Stock Analysis

- China

- /

- Tech Hardware

- /

- SHSE:688489

Exploring Pexip Holding And 2 Other High Growth Tech Stocks

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a series of gains, with small-cap indices like the Russell 2000 reaching record highs amid robust trading activity and geopolitical developments. As investors navigate these dynamic conditions, identifying high-growth tech stocks such as Pexip Holding can be key to capitalizing on innovation-driven opportunities in today's market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| CD Projekt | 21.20% | 28.62% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company that offers a comprehensive video conferencing platform and digital infrastructure globally, with a market capitalization of NOK4.59 billion.

Operations: Pexip Holding ASA generates revenue primarily through the sale of collaboration services, amounting to NOK1.07 billion. The company focuses on providing a comprehensive video conferencing platform and digital infrastructure worldwide.

Pexip Holding's recent performance and strategic presentations, such as at the Morgan Stanley European Technology Conference, underscore its recovery and potential in the tech sector. After a challenging period, the company reported a significant turnaround with third-quarter sales rising to NOK 228.48 million from NOK 214.86 million year-over-year and shifting from a net loss to a profit of NOK 5.8 million. This improvement is mirrored in their nine-month performance with sales up to NOK 786.04 million from NOK 708.43 million, alongside an increase in net income to NOK 58.24 million from a previous loss. Investing heavily in innovation, Pexip's R&D expenses are pivotal for its growth trajectory within the competitive software industry where it aims to outpace typical market expansions; notably, its revenue is expected to climb by 11.8% annually compared to Norway's average of just 1.9%. Moreover, earnings are projected to surge by an impressive rate of approximately 66.84% per year over the next three years—highlighting both its commitment to advancing technology and enhancing shareholder value through strategic reinvestments into its core operations.

- Click here and access our complete health analysis report to understand the dynamics of Pexip Holding.

Explore historical data to track Pexip Holding's performance over time in our Past section.

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Siglent Technologies Co., Ltd. is engaged in the research, development, production, sale, and servicing of electronic test and measurement equipment both in China and internationally, with a market cap of CN¥4.75 billion.

Operations: Siglent Technologies focuses on the electronic test and measurement equipment sector, offering products that serve both domestic and international markets. The company generates revenue primarily through the sale of these specialized devices.

Siglent Technologies, amidst a challenging tech landscape, has demonstrated resilience with its recent earnings report showing a slight revenue increase to CNY 354.64 million from CNY 349.41 million year-over-year, though net income dipped to CNY 91.65 million from CNY 119.02 million. This performance is underpinned by robust investment in R&D, crucial for maintaining competitive edge and innovation in high-tech industries; notably, the company's R&D expenses have been strategically aligned to bolster future growth prospects. With an expected annual earnings growth of 26.4%, Siglent is poised above the CN market average of 26.2%, reflecting its potential to outpace broader market expansions despite current volatilities.

- Navigate through the intricacies of Siglent TechnologiesLtd with our comprehensive health report here.

Assess Siglent TechnologiesLtd's past performance with our detailed historical performance reports.

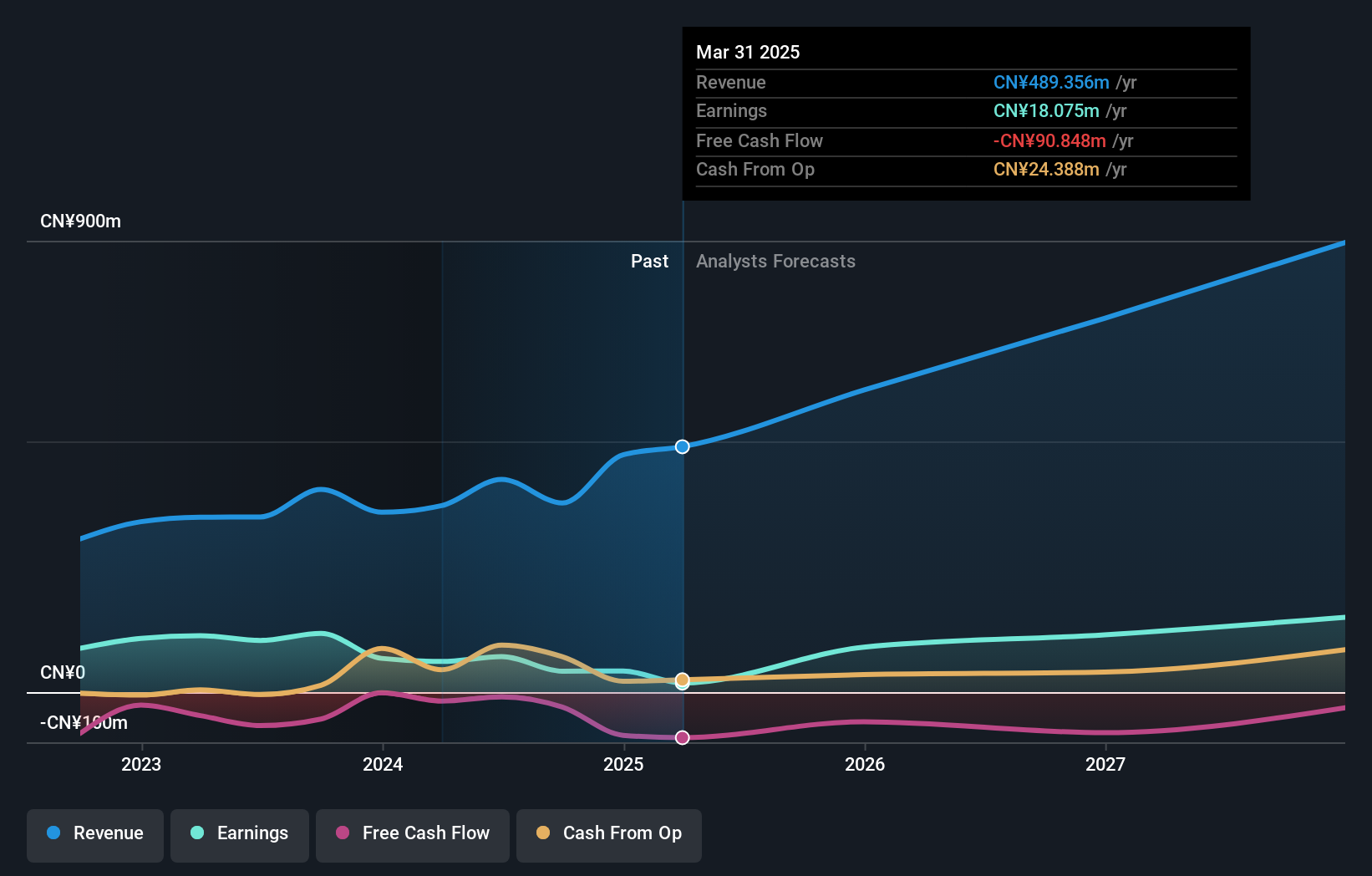

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market capitalization of CN¥4.19 billion.

Operations: Sansec Technology Co., Ltd. specializes in creating cryptographic products and solutions aimed at enhancing internet information security in China. The company's revenue is primarily derived from its commercial cryptographic offerings, reflecting its commitment to advancing secure communication technologies.

Sansec Technology, amidst a dynamic tech environment, has demonstrated mixed financial health with its nine-month revenue increasing to CNY 254.66 million from CNY 236.21 million year-over-year, though net income significantly dropped to CNY 14.16 million from CNY 39.7 million. This performance underscores the company's commitment to growth as evidenced by its projected annual earnings increase of 44.1%, surpassing the CN market average of 26.2%. Notably, Sansec's R&D investment aligns with its strategic focus on innovation, crucial for sustaining advancement in competitive tech sectors; R&D expenses have been pivotal in shaping its technological offerings and future trajectory. Additionally, the company has repurchased shares worth CNY 79.96 million under a buyback program initiated last year, reflecting confidence in its operational stability and future prospects despite current challenges.

Where To Now?

- Take a closer look at our High Growth Tech and AI Stocks list of 1288 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688489

Sansec Technology

Engages in the research, development, and production of commercial cryptographic products and solutions for internet information security in China.