Stock Analysis

- China

- /

- Communications

- /

- SZSE:000810

Exploring Three High Growth Tech Stocks In China

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts and economic indicators show mixed signals, the Chinese tech sector remains a focal point for investors. In this article, we will explore three high-growth tech stocks in China that demonstrate strong fundamentals and potential resilience amid shifting market dynamics.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 32.80% | 31.65% | ★★★★★★ |

| Ningbo Sunrise Elc TechnologyLtd | 27.16% | 27.67% | ★★★★★★ |

| Xi'an NovaStar Tech | 27.78% | 30.44% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 28.05% | 28.35% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.32% | 29.75% | ★★★★★★ |

| Imeik Technology DevelopmentLtd | 25.61% | 23.63% | ★★★★★★ |

| Zhongji Innolight | 33.22% | 33.17% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 23.14% | 34.30% | ★★★★★★ |

| Eoptolink Technology | 41.24% | 39.45% | ★★★★★★ |

| Huayi Brothers Media | 38.54% | 99.87% | ★★★★★★ |

We'll examine a selection from our screener results.

Skyworth Digital (SZSE:000810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Skyworth Digital Co., Ltd. manufactures and sells home video entertainment and intelligent connectivity solutions worldwide, with a market cap of CN¥12.57 billion.

Operations: Skyworth Digital Co., Ltd. generates revenue primarily from the sale of home video entertainment and intelligent connectivity solutions. The company operates globally, catering to a diverse market with its product offerings.

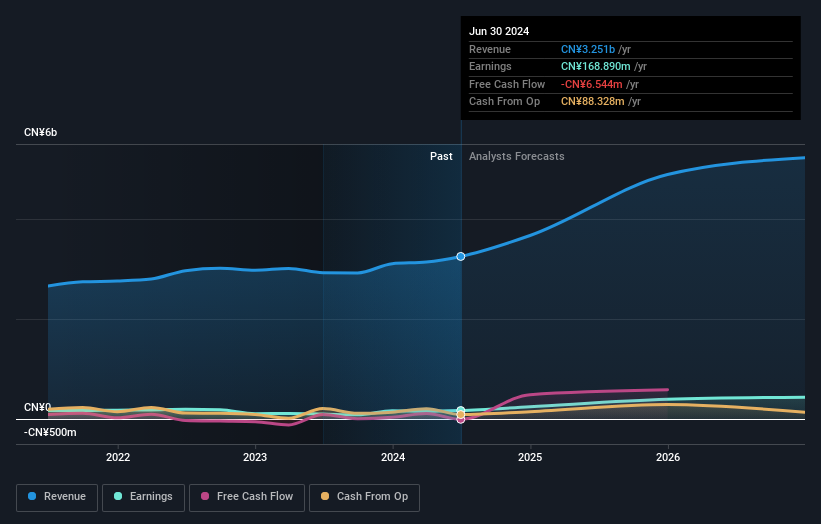

Skyworth Digital reported half-year sales of ¥4.44 billion, down from ¥5.15 billion a year ago, with net income at ¥181.82 million compared to ¥317.64 million previously. Despite this, its earnings are forecasted to grow 29.6% annually, outpacing the Chinese market's 22%. The company allocated significant resources towards innovation with R&D expenses contributing substantially to its strategy for future growth and competitiveness in the tech industry.

- Click to explore a detailed breakdown of our findings in Skyworth Digital's health report.

Assess Skyworth Digital's past performance with our detailed historical performance reports.

Talkweb Information SystemLtd (SZSE:002261)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Talkweb Information System Co., Ltd. operates in the education services and mobile games sectors in China, with a market capitalization of CN¥13.57 billion.

Operations: Talkweb Information System Co., Ltd. generates revenue primarily from Information Technology Services and Software (CN¥1.62 billion) and Computer, Communications, and Other Electronic Equipment Manufacturing (CN¥2.19 billion).

Talkweb Information System Ltd. reported a substantial revenue increase of 62.3% year-over-year, reaching ¥1.73 billion for the first half of 2024. However, net income dropped significantly to ¥3.34 million from ¥57.81 million previously, highlighting operational challenges despite robust sales growth. The company is expected to see annual earnings grow by 67.6%, driven by its strategic focus on R&D, which accounted for a notable portion of expenses at ¥295 million in the last quarter alone, reflecting their commitment to innovation and future competitiveness in China's tech landscape.

Jiangsu Hoperun Software (SZSE:300339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Hoperun Software Co., Ltd. operates as a software company offering products, solutions, and services based on new generation information technology across various regions including China, Japan, Southeast Asia, and North America; it has a market cap of approximately CN¥16.22 billion.

Operations: Hoperun Software provides software products, solutions, and services leveraging new generation information technology across China, Japan, Southeast Asia, North America, and other international markets. The company has a market capitalization of approximately CN¥16.22 billion.

Jiangsu Hoperun Software's earnings are forecast to grow at an impressive 38.9% annually, outpacing the broader Chinese market's 22%. Revenue is also expected to increase by 21.5% per year, surpassing the national average growth rate of 13.4%. With a strong focus on R&D, the company invested ¥295 million in the last quarter alone, underscoring its commitment to innovation and future competitiveness in China's tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Hoperun Software.

Understand Jiangsu Hoperun Software's track record by examining our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 246 Chinese High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000810

Skyworth Digital

Manufactures and sells home video entertainment and intelligent connectivity solutions worldwide.