Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688286

High Growth Tech Stocks to Explore in November 2024

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced notable volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before pulling back. Amidst this backdrop, small-cap stocks demonstrated resilience compared to their larger counterparts, highlighting potential opportunities in the high-growth tech sector for investors seeking dynamic growth amid cautious market sentiment. As we explore high-growth tech stocks this November, it's important to consider companies that demonstrate robust fundamentals and adaptability in navigating both macroeconomic challenges and industry-specific shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Integrity Technology Group (SHSE:688244)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Integrity Technology Group Inc. is a network security enterprise that offers network security solutions in China, with a market capitalization of CN¥3.06 billion.

Operations: Integrity Technology Group Inc. focuses on providing network security solutions within China. The company's revenue model is centered around offering specialized services and products designed to enhance cybersecurity for its clients.

Integrity Technology Group, navigating a challenging landscape with a net loss this year, still shows promise with projected revenue growth at 28.6% annually, outpacing the CN market's 14%. Despite recent earnings reports indicating a downturn with a net loss of CNY 31.58 million for the nine months ending September 2024, the company's focus on innovation is evident in its R&D expenses which are substantial yet crucial for long-term competitiveness. The firm's strategic emphasis on research and development not only underscores its commitment to advancing technology but also positions it well for potential future recovery and growth in the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Integrity Technology Group.

Understand Integrity Technology Group's track record by examining our Past report.

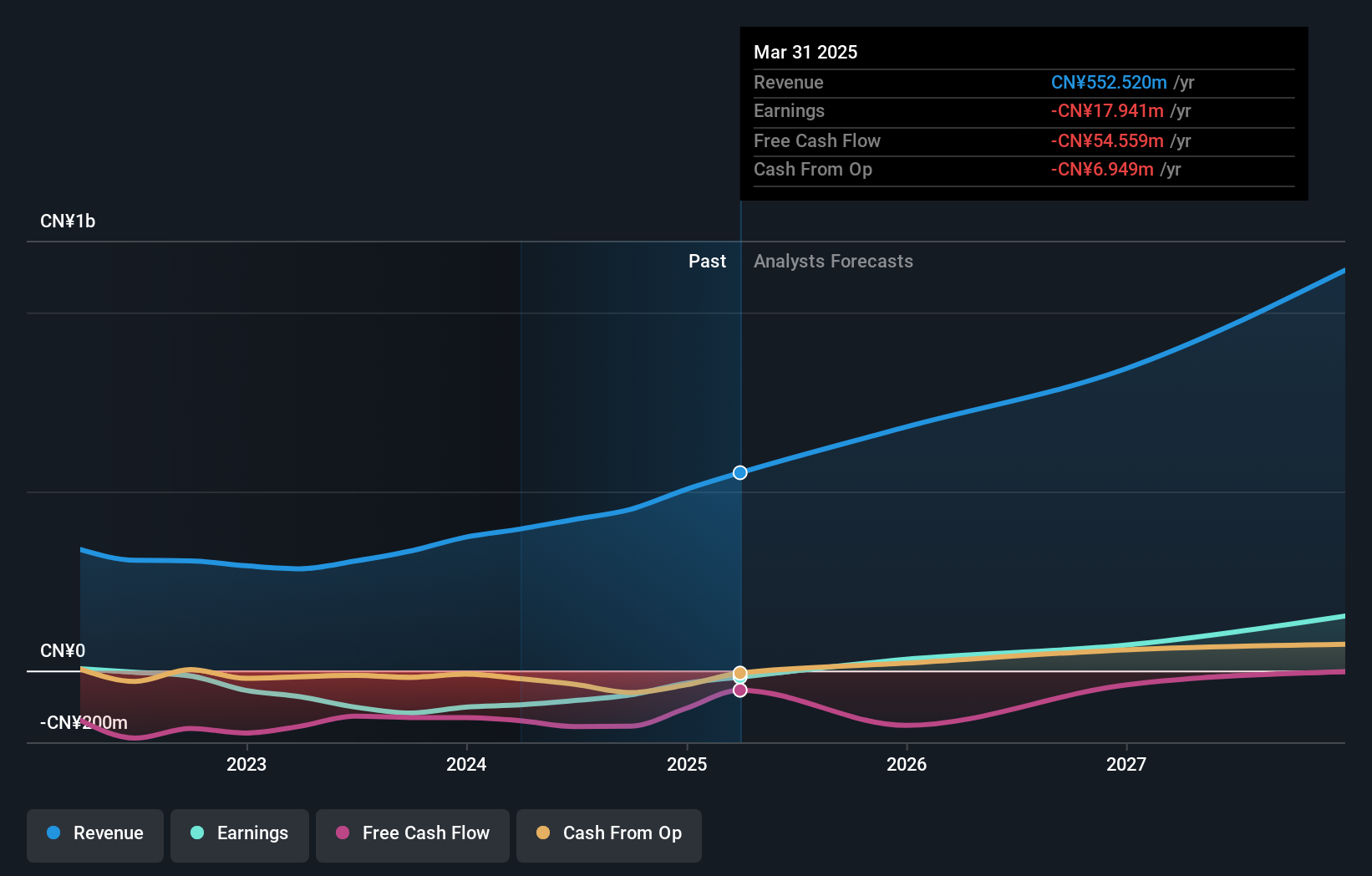

MEMSensing Microsystems (Suzhou China) (SHSE:688286)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MEMSensing Microsystems (Suzhou, China) Co., Ltd. is a company focused on the design and manufacture of micro-electromechanical systems (MEMS), with a market cap of CN¥2.91 billion.

Operations: MEMSensing Microsystems specializes in the design and manufacture of micro-electromechanical systems (MEMS). The company operates with a market capitalization of approximately CN¥2.91 billion, focusing on generating revenue through its MEMS technology offerings.

MEMSensing Microsystems, despite its current unprofitability, is on a trajectory to outpace the Chinese market with anticipated revenue growth of 26.8% annually, significantly higher than the market's 14%. This optimism is further supported by a substantial reduction in net loss to CNY 48.09 million from CNY 82.32 million year-over-year for the first nine months of 2024, showcasing effective cost management and operational improvements. The company's aggressive investment in R&D, crucial for maintaining technological competitiveness, has been marked by significant expenditures that are poised to foster innovation and drive future profitability, expected to surge by an impressive 117.83% per year.

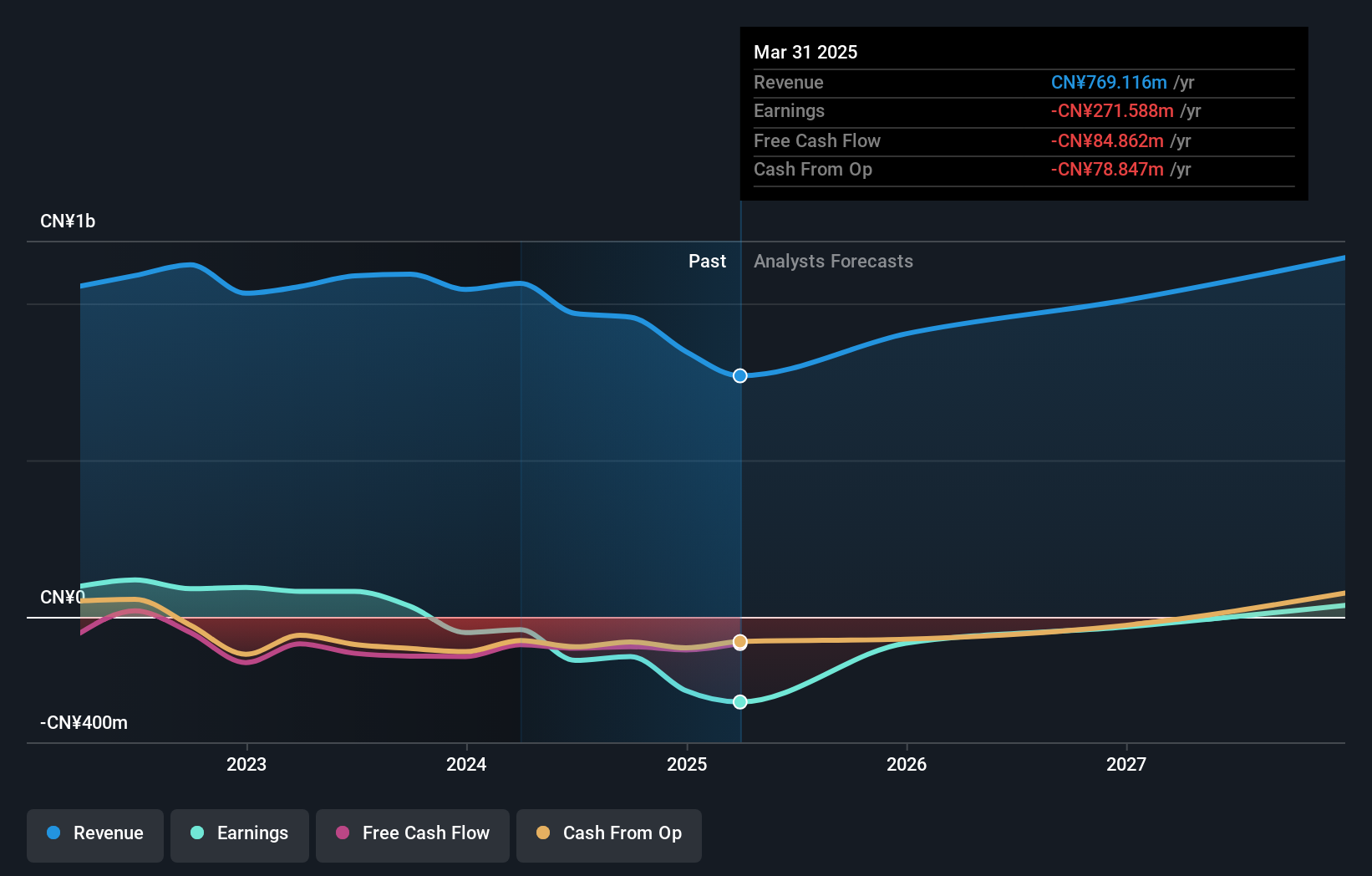

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. offers collaborative management software, solutions, platforms, and cloud services to organizational customers in China and has a market cap of approximately CN¥2.33 billion.

Operations: Seeyon Internet Software generates revenue primarily through its collaborative management software and related cloud services. The company focuses on providing solutions tailored to organizational customers in China, leveraging its expertise in software platforms to enhance business operations.

BeiJing Seeyon Internet Software, amidst a challenging fiscal period with a reported sales drop to CNY 616.88 million from CNY 705.32 million year-over-year and an increased net loss of CNY 109.4 million, remains focused on strategic growth through innovation. Despite these setbacks, the company's commitment to R&D is evident, with substantial investments aimed at driving future technological advancements and market competitiveness. This strategy aligns with industry trends where software firms are increasingly adopting SaaS models to secure stable subscription-based revenues. With revenue expected to grow by 15.6% annually, outpacing the broader Chinese market growth of 14%, and profitability anticipated within three years—forecasted at an impressive annual increase of 77.46%—Seeyon's forward-looking initiatives may well position it for recovery and growth in the evolving tech landscape.

Where To Now?

- Delve into our full catalog of 1282 High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688286

MEMSensing Microsystems (Suzhou China)

MEMSensing Microsystems (Suzhou, China) Co., Ltd.