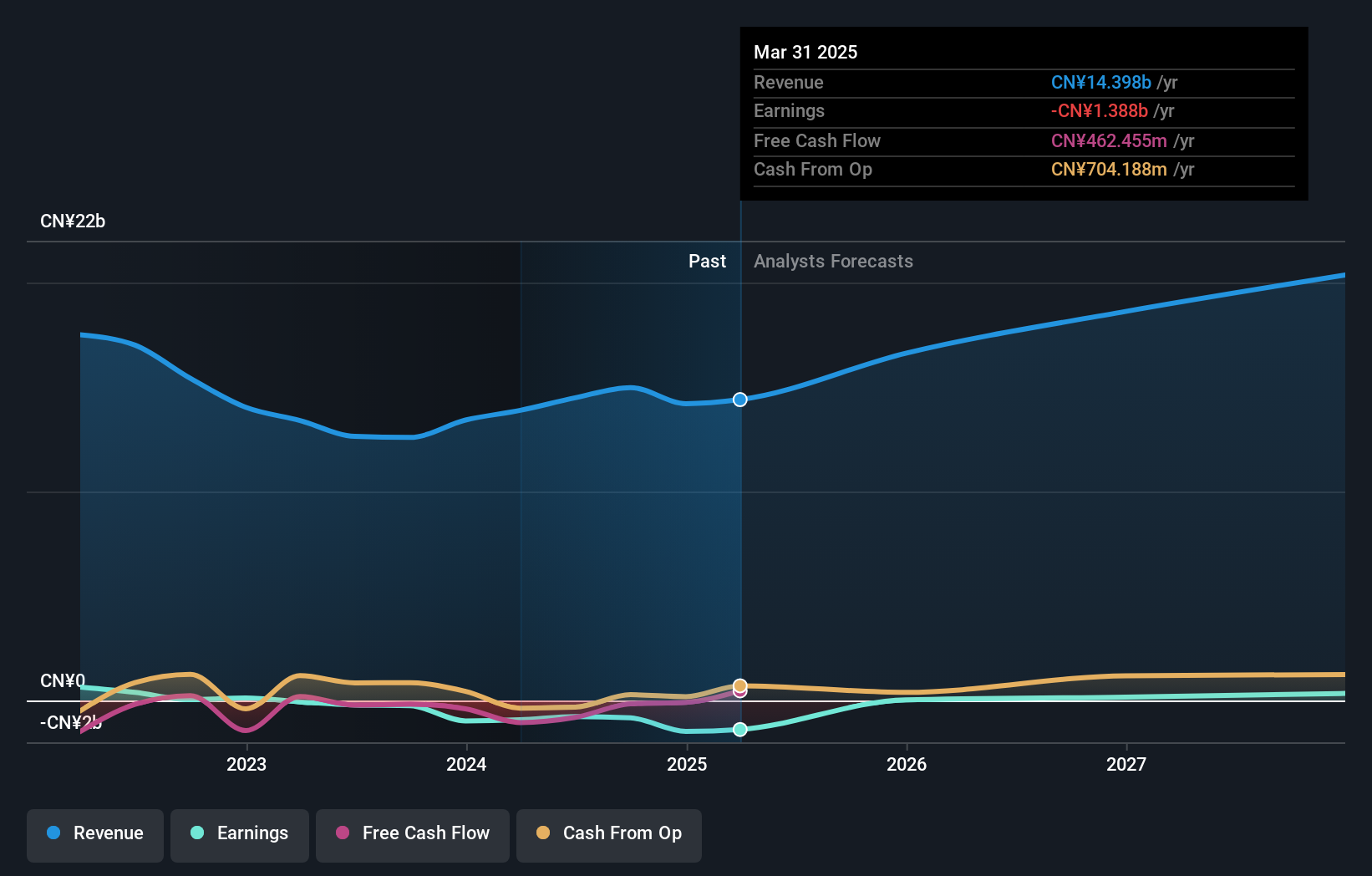

China Greatwall Technology Group (SZSE:000066)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Greatwall Technology Group Co., Ltd. (SZSE:000066) is a Chinese company engaged in the development, manufacturing, and sale of computer hardware and software products with a market cap of CN¥25.48 billion.

Operations: Greatwall Technology Group generates revenue primarily through the sale of computer hardware and software products. The company's financial performance is reflected in its market cap of CN¥25.48 billion.

China Greatwall Technology Group reported a 17.8% annual revenue growth, outpacing the CN market's 13.4%. Despite a net loss of ¥421.52 million for H1 2024, this marks an improvement from the previous year's ¥632.65 million loss. The company has invested heavily in R&D, with expenditures amounting to ¥1 billion in the latest fiscal year, driving innovation and future prospects. Forecasts indicate earnings could grow by 98.15% annually over the next three years as it aims for profitability within this period.

- Unlock comprehensive insights into our analysis of China Greatwall Technology Group stock in this health report.

Understand China Greatwall Technology Group's track record by examining our Past report.

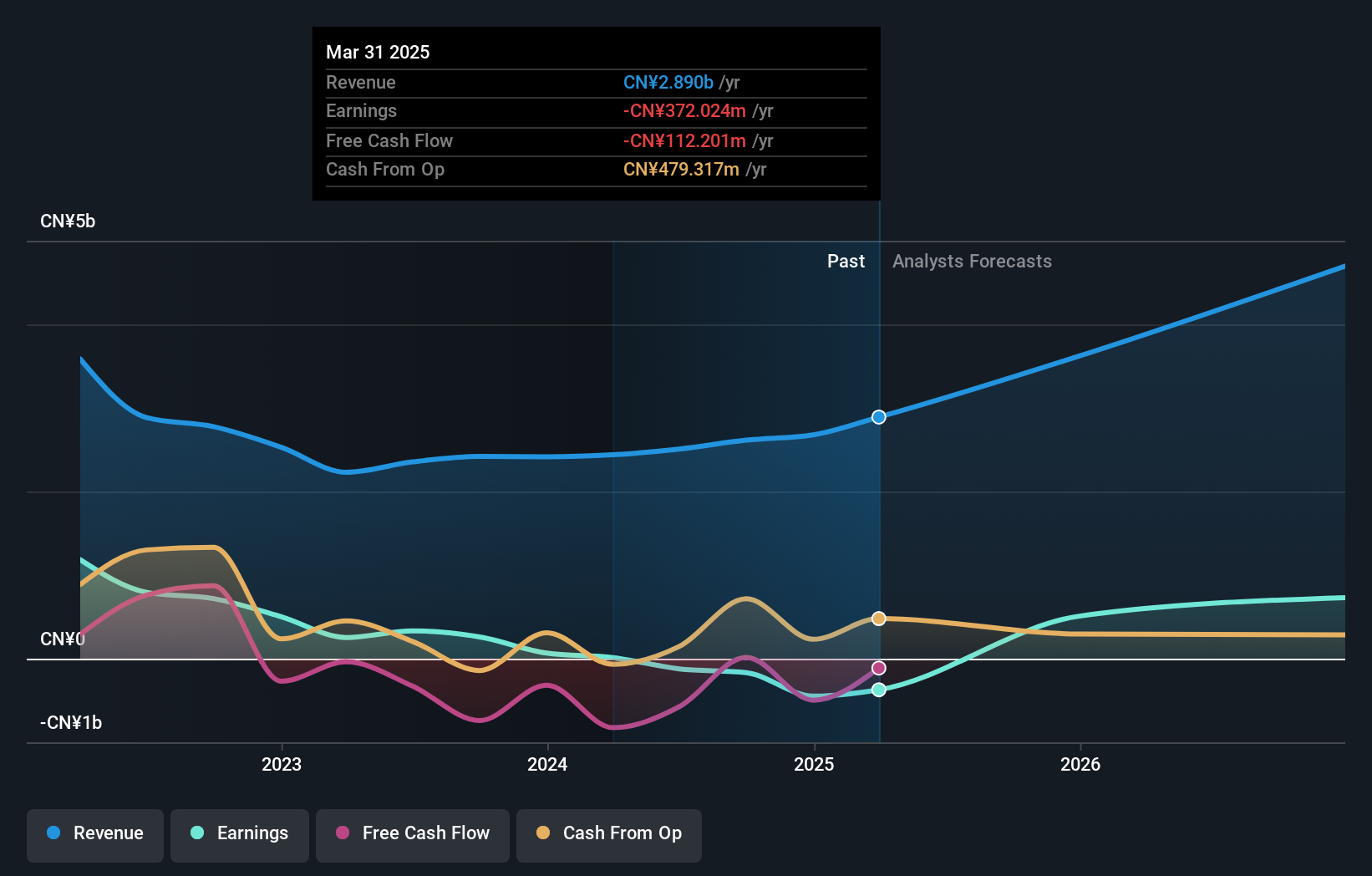

Beijing Shiji Information Technology (SZSE:002153)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Shiji Information Technology Co., Ltd. specializes in providing software solutions and services for the hospitality, retail, and entertainment industries, with a market cap of CN¥14.22 billion.

Operations: The company generates revenue primarily from the Computer Application and Service Industry (CN¥2.31 billion) and Commodity Wholesale and Trade Industry (CN¥655.73 million). The largest contributor to its revenue is the Computer Application and Service segment.

Beijing Shiji Information Technology reported a notable 16.5% annual revenue growth, outpacing the CN market's 13.4%. Earnings are projected to grow by an impressive 91.03% per year, driven by their strategic focus on R&D with expenses amounting to ¥1 billion in the latest fiscal year. The company's half-year sales reached CNY 1,375.72 million, up from CNY 1,195.72 million a year ago, reflecting strong performance and future potential in the tech sector despite current unprofitability.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. engages in the research and development, production, and sale of infrared thermal imaging technology in Asia, with a market cap of CN¥25.62 billion.

Operations: The company generates revenue primarily from the manufacturing of other electronic equipment, which accounts for CN¥2.45 billion. Additional revenue streams include technical services (CN¥33.25 million) and leasing (CN¥7.68 million).

Wuhan Guide Infrared has shown a steady increase in revenue, reporting CNY 1,149.74 million for the half year ended June 30, 2024, up from CNY 1,056.86 million a year ago. Despite a significant drop in net income to CNY 17.97 million from CNY 207.38 million last year, the company’s focus on R&D is evident with expenses contributing to its future growth potential; earnings are forecasted to grow by an impressive 63.5% annually over the next three years. The firm's revenue growth rate of 23.3% per year is notably higher than the CN market's average of 13.4%, indicating robust demand and strategic positioning within its industry segment.

- Dive into the specifics of Wuhan Guide Infrared here with our thorough health report.

Assess Wuhan Guide Infrared's past performance with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 1278 High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Shiji Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002153

Beijing Shiji Information Technology

Beijing Shiji Information Technology Co., Ltd.