Chinese Growth Companies With High Insider Ownership Include Shanghai Putailai New Energy TechnologyLtd

Reviewed by Simply Wall St

As Chinese stocks face a challenging landscape with corporate earnings missing expectations and a prolonged property sector slump, investors are increasingly looking for resilient opportunities within the market. One key indicator of potential success is high insider ownership, which often signals strong confidence from those closest to the company's operations. In this context, growth companies with substantial insider stakes can offer unique advantages. High insider ownership typically aligns management's interests with those of shareholders, fostering long-term growth and stability even amid broader economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Shandong Longhua New Material (SZSE:301149) | 34.4% | 42.5% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 29.9% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 34.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 42.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 85.3% |

| UTour Group (SZSE:002707) | 23% | 29.9% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

Let's uncover some gems from our specialized screener.

Shanghai Putailai New Energy TechnologyLtd (SHSE:603659)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Putailai New Energy Technology Co., Ltd. and its subsidiaries develop and sell lithium-ion battery materials and automation equipment in China, with a market cap of CN¥24.58 billion.

Operations: The company's revenue segments include the development and sale of lithium-ion battery materials and automation equipment in China.

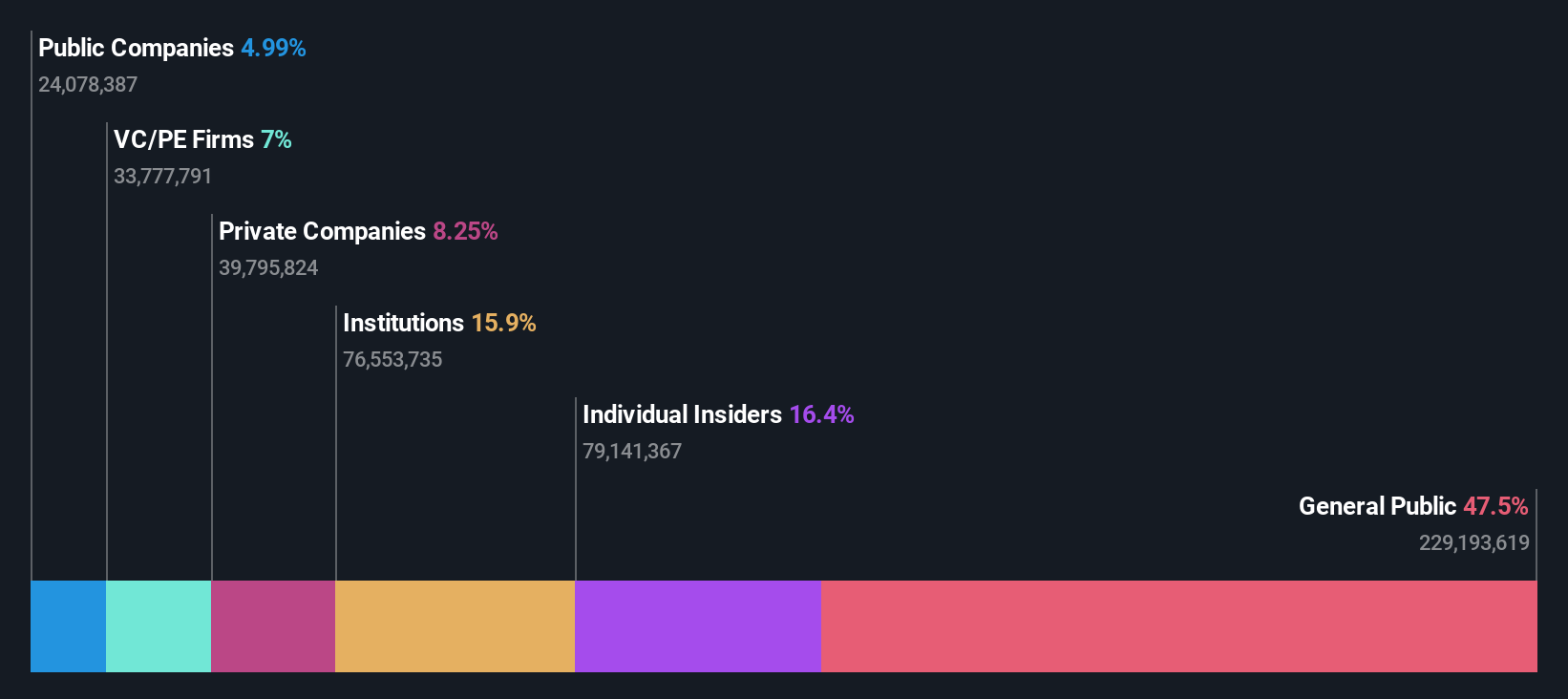

Insider Ownership: 36.5%

Earnings Growth Forecast: 26.9% p.a.

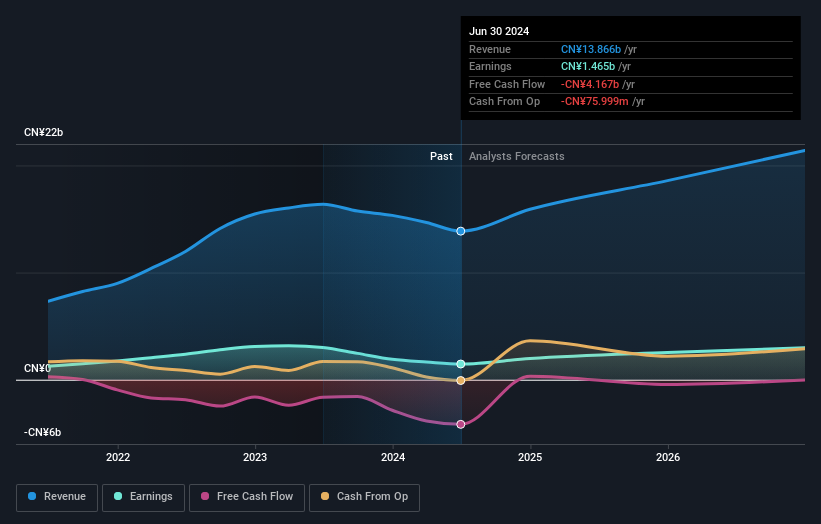

Shanghai Putailai New Energy Technology Ltd. demonstrates strong growth potential with an expected annual earnings growth of 26.9%, outperforming the Chinese market's 23.2%. Despite a recent decline in revenue and net income, the company is trading at a favorable P/E ratio of 16.8x compared to the market average of 27.4x, indicating good relative value. Additionally, a share repurchase program worth CNY 300 million underscores management's confidence in protecting shareholder value amidst lower profit margins and diluted shares over the past year.

- Click here to discover the nuances of Shanghai Putailai New Energy TechnologyLtd with our detailed analytical future growth report.

- Our valuation report unveils the possibility Shanghai Putailai New Energy TechnologyLtd's shares may be trading at a discount.

Ingenic SemiconductorLtd (SZSE:300223)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ingenic Semiconductor Co., Ltd. engages in the research, development, design, and sale of integrated circuit chip products both in China and internationally, with a market cap of CN¥22.48 billion.

Operations: Ingenic Semiconductor Co., Ltd.'s revenue segments include the research, development, design, and sale of integrated circuit chip products in both domestic and international markets.

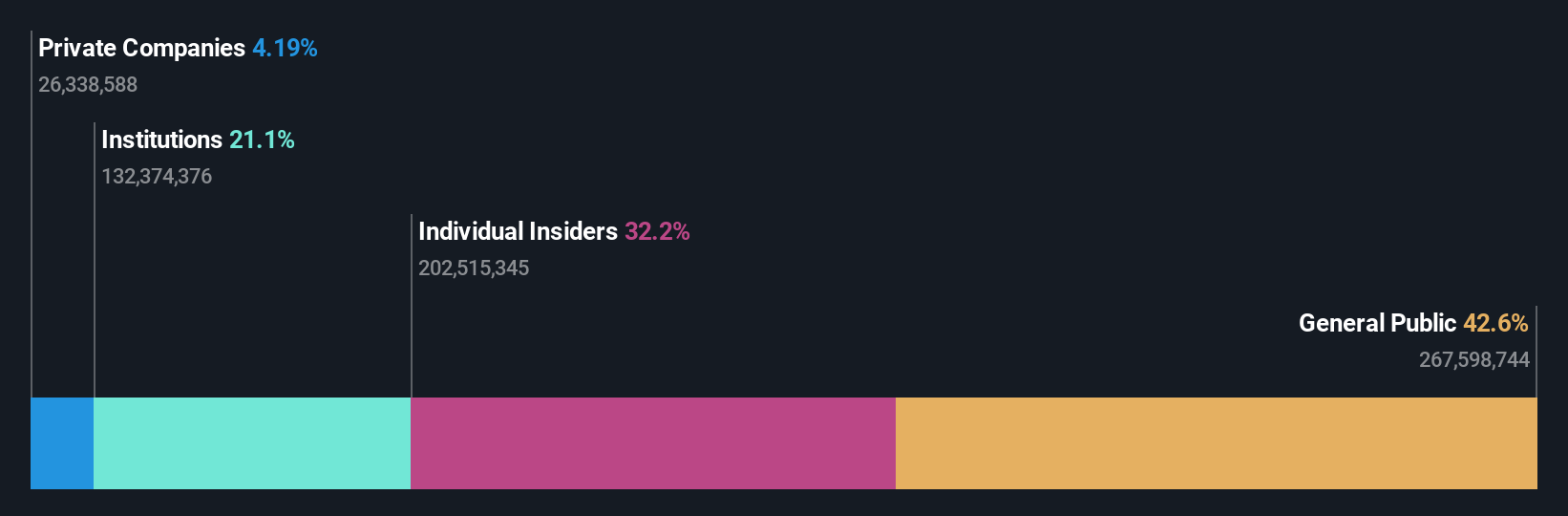

Insider Ownership: 16.7%

Earnings Growth Forecast: 32.4% p.a.

Ingenic Semiconductor Ltd. exhibits robust growth potential, with revenue expected to grow 20.1% annually, outpacing the Chinese market's 13.7%. Despite a slight decline in recent earnings (CNY 197.49 million) and revenue (CNY 2.11 billion), the company maintains a competitive P/E ratio of 43.9x, below the industry average of 47.5x. Earnings are forecast to grow significantly at 32.4% per year, surpassing market expectations and highlighting substantial long-term growth prospects despite low future ROE forecasts (7.3%).

- Click here and access our complete growth analysis report to understand the dynamics of Ingenic SemiconductorLtd.

- The valuation report we've compiled suggests that Ingenic SemiconductorLtd's current price could be inflated.

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Changchuan Technology Co., Ltd. researches, develops, produces, and sells integrated circuit equipment and high-frequency communication materials with a market cap of CN¥19.15 billion.

Operations: The company's revenue segments include integrated circuit equipment and high-frequency communication materials.

Insider Ownership: 32.3%

Earnings Growth Forecast: 49.5% p.a.

Hangzhou Changchuan Technology Ltd. has demonstrated significant growth, with half-year sales of CNY 1.53 billion and net income of CNY 214.88 million, reflecting substantial year-over-year increases. The company is forecasted to continue its robust revenue growth at 29.3% annually, surpassing the Chinese market average. Earnings are expected to grow significantly at 49.5% per year despite a low future ROE forecast (19.7%). Recent board changes and dividend affirmations indicate active corporate governance and shareholder returns focus.

- Dive into the specifics of Hangzhou Changchuan TechnologyLtd here with our thorough growth forecast report.

- Our valuation report here indicates Hangzhou Changchuan TechnologyLtd may be overvalued.

Next Steps

- Discover the full array of 380 Fast Growing Chinese Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603659

Shanghai Putailai New Energy TechnologyLtd

Shanghai Putailai New Energy Technology Co., Ltd., together with its subsidiaries, engages in the development and sale of materials of lithium-ion batteries and automation equipment in China.

Reasonable growth potential with adequate balance sheet.